24th Sep 2020. 8.58am

Regency View:

BUY Renew Holdings (RNWH) – Second Tranche

Regency View:

BUY Renew Holdings (RNWH) – Second Tranche

Click here for printer friendly version

Renew unexpectedly raise full-year guidance

Building a profitable portfolio is as much about strategically monitoring your open positions as it is about hunting for new opportunities.

This monitoring process, more often than not, centers around checking trading updates for red flags or for signs that all the good news is baked in.

Occasionally, new information will come to light that presents an opportunity to add to a previous recommendation at a better price.

We will never advocate doubling down on a stock just because it ‘got cheaper’, to reference Keynes, the market can most definitely remain irrational longer than we can remain solvent! No, this is about identifying a new entry catalyst that justifies snapping up a second tranche, and we believe Renew Holdings (RNWH) now has this second entry catalyst in place.

Renew were originally added to our portfolio back in February.

To recap, Renew is an engineering firm covering the infrastructure, environmental and energy sectors. They specialise in non-discretionary maintenance and renewal projects such as:

Network Rail – Renew is a major provider of infrastructure services to Network Rail, which just last year had a new £47.9bn investment cycle, Control Period 6 (“CP6”) approved.

5G rollout – Renew have managed to secure a key contract with EE to aid in the rollout of the UK’s largest 5G network.

Nuclear Decommissioning – Renew provide a range of services relating to nuclear decontamination, decommissioning and waste management.

The non-discretionary or essential nature of Renew’s contracts makes them unique, and as it turns out pretty well insulated from the impact of the pandemic…

September trading update surprises

At the start of the month, Renew released a trading updated designed to brief the market ahead of the release of their annual results which will be announced 8th December.

The statement from the board indicated that trading had been “strong” and “materially ahead of current market expectations” due the essential nature of Renew’s contracts.

“Our engineering activities in our Rail, Infrastructure and Environmental markets have remained robust and reliable throughout the Covid-19 pandemic” the statement read…

“The UK Government designated the majority of our activities as critical to the Covid-19 response and we have safely and proactively responded to the ongoing network demands.”

Adjusted operating profit is now forecast to be between £39m-£40m and net cash is also expected to be ahead of market expectations.

In the statement, Renew also confirmed that the integration of highways infrastructure firm Carnell, acquired in January 2020, is now complete. They went onto say that Carnell is “trading in line with our expectations and unaffected by Covid-19 reflecting the strength of its market and the nature of the essential services it provides”.

The market has clearly been underestimating the resilience of Renew’s business model. And whilst the cost of the pandemic is rising and likely to curtail government spending in certain areas, it’s looking unlikely that Boris will cut essential infrastructure spend as this will likely be central to his ‘Build Build Build’ economic recovery plans outlined in June.

Gap creates fresh technical catalyst

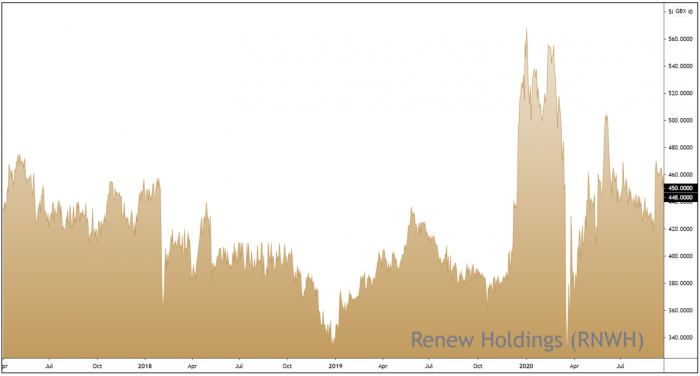

Given that we first recommended Renew in February, just before stock market carnage of March, it’s no real surprise that the technical timing of our first entry was sub-optimal.

And whilst the shares recovered much of their lockdown losses, during the summer months, the shares were trading in a tight descending price channel.

This channel was decisively broken as the shares gapped higher following the release of Renew’s market-beating update.

The bullish price gap has created a burst of fresh price momentum, and a layer of horizontal support at the bottom of the gap.

With prices now consolidating within a small ‘bull flag’ type formation, we now have a clear technical catalyst, when combined with the underlying strength of the September trading update makes for a compelling second entry opportunity.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.