8th Oct 2020. 8.54am

Regency View:

BUY Sureserve (SUR)

Regency View:

BUY Sureserve (SUR)

Click here for printer friendly version

A marvellously mundane business

Go hunting for exciting businesses on AIM and you’re far from guaranteed to find an exciting investment.

Many businesses creating products at the cutting edge of pioneering new technology are burning through cash like there’s no tomorrow.

Contrast this to the businesses who rarely get written about in the financial press, those who provide essential services that are neither pretty or pioneering, and you may just find an investment that sets the heart racing.

Today’s stock, Sureserve (SUR) is a great example of this…

Sureserve is a ‘compliance and energy support services group’ – yes I know, dull as dishwater! But take a look at their long-term, sticky contracts and they start to become much more interesting.

The group operates across two divisions:

Compliance Services – delivering just under two-thirds of group’s £212m revenue (FY 2019), and includes responsive maintenance, installation, and repair services in the areas of gas, electrical, water and air.

Energy Services – including energy efficiency services, renewable technologies and smart metering.

Sureserve work closely with large business and local authorities to deliver services that are essential within highly regulated environments such as social housing and education.

The majority Sureserve’s contracts have been given ‘key worker status’ and this has resulted in the firm being relatively unaffected by the ongoing pandemic.

Bob rebuilds the balance sheet

Central to Sureserve’s success is Executive Chairman Bob Holt OBE.

“Our prospects are fantastic of course because we’re in a strong position” bellows Bob during a recent interview with analysts.

He was helicoptered into Sureserve from Mears Group four years ago when, as he puts it, “the business was on its last legs”.

At that point in time the company had a cash draining construction business, was £47m in debt and had delivered four profit warnings in the space of three months.

Since then, Bob has overseen a transformation in the group’s structure and finances – streamlining the group into a low debt business which generates high levels of high margin recurring revenue.

Make no mistake, Sureserve is now a well-run operation with a clear vision for delivering consistent growth, and Bob views the pandemic as a real opportunity to increase market share…

“There will undoubtably be failings of businesses at the bottom end of the market who will disappear and I want to make sure we can capitalise on that”…

“I’ve increased my bidding team by six people recently because I want to grab those opportunities”.

Management mull over return of dividend as growth continues

A series of strong summer trading statements in May and August have been reinforced by yet another bullish update earlier this week…

The post year-end trading update, released on Tuesday, made for pleasant reading. It confirmed that the business continued to show “resilient growth in revenue, earnings and cash flow” and that full-year numbers (to 30 Sep 2020) would be “in line with management expectations”.

A raft of new contract wins during the summer has seen Sureserve’s order book balloon to £375m – creating an attractive level of forward visibility and leaving management contemplating a sustainable dividend policy.

Sureserve will also be investing in a number of new apprenticeship and in-job support schemes, and the group is well positioned to take advantage of the government’s plan to kickstart employment.

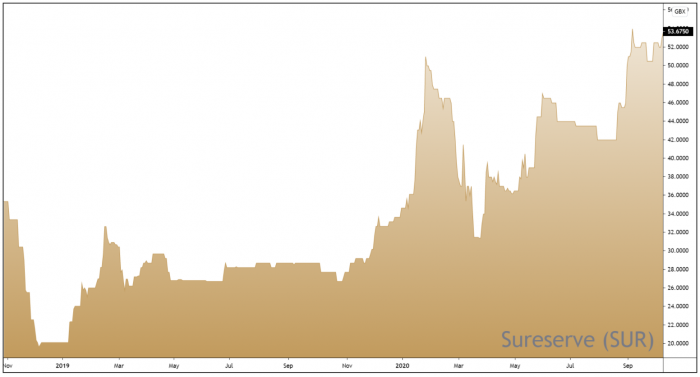

Holding above the highs

The recent series of bullish trading updates outlined above have given Sureserve’s share price plenty of bullish momentum.

After breaking above the key January highs at 51p last month, prices have consolidated their gains by treading water in a tight range just above those 51p highs.

This high and tight consolidation is a very bullish sign as it indicates that underlying demand is strong and that the shares are being accumulated ahead of another push higher.

Indeed, just this week we have started to see fresh upside momentum following Tuesday’s trading update, and this creates and an attractive backdrop to be buying the shares.

Growth at a reasonable price

Along with a bullish technical backdrop, Sureserve scores highly on most fundamental metrics.

The group’s £375m order book, along with ongoing recurring cashflows has seen the balance sheet swing from a £12.9m net debt position in 2019, to a £3.5m net cash position as of this week’s update. They also have access to a £25m revolving credit facility to fund any significant growth ambitions in the future.

Sureserve are trading on a forward earnings multiple of 10, which looks modest in comparison to the commercial services sector and the wider market. It also gives them a forward Price to Earnings growth ratio below 1 (0.9) and a Price to Sales ratio of just 0.38 – indicating that Sureserve offer growth at a reasonable price.

Overall, with a strengthening cash position, dividend reinstatement on the horizon and a high level of revenue visibility, Sureserve make for a high quality addition to our AIM Investor portfolio.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.