4th Jun 2020. 9.00am

Regency View:

BUY MTI Wireless Edge (MWE)

Regency View:

BUY MTI Wireless Edge (MWE)

The 5G and Smart Farming Stock

Of the several hundred AIM stocks we filter through each week, a small percentage will be adequately positioned to play a part in an emerging global theme and even fewer will be poised to benefit from two separate global themes.

Today’s stock, MTI Wireless Edge (MWE) is one such company. It is exceedingly well positioned to benefit from the global 5G rollout and it is also playing a key role in helping the agricultural sector manage issues around water scarcity.

MTI is an Israeli headquartered wireless solutions company consisting of three core divisions, each contributing roughly a third to revenues:

1. Antennas – these include traditional and multi-band antenna along with 5G backhaul antenna solutions to support mobile phone operators as they roll-out their 5G networks.

2. Water Control & Management – this division uses wireless control systems to manage agricultural irrigation – reducing water and power usage whilst providing higher revenue from accurate irrigation, leading to more and better-quality crops and plants being grown.

3. Wireless Distribution & Consulting – this division represents 40 international suppliers of wireless components and sells these products to Israeli defence sector.

Each division contributes roughly a third to revenues and no single customer generates more than 7% of Group turnover – creating a level of diversification which is unusual for a small growth stock.

Focus on 5G Likely to Pay Dividends

Whilst MTI started out as a one stop shop for traditional ‘off the shelf’ flat and parabolic antennas, the company has repositioned itself in recent years to focus on the high-end multi-band antennas for next generation 5G mobile networks.

5G is up to 20 times faster than 4G and the ever growing need for connectivity of personal devices, smart homes, smart offices and smart cities, the global 5G infrastructure market is predicted to grow at a compound rate of more than 30% a year for the next five years.

Of course, the path to transitioning telecom infrastructure to 5G is unlikely to be smooth in most countries, and may have become bumpier due to the pandemic, but 5G’s benefit to economic growth make its global rollout inevitable.

In 2019, demand for MTI’s 5G backhaul antenna doubled from 5% to 10% of overall antenna revenue. However, this number is expected to grow rapidly next year as many of the networks are in the testing phase and MTI anticipate “material sales starting in 2021”.

Smart Farming a Chinese Mega Market

The integration of wireless technology has not just been confined to our homes, offices and cities, ‘Smart Farming’ is growth market which has ever growing importance.

With the impact of global warming, increasing population sizes and reduced soil quality, smart farming is providing the answers by using modern technology to increase the quantity and quality of agricultural products.

MTI’s Water Control & Management division provides wireless water management systems for agricultural irrigation. Operating under the Mottech brand the firm has been positioned in the drought-ridden Australian market for several years but has only recently got a foothold in the high-growth Chinese market.

The Chinese smart farming market has doubled in the last four years and is estimated to be worth more than $26bn.

In April, during the peak of the pandemic MTI announced that it had signed a bundle of contracts with Chinese authorities worth $0.5m all for delivery in July. And last month MTI signed an agreement to acquire its joint venture partner’s 40% holding in a joint venture it established in China in 2017 (“Mottech China”). Following this acquisition, Mottech China is now a fully owned subsidiary of the Company.

MTI’s CEO Moni Borovitz said: “We significantly increased our focus on the Chinese market in the last two years with the opening of a local subsidiary. China has become Mottech’s fastest growing market and we expect this to continue to be the case and in time become one of its largest markets.”

Strong Fundamental Foundation

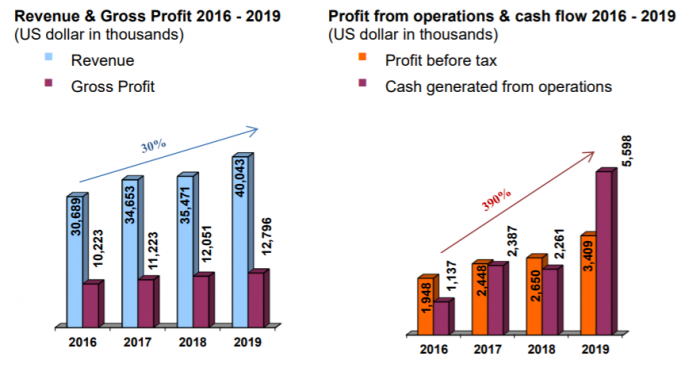

Whilst MTI’s key long term growth drivers of 5G rollout and Chinese smart farming all talk of jam tomorrow, a glance at MTI’s financials underlines the quality of the company…

MTI have a strong four-year positive track record of delivering revenue and profit growth, underpinned by healthy levels cash generation – creating a solid balance sheet. MTI also boast a forward dividend yield of 5.46% and unlike many stocks have maintained its pay-out policy in recent trading updates.

For the three months to March 31, MTI posted revenues of $9.6m, rising 5.5% year-on-year from 9.1m and pre-tax profit jumped by 22% to $717,000 up from $562,000 during the same period last year.

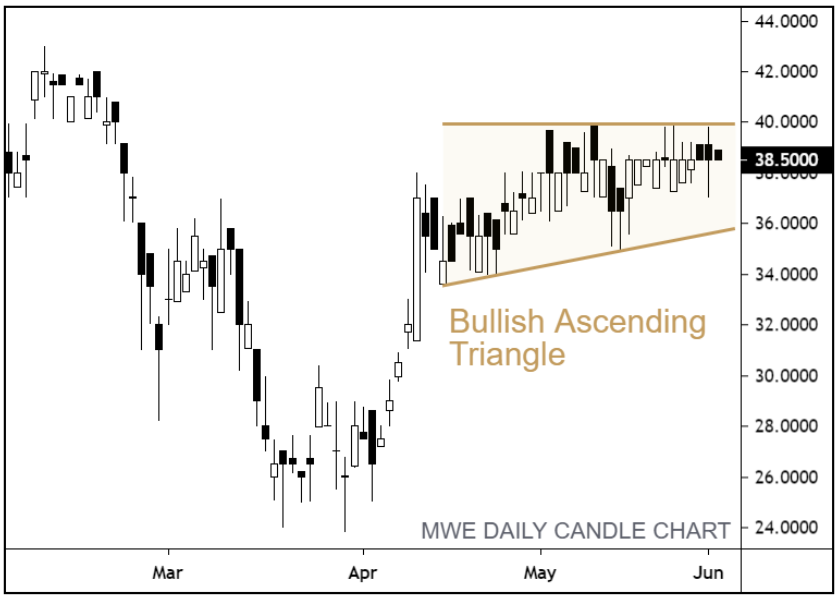

Bullish Ascending Triangle Takes Shape

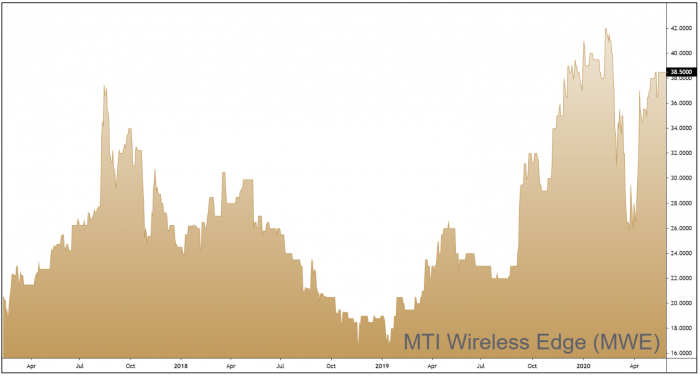

After being dragged lower by the market in March, MTI shares have been quick to bounce back and now trade just less than 10% below their February highs.

Being small in market cap and attracting plenty of big institutional interest means that the shares can go through periods of relative inactivity and we view the current period as a buying opportunity…

Recent price action has seen the shares track sideways whilst continuing to carve out lower swing highs – forming a bullish ascending triangle pattern. This indicates that the shares are being accumulated before another leg higher.

We are looking to position ourselves within this short-term consolidation pattern in order to reap the full benefits of any breakout.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.