23rd Apr 2020. 9.05am

Regency View:

BUY Kape Technologies (KAPE)

Regency View:

BUY Kape Technologies (KAPE)

2 Million Subscribers and Counting…

Cyber security is a technology sub-sector we like a lot.

A backdrop of tightening regulation, high profile data breaches and increased internet usage across multiple devices make for compelling growth catalysts.

When you couple this backdrop with the software as a service (SaaS) business model, which tends to have high recurring revenues and low costs, it’s not hard to see why we’re increasing our exposure to this sector theme.

We already hold GB Group (data security) and Eckoh (secure payments) in our AIM investor portfolio and today we are going for our hattrick!

Kape Technologies (KAPE) is a Virtual Private Network (VPN) specialist with over two million paying subscribers generating revenues north of $100m.

A fast growing billion-dollar market

A VPN encrypts your personal data whilst using the internet – significantly increasing your protection from data theft.

It works by routing your device’s internet connection through a private server rather than your internet service provider so that when your data is transmitted to the internet, it comes from the VPN rather than your computer.

Initially, VPN’s were developed for corporations that needed to protect their sensitive data from being sent over public networks. But ever since WikiLeaks became a household name, the personal VPN market has grown by leaps and bounds.

The global VPN market is currently worth $27bn and forecast to be worth $36bn by 2022. These forecasts are unlikely to be negatively impacted by the pandemic because the huge increase in remote working has only served to increase the awareness and demand for VPN’s.

Transformational acquisition

In November 2019 Kape paid $127.6m (£99m) for Colorado-based Private Internet Access (PIA), a leading VPN provider.

The acquisition more than doubled Kape’s paid subscriber base, building on their 40% organic growth in subscriptions (2019) – taking total subscribers to 2.35 million (2019).

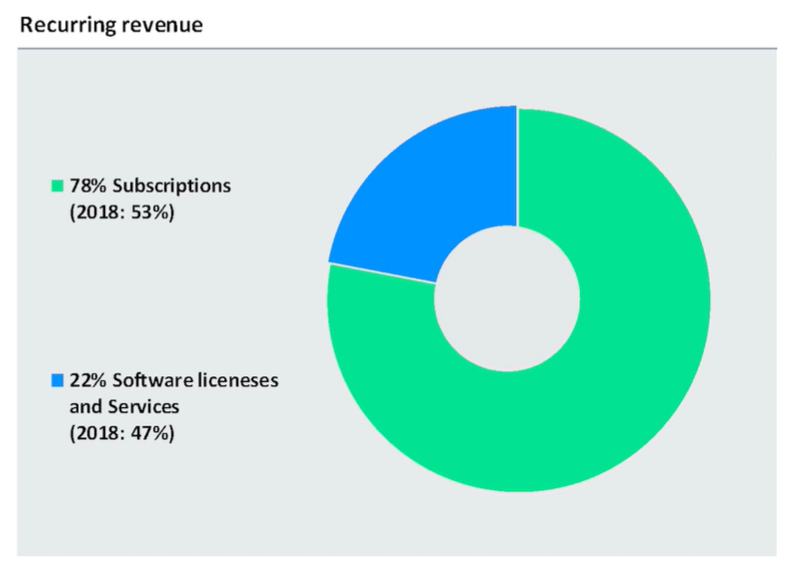

De-risking their revenue model by increasing subscriptions has been a key strategic goal for Kape and something they plan to build on. CEO Ido Erlichman stated in March that “we expect recurring revenue to increase to around 85%-90% in 2020”. The subscriptions are annual and paid in advance, so the model is brilliant for earnings visibility and cash generation.

The acquisition also significantly increases Kape’s foothold in the fast-growing US market and adds additional privacy products to Kape’s existing product suite. In Q2 Kape expect to launch their Cybersecurity Centre which is a dashboard that combines all the digital privacy and security needs for the end user – making it easier to up-sell additional products.

Kape funded the PIA deal through a mates’ rates short-term bridging loan from one of its largest shareholders, Tedi Sagi, the founder of the gambling software company Playtech (PTEC). Whilst PIA had existing debts of $32.1m, they were producing $14.7m in profits and $16.3m in operating cash flow. Kape expect the combined business to generate revenues of between $120m to $123m and underlying cash profit of between $35m to $38m by full-year 2020. They also anticipate making $3.5m to $4.5m of cost savings in the first 12 months post completion.

Growth at a very reasonable price

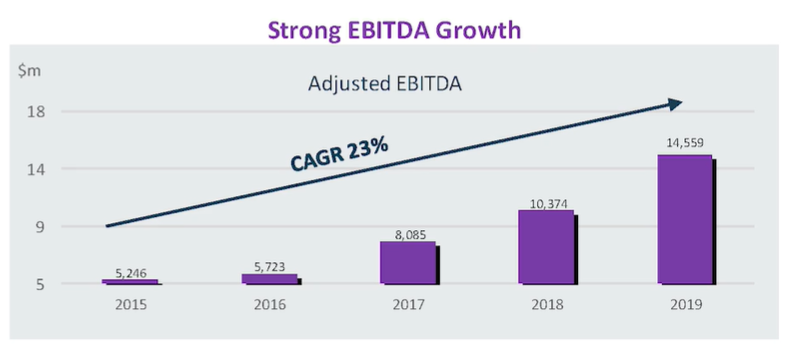

In March Kape published their full-year 2019 results which showed strong double-digit growth across all financial metrics.

Revenues jumped 26% to $66.1m, adjusted EBITDA surged 40% to $14.6m and cash flows increased by 12.5% to $17.9m.

The PIA deal should see Kape deliver full-year earnings (EPS) growth of 67% in 2020 – putting their forecast PE ratio of 16.6 firmly into perspective and indicating that Kape offer growth at a very reasonable price.

Kape reiterated it’s full-year guidance levels only last month and actually indicated that the pandemic was unlikely to have any negative impact on business. In fact, commenting in his recent COVID-19 statement, CEO Ido Erlichman said that due to the sharp increase in remote working, Kape is seeing “increased demand for its products”… “this has been especially apparent within the Group’s digital privacy division, and in particular Kape’s VPN offering”.

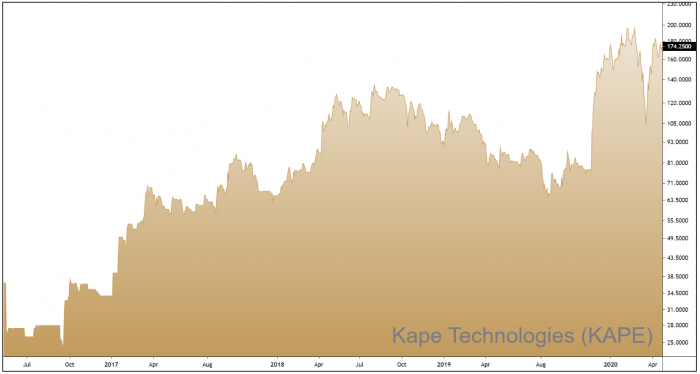

Multiple bullish price gaps

Bullish price gaps occur when buying pressure in the pre-open auction is so strong that prices open above the previous day’s range. The majority of price gaps are filled during the same trading day and hence they are no longer visible on the price chart. However, occasionally price gaps will hold and prices will progress higher – this is a bullish sign as it indicates that buying is being met with more buying and not being absorbed by sellers.

We can see from Kape’s daily candle chart (right) that prices gapped higher in November following the PIA acquisition. Prices also gapped higher and held these gaps twice during March, at a time when there is no shortage of sellers. These bullish price gaps provide a clear indication of Kape’s relative strength. How many AIM stocks are in touching distance of all-time highs at the moment? The answer is less than 10%.

With bullish momentum on the price chart, strong underling catalysts for growth and resasurances that total demand is relatively unaffected by the pandemic, Kape makes an attractive addition to our AIM Investor portfolio.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.