14th Apr 2022. 8.57am

Regency View:

BUY Kitwave (KITW)

Regency View:

BUY Kitwave (KITW)

A small stock with big competitive advantages

Having a competitive advantage is a key factor in maintaining growth in any business.

Establishing an advantage, no matter how slim, can contribute towards maintaining higher margins, developing brand loyalty and ultimately overtake or acquire the competition, and today’s stock is a prime example…

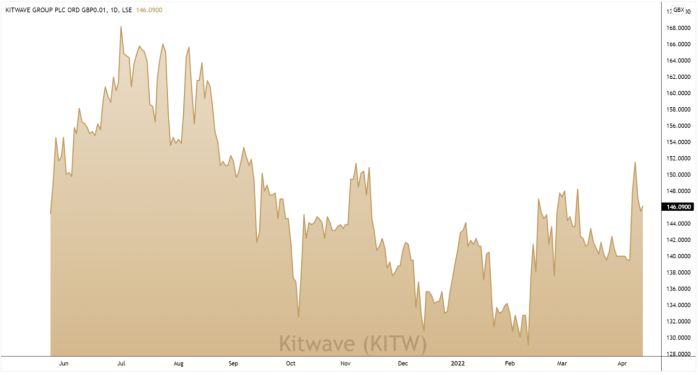

Kitwave (KITW) is a UK-based food and drink wholesaler which IPO’d in May last year.

Kitwave’s competitive advantages include:

- In-house fleet of delivery vehicles and drivers

- Extensive depot network

- 23-day stock retention

These competitive advantages have allowed the business to thrive while others have struggled…

The in-house fleet means Kitwave has been relatively unaffected by the diver shortages that have plagued third-party providers.

The extensive depot network allows Kitwave to offer next-day delivery within 25-mile radius of a depot and three-day delivery slots nationwide.

And Kitwave’s 23-day stock retention has enabled the business to cope with the inbound supply chain disruption.

Range, delivery and availability

The mastermind behind maintaining Kitwave’s competitive advantages is long-term CEO Paul Young.

Paul started the business back in 1987 as a tobacco and ambient supplier in the Northeast. Kitwave now have a complete nationwide offering, delivering: chilled, frozen, fresh, butchery, alcohol and a small amount of tobacco.

“We’re a business that has built a reputation on range, delivery and availability”, said Paul in a recent interview.

He certainly hasn’t cut any corners when it comes to achieving sustainable growth…

“We’re extremely good at acquiring family run businesses. We don’t buy broken, distressed businesses, we buy good businesses and try to make them better”.

Kitwave’s latest acquisition is a prime example of this…

In February, Kitwave aquired M.J. Baker Foodservice, the West Country’s leading independent foodservice supplier.

The deal, for £18.5 (net cash), will immediately enhance Kitwave’s Foodservice division, adding an estimated £17m in turnover and £1.5m in profit before tax.

And with Kitwave only having market share of less than 2%, Kitwave is well placed to consolidate the fragmented UK Grocery & Foodservice wholesale market.

February’s Final Results deliver the goods

In February, Kitwave delivered a robust set of results (FY21) along with a very upbeat outlook…

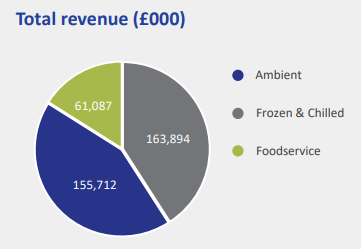

Whilst headline numbers showed a dip in revenue due to the pandemic, revenue recovered strongly in the second half of the last financial year (to end Oct 21) as Covid-19 restrictions eased, enabling Kitwave to generate earnings of £15m on turnover of £381m.

Kitwave managed to maintain gross profit margins at 18% during the year and profit before tax jumped by 63% to £2.1m, demonstrating the resilience of the business model.

The group’s balance sheet improved considerably, with Kitwave using the £64m raised during the IPO to de-leverage. And given Kitwave’s healthy level of free cashflow (£10.8m) and accelerating profitability, we expect their financials to continue to improve.

Kitwave also updated its warehousing capacity during the year – building a new 70,000 sq. ft distribution centre in Luton as a replacement for the previous site at Luton airport.

Delivered on time and in budget, the new site has the ability to store in excess of 5,000 pallets in highly efficient cold store conditions – ensuring Kitwave are well placed to meet future growth expectations.

And just last month, Kitwave opened a new 165,000 sq ft ‘distribution hub’ in Wakefield, which has replaced the Group’s previous Wakefield site and will allow for the integration of its Leeds depot.

Kitwave’s Full-Year 2022 outlook is very positive, with revenue set to return to pre-pandemic levels of around £590m (£381m FY21).

“Barring any further lockdown restrictions, we expect the Group to operate in the current year at efficiency and volume levels similar to those prior to the pandemic” commented Paul Young.

The Group has at its disposal a pipeline of exciting opportunities and is well placed to accelerate both organic revenue and profit growth through its buy-and-build strategy” he added.

Growth at a reasonable price

Kitwave’s forward valuation certainly catches the eye…

The shares are trading on a forward price to earnings (PE) ratio of just 10.7, which is one of the best in the Food & Drug Retailing sector.

Kitwave’s modest forward PE also looks attractive relative to a projected four-fold increase in earnings per share (EPS) growth. This gives Kitwave a Price to Earnings Growth (PEG) ratio of 0.1 (anything below 1 is considered good) – indicating that Kitwave offer growth at a very reasonable price.

It’s also worth mentioning that Kitwave paid a maiden dividend of 6.75p per share (4.59%), which the board expect to maintain and the shares currently trade on a market-leading forward dividend yield of 4.33%.

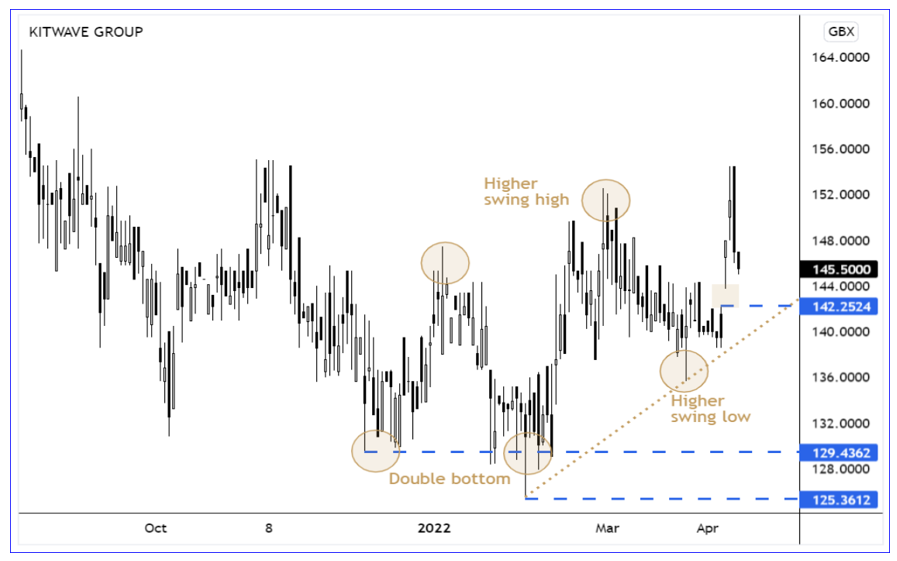

On the Kitwave’s price chart, we are starting to see a bullish technical structure emerge…

Having ‘double bottomed’ in February, the shares have carved out a higher swing low, and a higher swing high.

This swing structure, along with the bullish price gap which formed last week, indicates that momentum is starting to turn positive, and a new uptrend is starting to emerge.

Indeed, with multiple levels of support on the price chart and a bullish set of Final Results behind them, we believe Kitwave are well positioned to deliver strong shareholder returns.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.