15th Sep 2022. 9.00am

Regency View:

BUY Kape Technologies (KAPE)

Regency View:

BUY Kape Technologies (KAPE)

Kape Tech a compelling buy at current prices

Of all the investment sectors we look at in our analyst team, there is perhaps none more compelling than cyber security…

It is a vast global market, growing at a rapid pace due to several powerful catalysts which impact a wide demographic.

They cyber security market is expected to reach $19bn by 2024 and 70% of customers are under the age of 40.

Data privacy concerns have grown rapidly in the last three years as the growing number of internet-enabled devices within each household makes it harder to keep our digital footprint secure.

Stocks within the cyber security sector typically operate a Software-as-a-Service (SaaS) model which tends to be characterised by low-costs and high levels of recurring revenues.

This makes cyber security reasonably well insulated from the current macro headwinds of rising inflation and supply-side shocks.

One stock that we particularly like within this sector is Kape Technologies (KAPE)…

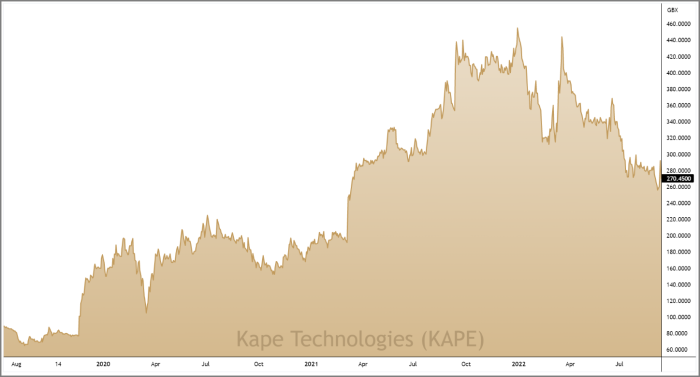

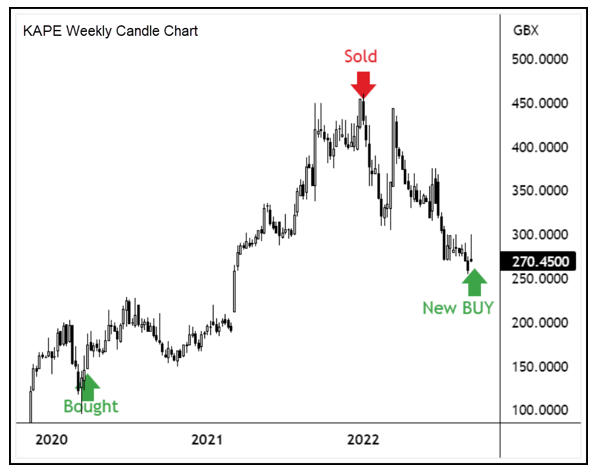

Kape first came to our attention in April 2020, and we were surprised to see that a stock with such strong potential and high levels of recurring revenue had been lumped in with the rest of the market during the initial pandemic-induced sell-off.

We subsequently enjoyed a strong bounce-back run in the stock and crystallised a triple digit gain at the turn of this year when valuations became a little stretched.

Now, with the stock more than 40% below its January highs, and Kape delivering record results on Monday, we find ourselves wondering if the market has once again missed-priced this impressive growth stock.

Integration of key acquisition puts Kape on the express train

Kape’s SaaS product suite specialises in VPN’s (virtual private networks) which create digital privacy and antivirus software for digital security.

The majority of Kape’s products are purchased through rolling subscriptions and given the essential nature of digital privacy and security, these subscriptions tend to be very ‘sticky’.

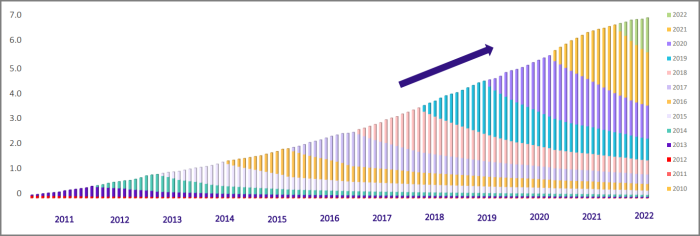

Kape has done an outstanding job of growing its subscription base through a powerful combination of organic growth and smart acquisitions…

In 2019, Kape paid $127.6m (£99m) for US-based Private Internet Access (PIA), a leading VPN provider – a move which more than doubled Kape’s subscription base.

This was followed by the ‘transformational’ acquisition of ExpressVPN for $936m (£807m) in December last year.

ExpressVPN has more than 3 million active users across 180 countries – taking Kape’s subscription base past the 7 million mark.

The acquisition of ExpressVPN added significant scale to Kape’s existing cyber security product suite and provides multiple cross-sell and up-sell opportunities across a larger customer base and wider geographic footprint.

Integration of ExpressVPN is on track and Kape expect to deliver annualised cost synergies north of $30m by next year.

Kape’s strong half-year results create a buying catalyst

On Monday, Kape released a stellar set of half-year results for the six months to June 30, 2022…

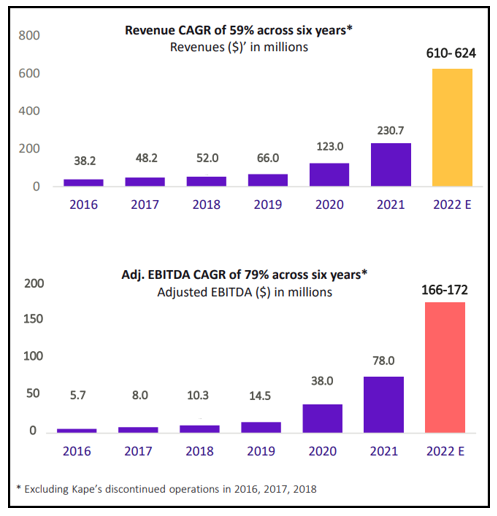

Headline revenues were $302.4m, up from pre-ExpressVPN levels of $95.5m a year ago and up 19% on a pro forma organic basis.

A staggering $268m of Kape’s revenues are recurring in nature, up 353.5% and giving Kape very high levels of earnings visibility.

Kape said ongoing demand for privacy and security products continues to drive both new customer growth and upsell opportunities from existing subscribers. Its privacy segment revenues grew 19% on a pro forma organic basis, with the security division growing 15.7%.

Operating profit jumped three-fold to $59m versus $13.6m during the same period last year – underlining just how earnings enhancing the ExpressVPN deal has been.

Kape’s cash balance has more than doubled to $62.9m and net assets have tripled to $917.3m while net debt has fallen to $391.9m from $457.5m in December 2021.

Looking ahead, Kape maintained its strong full-year outlook and expects to generate revenues for the year ended 31 December 2022 of between $610-624m and pro forma Adjusted EBITDA of between $166-172m for the year ending 31 December 2022.

Growth at a reasonable price

After a 40% sell-off from their January highs, Kape’s share price is trading on a highly attractive forward valuation…

Investors are being asked to pay just 6.7 times forward earnings, giving Kape one of the cheapest valuations in the Software & IT Services sector.

The stocks lowly forward PE also looks very reasonable relative to forecast earnings per share (EPS) growth of 37.6% – giving Kape a price to earnings growth (PEG) ratio of just 0.2 and indicating that the shares offer growth at a reasonable price.

And when you consider Kape’s high level of earnings visibility, and the growth projections for the wider cyber security market, we believe Kape is a compelling buy at current prices.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.