27th Feb 2020. 8.58am

Regency View:

BUY Renew Holdings (RNWH)

Regency View:

BUY Renew Holdings (RNWH)

Playing the Boris Infrastructure Boom

From prioritising the rollout of 5G to giving the green light for HS2, improving Britain’s aging infrastructure is at the very heart of Bojo’s vision for post-Brexit Britain.

Boris is calling his plans for high-speed rail, greener buses and the provision of protected cycleways a “transport revolution” and infrastructure spending is set to get a boost in the upcoming Budget on 11th March.

One stock that’s exceedingly well positioned to benefit from this infrastructure boom is Renew Holdings (RNWH).

Renew is an engineering firm covering the infrastructure, environmental and energy sectors. It specialises in non-discretionary (essential) maintenance and renewal projects – which means it takes on substantially less risk than those delivering large enhancement schemes.

With operating profits in excess of £38m (FY2019) and an engineering services order book of £542m, Renew is a high quality play on an emerging theme that our AIM Investor portfolio is yet to gain exposure to. And whilst the infrastructure sector tends to be cyclical in nature, a deeper dive into Renew’s contract pipeline reveals a host of exciting growth opportunities…

Network Rail’s £47.9bn Agreed Spending Plan

Renew is a major provider of infrastructure services to Network Rail, which just last year had a new £47.9bn investment cycle, Control Period 6 (“CP6”) approved.

CP6 included a 25% hike in spending on operations, maintenance, support – great news for Renew which generates almost two-thirds of its engineering services turnover from its rail activities. Renew managed to secure all the CP6 contracts that it tendered for including additional contracts such as the Multidisciplinary Renewals and Geotechnical & Earthworks five-year frameworks in Scotland.

£22bn 5G Rollout

An estimated £22bn will be invested in the rollout of 5G across the UK to meet increasing demand for internet access.

Renew are seeing a “significant increase in work on Telefonica’s frameworks in London, the South East and the North East of England”.

All four major telecoms network providers have announced plans to launch 5G and Renew have managed to secure a key contract with EE to aid in the rollout of the UK’s largest 5G network. Further 5G investment is expected to follow as the government targets widespread UK coverage by 2023, and Renew see the wireless communications sector as a key driver for future growth.

UK’s £124bn Nuclear Decommissioning Provision

The UK Government’s nuclear decommissioning provision is currently estimated at £124bn. The Nuclear Decommissioning Authority spends around £3bn per annum on its 17 nuclear licensed sites across the UK, the largest of which is Sellafield in Cumbria.

Renew provide a range of services relating to nuclear decontamination, decommissioning and waste management. Last year, Renew’s the largest nuclear contract, Decommissioning Delivery Partnership with Sellafield, was extended to 2026. Renew have also recently signed new contracts with EDF Energy, to extend the life of the pressurised water reactor at the Sizewell ‘B’ nuclear power plant and with BAE Systems, providing engineering support to the nuclear submarine programme.

5-Year Fundamentals

Renew boasts an impressive five-year track record of year-on-year earnings and dividend growth.

In November, Renew released their full-year 2019 numbers – showing a 23% jump in adjusted operating profit to £38.3m, benefiting from a full year’s contribution from specialist rail contractor QTS, which Renew acquired in 2018. A stacked order book worth £542m underpins robust earnings per share (EPS) forecasts of 41.7p for 2020 year-end and 43.8p in 2021.

It’s also worth noting that net debt more than halved in 2019 from £21.4m to 10.2m, and it provides comfort to know that CEO Paul Scott is committed to keeping Renew’s balance sheet in check whilst continuing to make strategic acquisitions.

Technical Timing Ticks the Boxes

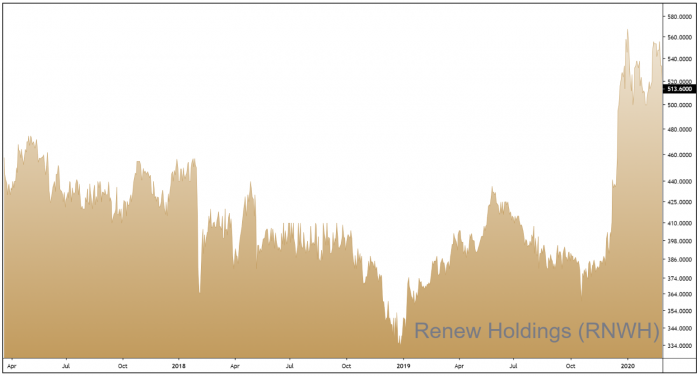

Renew’s post-election ‘Boris bounce’ not only took the shares through the May 2019 highs at 439p, it also saw prices break above the key 2017 highs at 490p. We view the removal of such key long-term resistance levels as a major positive which clears the path of the shares to trend higher.

After hitting highs of 568p at the turn of the year, the shares retraced within a small descending channel and recent price action has seen Renew ‘break and retest’ this channel – a powerful bullish entry pattern.

This week’s retest comes in the light of a much wider sell-off in equity markets globally. As Renew is focused on non-discretionary (essential) infrastructure spending the shares have defensive qualities which look very attractive in the wider market context. We believe the timing is right to add Renew to our AIM Investor portfolio.