3rd Oct 2019. 8.29am

Regency View:

BUY Sylvania Platinum (SLP)

Regency View:

BUY Sylvania Platinum (SLP)

Riding the Rhodium Bull Market

We’re working hard to build a portfolio that, within reason, will remain insulated from the risk of a no-deal Brexit. With the Halloween deadline fast approaching, we believe South African miner, Sylvania Platinum (SLP) is the ideal addition to our portfolio.

SLP is a low-cost, cash-rich producer of platinum group metals (PGM’s), platinum palladium and rhodium.

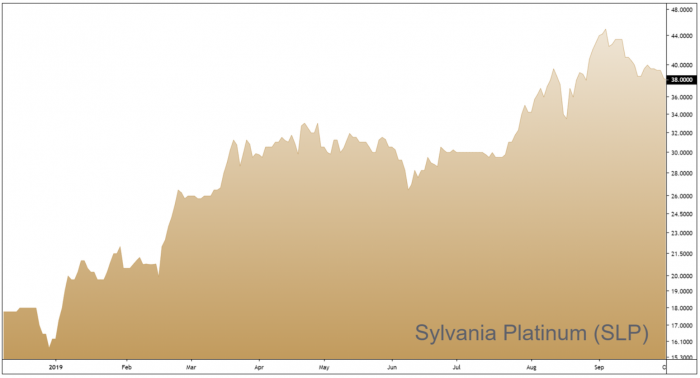

Buoyed by a bumper set of results in September, SLP trades on a single-digit earnings multiple whilst offering attractive levels of growth and income.

A region which boasts the worlds largest reserves of PGM’s

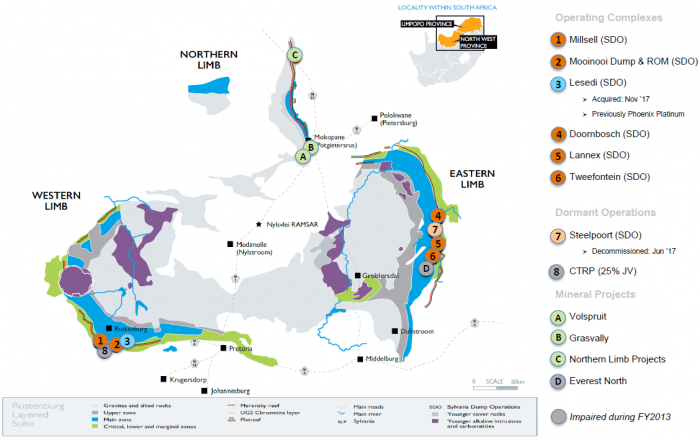

Operating out of South Africa’s Limpopo and North West provinces, SLP has two distinct lines of business:

1. The re-treatment of PGM-rich chrome tailings material from mines in the region.

2. The development of shallow mining operations and processing methods for low-cost PGM extraction.

Its Sylvania Dump Operations are seven active PGM recovery plants that treat chrome tailings from surrounding chrome mines across the western and eastern limbs of the Bushveld Igneous Complex – an area which contains the world’s largest reserves of PGM’s

The Northern Limb Projects include four ‘hot spot’ PGM exploration targets, located in close proximity to one another.

Low-cost producer

SLP’s September trading update confirmed another year of record output – taking production levels to 72,090 ounces on the back of improved recovery rates. The board’s guidance for 2020 has production levels forecast at between 74,000 to 76,000 oz.

Whilst production is rising, overall operating costs have actually declined, making SLP increasingly profitable. Increased production efficiencies and a 10% fall in the value of the rand against the US dollar have helped to keep domestic cost pressures low – giving SLP an all-in cash cost of $672/oz.

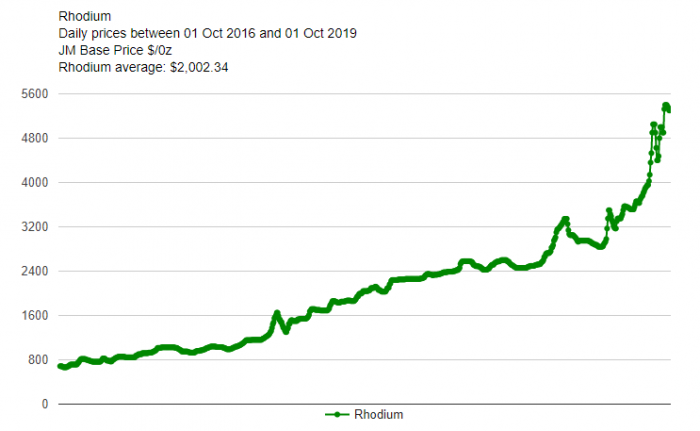

Auto makers drive rhodium to 11-year high

All three PGM’s are used in vehicle exhaust systems (catalytic converters) to neutralise pollutants.

However, rhodium has been given increasing importance in recent years because it is the most effective of the three at reducing nitrogen oxide (NOx) emissions. The well-publicised ‘emissions scandal’ along with China’s accelerating introduction of emissions standards has seen demand for rhodium soar.

Rhodium has leaped from $615 an ounce in mid-2016 to over $4,000 an ounce this month, shooting up by more than $1,000 since mid-February alone. This is of course great news for SLP which has a relatively large exposure to rhodium, compared to its peers.

A Zulu worthy stock

Jim Slater, legendary small-cap investor and author of the Zulu Principle developed an investment approach which found companies that are poised to deliver impressive earnings growth but can still be bought at a reasonable price. There’s no doubt that Jim would approve of SLP…

SLP trades on a forward price to earnings (P/E) multiple of just 4.9 whilst offering forecasted earnings per share (EPS) growth of 34.7%. The company is debt free with a net cash pile of $21.4m – allowing it to fund expansion projects with existing cash resources. The growing cash pile has also allowed management to reward shareholders with a 116% hike in its dividend payout to 0.8p per share.

SLP’s share price is locked within a powerful long-term uptrend and with prices having recently undergone a 20% pullback from their September highs, we view this short-term profit taking as a buying opportunity.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.