8th Aug 2019. 8.58am

Regency View:

BUY Johnson Service Group (JSG)

Regency View:

BUY Johnson Service Group (JSG)

Customer Retention is the Key to Johnson’s Success

The AIM market is full of ‘exciting’ businesses on the cutting edge of pharmaceutical breakthroughs or waiting to strike oil but often, these businesses, which are long on potential, short on fundamentals, make terrible investments.

AIM Investor’s one and only goal is to isolate the best possible investment opportunities in the AIM market. More often than not, these opportunities are very different to the headline-grabbing story stocks. A perfect example of this is Johnson Services Group (JSG)…

JSG provide textile rental and related services. The Group is the leading supplier of workwear and protective wear in the UK, clothing over 1.3 million people a week. It also provides premium linen services for the hotel, catering and hospitality markets, and high-volume hotel linen services, processing nearly 36 million items a month.

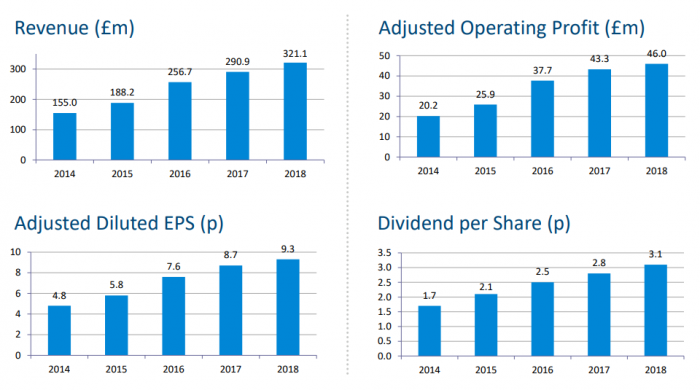

Whilst there’s only so much excitement that dirty laundry can generate, JSG’s ruthlessly efficient operation has maintained client retention rates of 95% for the past four years. This has allowed JSG to achieve impressive levels of organic growth which, alongside a few well-timed acquisitions, have seen JSG more than double their revenues since 2014.

Concentrating on the commercial sector is paying off

Management have worked hard to reposition the business away from the struggling high-street and towards the higher margin commercial sector. In 2017, JSG sold the last of their Johnsons dry-cleaning businesses, enabling them to concentrate on consolidating the highly fragmented textile rental sector.

JSG now focuses on two market segments:

1. Workwear – providing protective wear and workplace hygiene services through its market-leading Johnson’s Apparelmaster brand.

2. Hotels, Restaurants and Catering (Horeca) – operating across several well-established brands, JSG provide textiles such as linens to hotels, restaurants and catering companies.

Refocusing the business has really paid off, reflected in a string of bullish trading updates and broker upgrades during the last year (see Strong Summer Statement below).

In 2018 sales rose 10.4%, while adjusted operating profit was up 6.2% to £46m and adjusted earnings per share jumped 6.9%. Acquisitions made a strong contribution to the progress, but organic sales growth was also impressive in its own right at 7.8%.

Having experienced a significant increase in peak summer volumes last year, JSG is targeting increased capacity and productivity with a new high-volume hotel linen facility in Leeds. Management recently confirmed that the new facility remains on schedule and within budget and is expected to be operational in the second quarter of 2020.

It’s also worth noting that JSG is purely UK focused, hence why it’s share price has been unfazed by the pounds recent battering. In fact, the weaker pound is beneficial for the UK leisure and hospitality market, helping to mitigate some of downside from a hard Brexit.

Strong summer statement

JSG’s July trading update read well…

Management upgraded their outlook on the back of strong trading and encouraging organic growth during the first half of the year – prompting brokers HSBC and Investec to re-rate the stock.

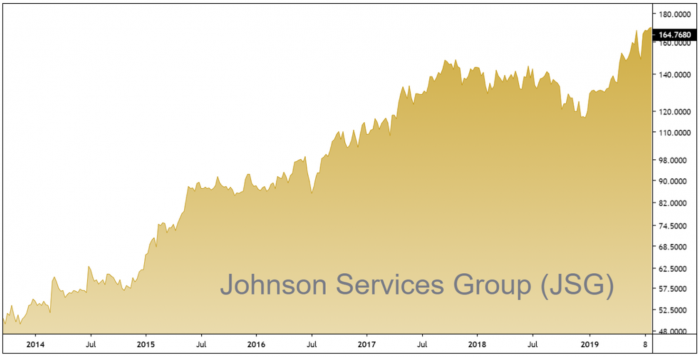

Market reaction to the trading update has been very bullish with the shares breaking to new highs for the year. With short-term price momentum now realigned with JSG’s multi-year uptrend, we believe it’s a great time to snap up some shares.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.