10th Sep 2020. 8.59am

Regency View:

BUY Next Fifteen Communications (NFC)

Regency View:

BUY Next Fifteen Communications (NFC)

Click here for printer friendly version

Fifteen minutes of fame

The old business school adage ‘diversify or die’ has perhaps never had more bite.

Those firms who have tentacles spread across many different sectors are naturally better placed to orientate towards growth in a rapidly changing business landscape.

This is especially true in the media & marketing sector where corporate cost cutting, combined with the Zoom boom, has seen a tidal shift in spending away from traditional media towards digital.

One company who is very well positioned to navigate this digital transition is Next Fifteen Communications (NFC).

NFC is a is a digital marketing and communications group whose 18 sub-brands span everything from digital content to PR to market research.

“Everyone will be famous for 15 minutes, but we care about what happens next” proclaims long-term CEO Tim Dyson as he explains the origin of the groups name. “Making brands famous is in our DNA” and they certainly have an impressive roster of big-name clients, Apple, Cisco, Google to name but a few…

In fact, it is this skew towards deep-pocketed big-tech and away from the hard-hit travel and leisure sectors has helped insulate NFC from the brutal impact of the pandemic.

Big tech now accounts for more than 55% of group revenues and recent new business wins at DuPont, Google Cloud, O2 and TDK will see that number increase.

Good PR starts at home

NFC’s summer trading statement was surprising.

The numbers far exceeded management’s expectations set back in March. Revenues for the six months to the end of July are now forecast to be up by around 6.5% year-on-year to £126m.

Adjusted profit before tax is expected to be more than 16% higher at a minimum of £20m, with operating margin climbing above 16%, having been 14.7% in the first half of the previous financial year.

To turn the media bloodbath, that is the pandemic into a net positive speaks volumes about the resilience of NFC’s business model. It also show’s that this PR firm is just as adept at managing the markets expectations as they are at manipulating the press for their clients!

The messaging to analysts has gone from ‘this is going to hurt’ headlines in April to ‘we’re upping full year forecasts’ in August – a pretty impressive turnaround and one that has made the market sit up and listen…

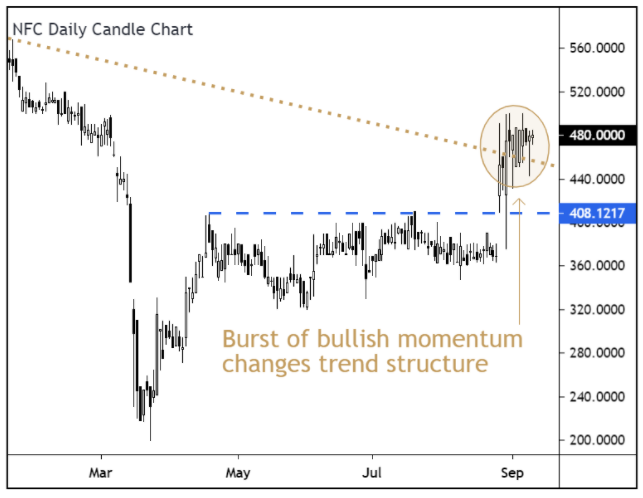

The shares gapped above short-term resistance at 408p on the back of the 25 August trading update. This burst of bullish momentum served to simultaneously snap the descending trendline and form a higher swing low – indicating the momentum and trend dynamics of NFC’s share price has shifted in favour of further upside.

Silicon Valley acquisition reveals new growth strategy

Last week, NFC announced the acquisition of Silicon Valley ‘growth incubator’ Mach49.

Incubators are organisations designed to nurture innovation by providing start-up businesses with access to expertise and investment. Mach49 is a very successful example of the incubator model, they have annual revenues of $13m and a roster of global clients that include Schneider Electric, Pernod Ricard, TDK and Stanley Black & Decker.

The acquisition of Mach49 is seen as the “cornerstone” of NFC’s plan to build a $100m innovation business to work alongside its data, technology and brand marketing companies according to NFC CEO Tim Dyson…

“The acquisition of Mach49 takes NFC in a new strategic direction. There is tremendous pressure within large businesses to innovate and transform to meet the world’s challenges, as well as to fight market disruption from venture capital-backed start-ups…” Tim explains in his acquisition statement.

“Combining Next15’s experience with high growth Silicon-Valley companies and Mach49’s expertise in creating and launching new ventures, incubators and corporate venture capital funds will give us a unique service offering for global businesses to build and scale resilient new ventures,” he added.

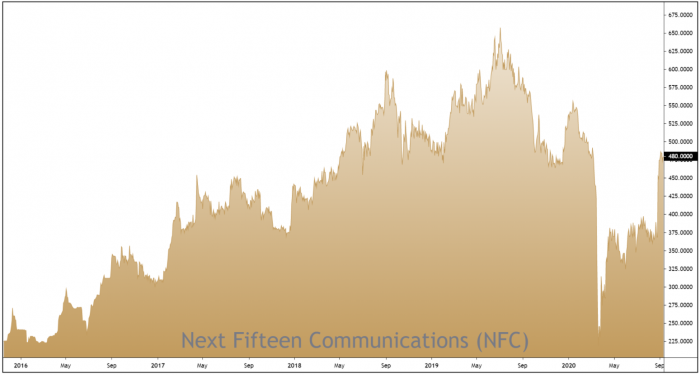

Whilst the acquisition is slightly left field, Tim has a real knack at pulling these things off. After taking the reins in 1992, he’s transformed NFC into a highly diversified marketing powerhouse – overseeing a ten-fold increase in the firms market cap during the last decade.

Prudently protecting cashflow

To say that NFC is immune to the effects of the pandemic would be a lie. First half organic (like-for-like) revenues contracted roughly 6% compared to the same period of 2019. And a dividend suspension combined with delaying non-critical spending indicate that management are prudently protecting cash flow.

However, NFC is expected to end 2020 with £11m net cash and they have a £60m revolving credit facility, which we can see from the above, is already being used to snap up exciting new growth assets. This improving balance sheet, along with a relatively modest earnings multiple and a clear strategy for delivering growth, makes NFC an attractive addition to our AIM investor portfolio.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.