Regency View:

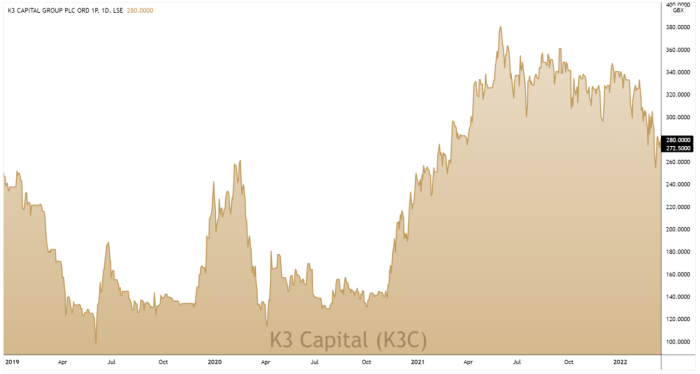

BUY K3 Capital (K3C)

K3 offer income and growth

When investing in small caps, the term ‘income & growth’ is often seen an oxymoron…

After all, why would a small, growing business choose to pay out a dividend rather than reinvest in further growth?

However, every now and again you find a company that manages to strike the perfect balance between rewarding shareholders with a progressive dividend and maintaining robust levels of organic growth, and we believe K3 Capital (K3C) is the perfect example…

K3 is a M&A (mergers and acquisitions) house for SME’s which has diversified through strategic acquisitions to cover debt restructuring, tax advice and insolvency.

The shares look attractively priced, with double-digit earnings per share (EPS) growth and a market-leading dividend yield.

Building an ‘end-to-end platform’ of services for SME’s

Having started as an M&A specialist, K3’s ambitious CEO, John Rigby has opportunistically grown the business into a diversified financial services powerhouse…

K3’s M&A division is the UK market leader in company sales and its tax advisory division one of the most established R&D tax reclaim businesses in the UK.

In 2020, during the height of the pandemic, Mr Rigby managed to pull off a game-changing merger with restructuring and advisory firm Quantuma.

The deal, worth £42m, has more than doubled K3’s top line revenues from £15m in 2020 to £47.2m in 2021.

Quantuma is major player in the insolvency market with a 5% national share, behind only Begbies Traynor (BEG) – a stock we also hold in our AIM Investor portfolio.

The withdrawal government support and the unwinding of legislative changes is providing a strong tailwind for the insolvency and debt restructuring market.

K3 have launched a debt advisory business to help M&A customers finance bids, and John Rigby’s vision of an ‘end-to-end platform of services’ is taking shape.

Commenting on the Quantuma deal, Mr Rigby said:

“It creates a group with diversified income streams, recurring revenues, multiple and complementary channels to market and significant cross selling opportunities.”

M&A outlook remains strong

When the pandemic first hit, there was a huge amount of uncertainty around the UK M&A market, and it was a driving force behind K3’s decision to diversify the business with the acquisition of Quantuma.

However, rather that M&A activity dwindle as first thought, it’s been quite the opposite with K3 enjoying a record period – with its M&A division delivering revenue growth of 66% to £9.8m (H1FY22).

Most of the growth in M&A was organic, with appointments up 47% and mandates growing 75% resulting in the number of offers rising 36%.

In its February Half-Year report, K3 said:

“Our M&A Division continues to see strong KPI performance, with growing transaction fee pipelines underpinning our expectations for H2 and beyond…

December was the most profitable month within the M&A division in FY22 to date.”

Rock-solid financials

K3’s financials are in rude health…

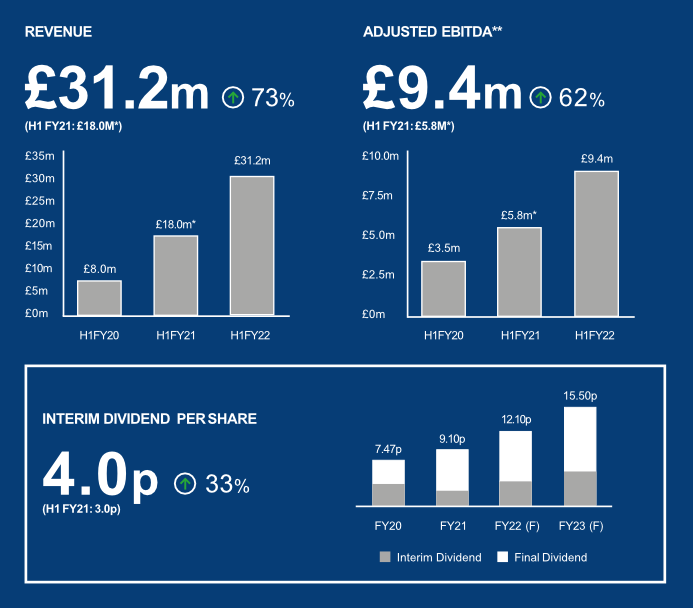

As the Quantuma merger continues to bed in, top-line revenue has surged 73% during the last half-year (H1 FY22) and adjusted earnings (EBITDA) have followed suit, up 62% to £9.4m.

K3 have outlined ambitious growth targets over the next five years with EBITDA from the existing businesses set to increase from an estimated £16m this financial year to £23m by May 2023 and to between £33m-£36m by May 2026.

In addition to this more than doubling of organic earnings, K3 plan to add another £10m-£17m through acquisitions, taking total EBITDA to between £50m-£53m – making K3’s mid-tier PE ratio of 12.3 (forward) look very attractive.

And based on discounted cashflow analysis, the shares are trading at a ‘deep discount’ to fair value of £9.90p.

K3 run a debt-free balance sheet with net cash of £8.83m, and in their recent Half-Year report reiterated their commitment to a “progressive dividend policy”…

K3’s Full-Year 2021 pay-out will be 9.10p per share and this is forecast to increase by 70% over the next two years – putting K3 on a forward dividend yield of 5.43%.

And whilst current year dividend cover looks relatively thin at 0.84 (TTM), it is forecast to rise to 1.55 in-line with K3’s projected earnings growth.

In summary, K3 is a well-run business which looks to reward investors as they grow, and we’re happy to be along for the ride!

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.