22nd Aug 2019. 9.01am

Regency View:

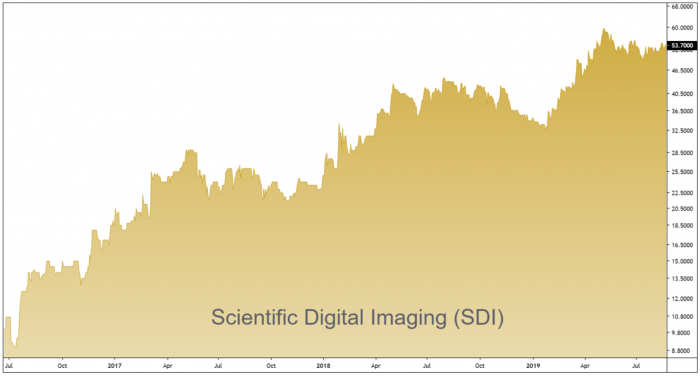

BUY Scientific Digital Imaging (SDI)

Regency View:

BUY Scientific Digital Imaging (SDI)

Putting a Buy and Build Strategy Under the Microscope

Growth through acquisition or ‘buy and build’ is a strategy that requires a top-level management team. Get it wrong and your business can become a disjointed debt-laden mess, get it right and you can fast-track your earnings growth to levels that an organic strategy would take years to achieve.

One company which has perfected the art of buy and build is Cambridge-based technology firm Scientific Digital Imaging (SDI).

Their highly experienced management team have been in place since 2014, making nine acquisitions and delivering a compound annual sales growth rate of 27% between 2015 and 2018, with pre-tax profits growing 82% per annum.

Art Preservation to Astronomy

SDI designs and manufactures scientific and technology products for use across a myriad of industries including healthcare, astronomy, life science and art preservation. It’s brands and subsidiaries can be split into two main categories:

1. DIGITAL IMAGING

Atik Cameras designs and manufactures cameras so sensitive that they can photograph wisps of space dust outside the body of our galaxy!

Synoptics is SDI’s largest revenue generator (contributing 33.3% in 2018). It designs and manufactures scientific instruments based on digital imaging, for the life science research, microbiology and healthcare markets. One of its many sub-brands, ProReveal, is currently being used by the NHS to test how much protein remains on surgical instruments after they have been decontaminated.

Graticules Optics, purchased in February for £3.4m. Graticules applies chemical etchings and micro patterns to glass, film and metal foil, serving the microscopy, metrology, education, scientific and defense markets.

2. SENSORS AND CONTROL

Sentek is a major driver of organic growth for SDI and is their second largest subsidiary. Sentek manufactures and markets off-the-shelf and custom-made electrochemical sensors for water-based applications. These sensors are used in laboratory analysis, in food, beverage and personal care manufacture, as well as the leisure industry.

Astles Control Systems is a supplier of chemical dosing and control systems to different manufacturing industries including beer cans, motor components, white goods and architectural aluminium.

Applied Thermal Control was SDI’s largest acquisition in 2019. They design and manufacture precision re-circulating chillers, coolers and heat exchangers used to control the thermal environment for use in electron microscopes, X-ray diffraction, mass spectrometers and bioprocess automation.

MPB Industries SDI’s latest purchase, bought in April 2019 for £1.6m, MPB is a specialist in flowmeters which has countless applications from human medical anaesthesia to aviation.

Management Who Know How to Make Money

SDI’s management team have a proven ability to add shareholder value through sensibly priced acquisitions. They also increase the value of the acquired companies through investment and a higher focus on growing turnover.

Chairman Ken Ford, a former investment banking CEO, brings over 36 years of City experience in the mergers and acquisition world. In short, he knows how to make money! CEO Mike Creedon (on the right) is a Chartered Certified Accountant. He also has considerable experience of working within quoted companies and technology businesses, and fundraising, mergers and acquisitions.

Together, Ken and Mike have managed to more than triple SDI’s share price since January 2014 and they have plans to turn SDI into a £100m market cap business.

Growth at a Reasonable Price

SDI trades on a forecast P/E multiple of 14.5. When you compare this to its forecast earnings growth rate of 32.8%, SDI looks to offer growth at a very reasonable price. The buy and build specialists are yet to pay out a dividend, and if they can continue to generate a higher return through re-investing cash in acquisitions, it makes sense to do so.

July’s trading update made for impressive reading with full-year revenue jumping 20% to £17.4M and profit before tax up by 32% to £3m.

With a full year of sales from new acquisitions expected to drive growth during the next financial year, SDI’s long-term uptrend looks set to continue.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.