25th Jul 2019. 9.02am

Regency View:

BUY IG Design (IGR)

Regency View:

BUY IG Design (IGR)

A perfectly packaged growth stock

From Christmas cards to crackers, gift bags to birthday banners, IG Design (IGR) provide just about every accessory you need to celebrate just about any special occasion.

This British based company has a truly global reach with key revenue streams in America, Asia and Australia. In the last year alone, it has sold 750m units of consumer products to more than 11,000 customers in over 80 countries. That’s 1.6bn meters of gift wrap for those of you who are interested!

They produce own design and licensed products covering four main categories:

1. Celebrations (gift wrap, crackers and cards)

2. Stationery & Creative Play, including the Kid’s Create brand

3. Gifting (frames, albums, diaries and calendars)

4. Not-for-resale consumables – premium bag solutions to package in-store purchases

This is a low margin, high volume business and IGR’s ‘one stop shop’ in-house design, sourcing and manufacture approach, along with a series of shrewd acquisitions, has allowed it to build the scale necessary to flourish.

As AIM stocks go, IGR is a top tier company by any metric you wish to choose. Management have a proven track record of delivering double-digit sales and profit growth. They have also maintained a healthy balance sheet and rewarded investors with a steadily rising dividend.

Game changing acquisition

In August last year, IGR snapped up US rival Impact Innovations for £56.5m, creating the world’s biggest consumer gift packaging business.

The strategically transformative deal has seen IGR double its US revenues, helping to further insulate the stock from the potential fallout of a hard Brexit. In fact, US sales now account for more than 50% of group revenues.

The Impact deal has also seen IGR further deepen relations with US retail giant Walmart, its largest customer. Walmart has a ‘Made in America’ initiative and Impact’s US manufacturing base is a significant strategic asset for IGR. A move that was further underlined by Walmart recently awarding Impact its Seasonal Supplier of The Year award for 2019.

IGR’s focus on working with mass discount retailers such as Aldi, Costco, Tesco and the aforementioned Walmart has delivered significant growth. Sales in the discount retailer segment have jumped 71% during the last fiscal year (March 2019) to £277m, representing 62% of the group’s revenues.

Even when you strip out the Impact acquisition, organic revenue growth across IGR’s top ten customers averaged a very healthy 17% for the year.

Record revenues

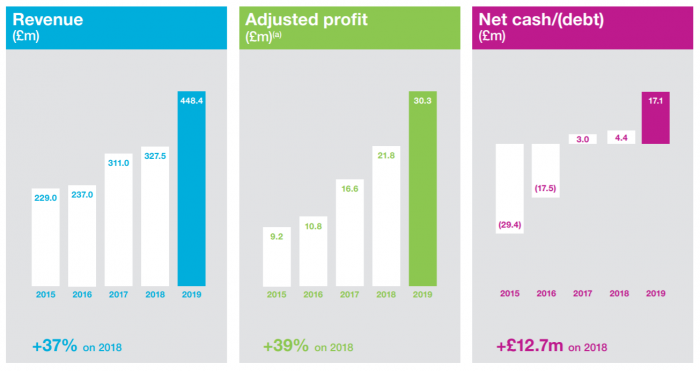

In June, IG Design confirmed that it had delivered record full-year revenues of £448m (March 2019), a 37% increase year on year, including organic growth of 9.8%.

Adjusted profit before tax increased by 39% to £30.3m, delivering 33% growth in earnings per share (EPS) to 29.3p.

These solid numbers were backed up by a 42% hike in their divided to 8.5p, a trend that is forecast to continue.

Of course, these headline earnings numbers should never be viewed in isolation. When we step back and look at IGR’s five-year performance in revenues, profit and cash generation, it’s clear to see that IGR is high quality business.

With the full efficiency benefits of their Impact acquisition yet to realised and a new state of the art printing press coming on stream in early 2020, IGR look well positioned to maintain their current growth rate.

A powerful price pattern is emerging

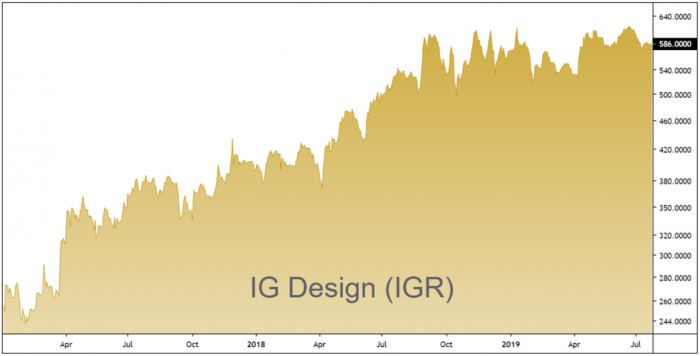

Having rallied over 50% during 2018, IGR’s share price has undergone a healthy period of consolidation.

This consolidation phase has seen the shares carve out a series of higher swing lows whilst being contained beneath a key area of horizontal resistance, forming a bullish ascending triangle pattern.

Whilst we rarely highlight technical patterns in our AIM Investor reports, this powerful pattern is a worthy exception as it can often culminate in an explosive move to the upside.

We’re going to position ourselves within the ascending triangle in order to maximise our potential upside.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.