4th Feb 2021. 8.59am

Regency View:

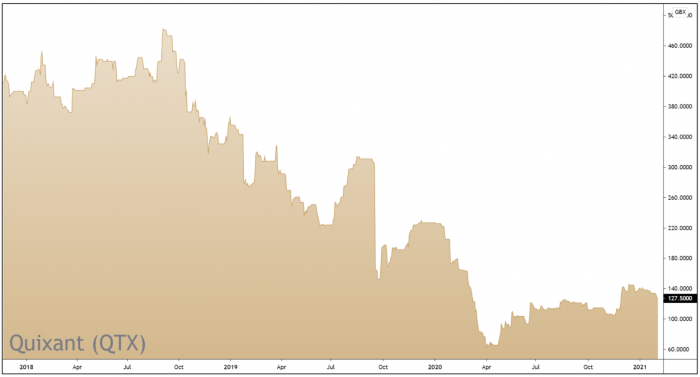

BUY Quixant (QTX)

Regency View:

BUY Quixant (QTX)

Click here for printer friendly version

A cheap bet on the casino recovery

In late March 2020, the Las Vegas Strip looked like the morning after the end of the world.

The fountains in front of Caesars Palace were dry, the gondolas were docked at the entrance to the Venetian, and most importantly of all, the hordes of slot machine zombies had vanished.

The COVID-19 pandemic has hit the casino industry very hard. This was the first time the entire Strip had been shut down since the JFK assassination, and similar scenes could be found at Macau and the world’s other gambling meccas.

To an outside investor, this unprecedented pressure on a historically resilient industry can be very useful. Valuations have been driven lower, and it becomes much easier to spot the management teams who can adapt and keep costs under control.

We believe a great example of this is Quixant (QXT), who make hardware, software and display technologies used by the casino gaming, broadcast and healthcare sectors.

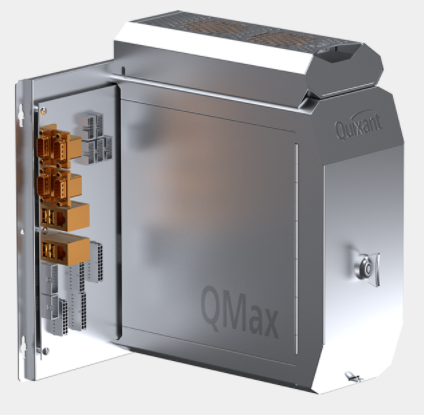

Quixant made its name in 2005 when it bought to market the first off-the-shelf computer platform for casino gaming slot machines. Now the group offer a range of gaming components including, Slot Accounting Systems, data storage units and LED light sequencing machines.

These standardised components allow slot machine manufacturers to focus purely on game design, rather than developing the hardware and software which powers the machines.

Densitron offers valuable diversification

In 2015, Quixant acquired Densitron, a company which build modular control surfaces and integrated control systems for use in the broadcast and healthcare sectors – think control hubs for which TV producers sit behind and medial displays for ventilators.

This diversification away from the hard-hit casino gaming sector has been invaluable for Quixant.

While gaming revenue halved to $11.9m during the first half of 2020 (H1 2019: $23.6m), Densitron’s revenues have remained far more robust – dropping by a modest 13% $16.0m (H1 2019: $18.4m), with demand in healthcare offsetting some weakness in the broadcast sector.

The Densitron buffer meant total group turnover was down by a third in the first half. Looking ahead, Quixant expects to make a modest second-half profit, meaning the business will be break-even for the year (adjusted profit before tax expected to be in excess of $1m).

Cost control paying off

Alongside Densitron’s diversification, Quixant’s management team, led by CEO Jon Jayal, have done a great job of trimming costs while maintaining clients and keeping financial reserves intact.

Quixant have worked collaboratively with their customer base to ensure payment of receivables has been maintained while also finding incremental cost savings.

Net cash as of 31 December actually increased in 2020 to $17.4m, up from $16m the year prior, and they haven’t lost a single client during the period.

Quixant’s collaborative approach to dealing with the strain of the pandemic has also created an additional opportunities…

Rising cost pressures on slot machine manufactures is set to increase the need for standardisation of components – good news for Quixant.

In a recent interview, CEO Jon Jayal said:

“We can accelerate our customers recovery through helping them outsource further parts of their eco-system to Quixant”…

“Some of our smaller customers are now going to struggle with launching new games, Quixant can bring game frameworks to them, allowing them to have a standardised software platform upon which they can base their games” he added.

Darkest before dawn

With a backdrop of continued COVID-19 mutations and ongoing travel restrictions, the casino and gaming industry remains very much under the cosh. However, we are starting to see a glimmer of sunlight on the horizon…

Macau’s gross gaming revenue is expected to show solid month-on-month gains this year compared to 2020’s compressed numbers and investment bank Sanford C. Bernstein expect revenue returning to about 80% of 2019 levels this year.

Las Vegas is also slowing opening up after a second bout of restrictions, and casinos are working with the government to aid in the Nevada vaccination rollout plan.

It is also worth noting that the share price of Quixant’s longest standing client, Australia-based manufacturer, Ainsworth Game Technology (ASX:AGI) has surged 150% since December – indicating that investors are starting to regain confidence in the sector.

Quixant themselves are anticipating a sharp recovery in earnings, making their forward Price/Earnings multiple of 24.6 look increasingly attractive.

Make no mistake, Quixant is a recovery play and hence highly speculative in nature. But given their solid financials and sector diversification, we believe they are a gamble worth taking.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.