13th May 2021. 9.02am

Regency View:

BUY Mpac Group (MPAC)

Regency View:

BUY Mpac Group (MPAC)

Bringing AI to the factory floor

Think robotics and artificial intelligence (AI) and you’d be forgiven for having an image of an early-90’s science fiction-style ‘cyborg’ in your head.

For those of us working outside of industries using these rapidly advancing technologies, they still seem a little abstract.

But the reality is that almost any form of mass production is utilising not just advanced robotics, but integrated data capture – feeding artificial intelligence systems that can improve efficiency in real time.

Mpac Group (MPAC) create ‘automation ecosystems’ for manufacturing processes.

An automation ecosystem is where a set of Robotics Process Automation (RPA) and AI systems come together harmoniously to create intelligent, cognitive, end-to-end automation.

In short, Mpac supply and service high-tech packaging machinery and equipment.

They have a global blue chip client base spanning 10,000 machines across 80 countries, with manufacturing and service hubs in Canada, US, UK, Netherlands and Singapore.

The business is debt free, cash generative and has plenty of scope or organic and acquisitive growth.

Intelligent technologies

Mpac’s marketing message is clear, ‘whole line, whole life, whole planet’…

They offer clients a ‘whole line’ solution – from primary packaging right through to the end of line boxed up cartons ready for distribution.

They aim to provide service and support for the ‘whole life’ of the machinery. And their advanced data capture is designed to increase energy efficiency and reduce packaging waste, taking the health of the ‘whole planet’ into consideration.

While Mpac covers a diverse number of sectors, its core focus is on the pharma, healthcare and food & beverage sectors.

The Group’s business model is understandably dominated by the design, build and installation aspects, but CEO, Tony Steels expects to see high levels of growth in monitoring as migration to smart technologies accelerates and the adoption of AI-enabled equipment becomes standard.

“Where we see real growth in the business is in the monitoring side of things” said Tony as he addressed analysts on a Zoom call following the publication of Mpac’s Full-Year numbers in April.

“All our equipment is able to gather data during the production process, and we now offer customers modules to analyse the data to improve performance” he continued.

Acquisition opens door to high-growth craft beer market

In autumn last year, Mpac acquired US-based packing equipment manufacturer, Switchback for £10.2m.

Switchback has benefitted from the shift towards recyclable packaging and has a market-leading position in the craft brewing market.

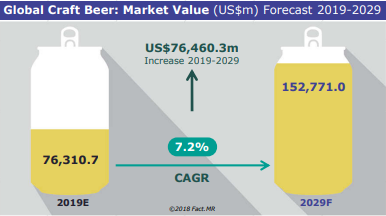

Craft brewing is a fast-growing niche set to double in size over the next decade.

The Switchback deal is performing better than management had expected, adding breadth to Mpac’s carton and end-of-line solutions, as well as building North American sales, which now accounts for over half of group revenues.

Impressive order book underpins strong financials

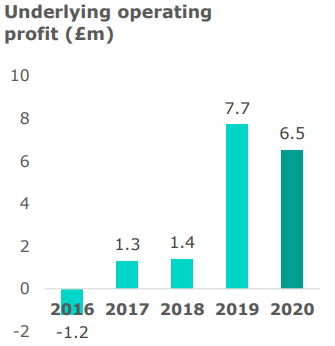

2019 marked a step-change in Mpac’s profitability as manufacturing growth accelerated and revenue from serving more than doubled, causing Mpac’s underlying profitability to increase five-fold from £1.4m (2018) to £7.7m (2019).

While Full-Year 2020 underlying profit has not surprisingly dropped back a bit to £6.5m, Mpac’s sticky service revenue actually grew year-on-year to £19.6m, representing 25% of total group revenue for the year. Gross margins were unchanged at 29% (FY 2020), which given last years headwinds is no mean feat.

In terms of balance sheet security, Mpac ticks plenty of boxes… Mpac is debt free and cash flow from operating activities increased to £11.2m in 2020, up from £5.1m the year prior – giving them a closing cash position of £15.5m (FY 2020).

Mpac’s strong financial position is underpinned by its impressive order book…

Mpac saw a huge turnaround in the second half of 2020 and order intake in H2 2020 was about 200% up on the first half. That strong bounce-back saw Mpac end 2020 with an order book of £55.5m, up from £55.2m in 2019.

The trend is your friend

When it comes to stock selection, simple technical analysis, based on robust concepts can be one of the most effective, forward-looking quality filters there is.

The collective intelligence of the market is not something to be ignored, and an established uptrend signals sustained buying pressure over a prolonged period.

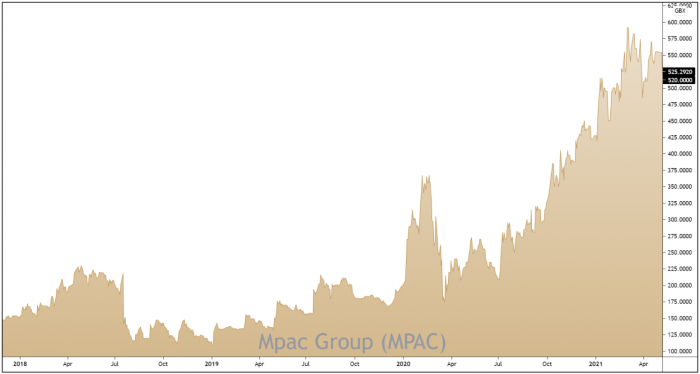

Mpac’s price chart is a beautiful example of this…

The shares have been marching higher since the summer – propelled by as a series of bullish trading updates and broker upgrades.

Despite the rise in the share price, Mpac is still trading on an attractive forward Price / Earnings ratio (PE) of 14.7. This PE is ranked 9th out of the 38 companies in the Machinery, Equipment & Components market.

Recent price action has seen the shares undergo a healthy period of mean reversion. And a small series of higher swing lows and lower swing highs has created a converging consolidation pattern which tends to signal trend continuation.

This week’s market-wide sell-off has taken prices back to the bottom of the consolidation pattern, allowing us to optimise our entry into this undeniable uptrend.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.