11th Jul 2019. 8.57am

Regency View:

BUY Ramsdens (RFX)

Regency View:

BUY Ramsdens (RFX)

Pawn stars and precious metals

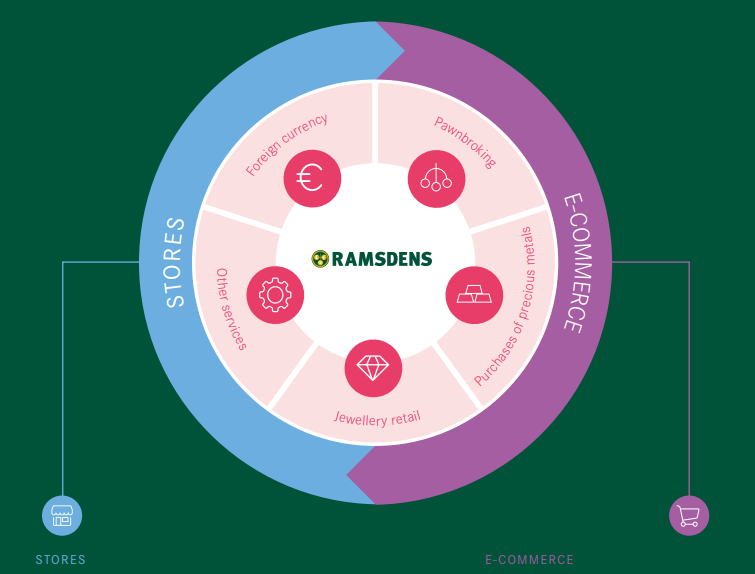

It is often said that ‘diversification is the only free lunch in finance’, a way of reducing risk without proportionately lowering your expected return. This investing mantra is applied to great effect in large established businesses but very few AIM stocks are as beautifully diversified as Ramsdens.

The Middlesbrough-based financial services firm provide a range of interlinking services that include foreign currency exchange, retail jewellery, pawnbroking and a precious metals buying and selling service. This cleverly diversified business model has enabled Ramsdens to deliver consistent growth at a time when the UK high street is dwindling.

Foreign currency exchange represents the largest chunk of Ramsdens profits. Last year they exchanged almost £500m of foreign currency for 705,000 customers to take gross profit from this activity to £11.6m (38% of total group profits). A quarter of Ramsdens’ gross profit of £30.5m last year was generated from pawnbroking. This is a high-margin business that produces a reliable yield in excess of 100% on a loan book of £7.6m which expanded 19% in the last financial year.

Rapid expansion through bargain basement acquisitions

Ramsdens have been rapidly expanding their branch footprint throughout the UK. In the last eighteen months they’ve added 32 new stores, taking them to 163 stores in total, 18 of which were snapped up for £1.5m from The Money Shop, offering a low-cost and low-risk opportunity to scale up its foreign exchange service in new locations. The new stores have a targeted payback period of just 30 months and with a cash pile of £13m and access to a low-cost £10m revolving credit facility, Ramsdens has the firepower to fund further acquisitions.

Ramsdens also has a growing online presence. Its foreign exchange website ramsdensforcash.co.uk allows customers to buy, on a click and collect basis, pre-paid travel cards or travel money. In addition, the website acts as a portal to the international money transfer service where payments can be made online.

Their second domain, ramsdensjewellery.co.uk, is focused on selling new and second-hand jewellery. It also acts as a catalogue for its branches to generate in-store sales. Online sales soared by 77% and should continue to make strong headway as this segment still only accounts for 5% of jewellery sold.

Hedging your bets on Brexit

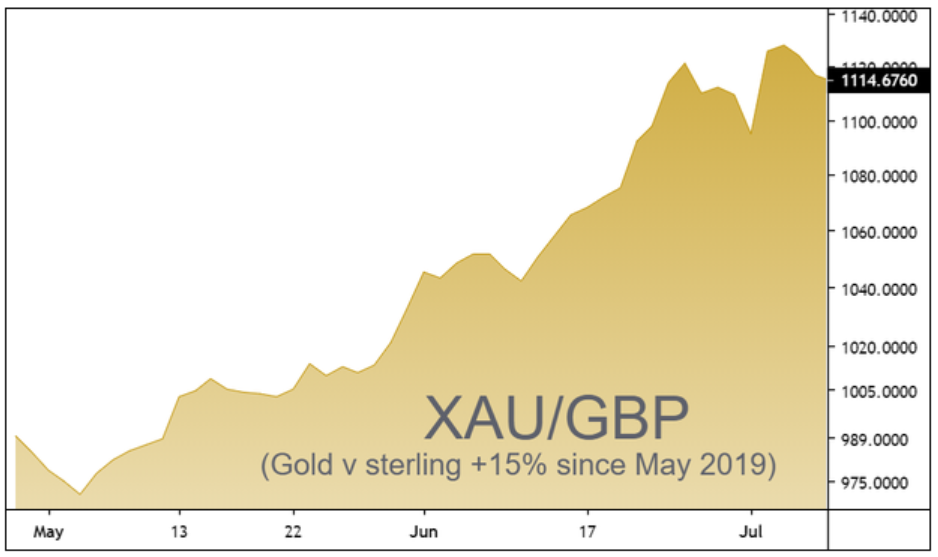

Through its precious metals buying and selling service, Ramsdens buys unwanted jewellery, gold and other precious metals from customers. This segment of the business benefits directly from an increase in the sterling value of gold – which has rocketed 15% since May (see chart) due to the US central bank becoming more dovish, weakening the dollar and driving up the price of gold.

Of course, in the event of a hard Brexit sterling is likely to weaken significantly, driving up the sterling value of gold and directly benefiting Ramsdens precious metals buying and selling service and its pawnbroking pledge book.

Record profits trigger new wave of buying

In June, Ramsden’s released an impressive set of full-year numbers, reporting record pre-tax profits of £6.7m on revenue of almost £47m.

Investors were rewarded by a 9% hike in the divided, taking it to 7.2p a share which is well covered by earnings per share (EPS) of 17.4p. The shares are currently trading on a forward PE multiple of 9.57, which looks attractive given earnings that have an average compounded annual growth rate (CAGR) of nearly 27% and a forecasted dividend yield of 4.16%.

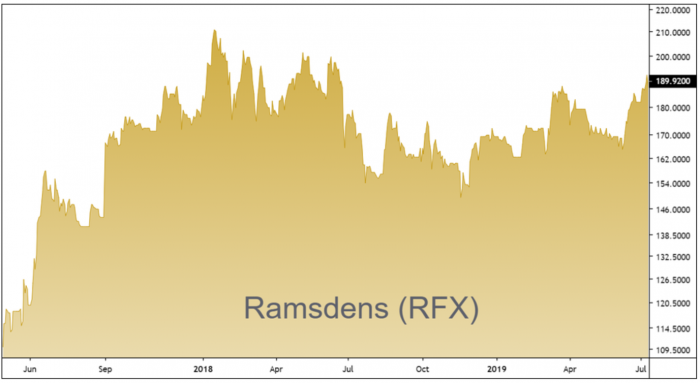

Following the June trading update the shares have broken higher, indicting that we are not the only ones who believe that Ramsdens has further to run. With short-term price momentum now firmly realigned with the bigger picture trend structure we believe the time is right to snap up some shares in this high-quality British company.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.