31st Oct 2019. 9.09am

Regency View:

BUY GB Group (GBG)

Regency View:

BUY GB Group (GBG)

The Cyber Security Stock with a Global Identity

How safe is your password? As much as we struggle to believe that anyone could possibly know our first cat was called Mr Tiddles the sobering answer is – not very.

Our increasingly digitised lives make it easier than ever for fraudsters to get their hands on our personal information and identity theft is at an all-time high. In the UK alone there were 190,000 reported cases in the past twelve months.

Companies are under mounting pressure to prevent and detect such data violations. Recent, high-profile cases include hacked question-and-answer website Quor, compromising the names and email addresses of 100 million users. And Yahoo! who recently settled a lawsuit over the loss of data belonging to 3 billion users, including email addresses and passwords.

The EU’s new data privacy rules (‘GDPR’), introduced in May 2018, place an even greater responsibility on companies to verify and safeguard personal data in a lawful and transparent manner.

One firm delivering consistently high earnings growth from this rapidly expanding market is identity data intelligence specialist GB Group (GBG).

GBG can verify the identity of 4.4bn people globally. Its products and services enable its customers to better understand and verify their customers and employees, covering three main areas:

1. Location Intelligence – GBG’s Loqate product is used 70 million times every day, leading the world in location intelligence for businesses of all sizes and sectors.

2. Identity Verification – GBG’s IDScan, ID3global and Identify Solution products provide layered ID document verification and biometric checks, helping businesses onboard legitimate customers quickly.

3. Fraud & Compliance Management – GBG’s Predator, Instinct and Connexus brands off solutions to combat complex financial crimes with unification of digital and data.

A global identity

It’s very rare on AIM to find a company that’s so geographically diversified. GBG works with clients in 72 countries, including some of the best-known businesses around the world, ranging from US e-commerce giants IBM and ebay to Asia’s biggest banks and European household brands.

GBG’s international revenues now represent over 45% of total business with significant recent growth in two key target markets, North America and Asia. GBG has achieved this through a healthy balance of organic and acquisitive growth – in June’s FY2018 numbers, revenue increased 37% to £119.7m, of which 17% was organic – the remainder due to synergy benefits from its purchase of Postcode Anywhere (PCA Predict) for £73m in 2017.

GBG has recently made a further two strategic acquisitions:

1. VIX Verify for £21.3m in October 2018 – an Australian company that specialises in identity and location intelligence.

2. IDology for £232m in February 2019 – a US based provider of identity verification and anti-fraud services.

The purchase of IDology represents a major step up in GBG’s plans for expansion into North America and whilst it has seen their balance sheet swing from a net cash to a net debt position, the benefits of this acquisition should be considerable…

Today, the US Identity Verification market is valued at $1.5bn, with a predicted growth rate to 2022 of 14%. GBG’s acquisition of IDology will provide the combined business with the critical mass to improve its customer offer, operational efficiency and deliver scale in a key target market.

Paying up for quality

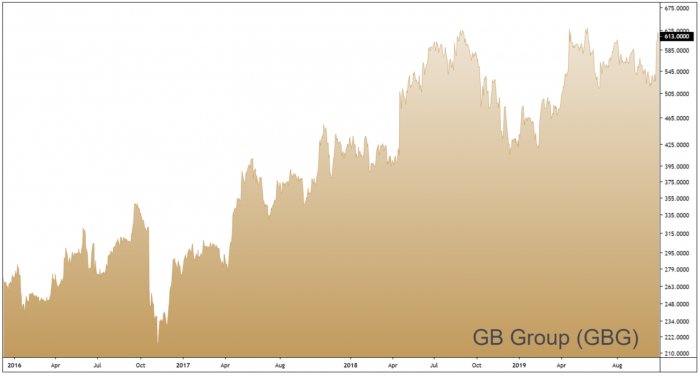

With a forward PE of 33 and a share price near 52-week highs, GBG is certainly not a bargain basement stock but sometimes its worth paying up for quality.

GBG released a bullish trading statement last week which revealed a 138% surge in half-year adjusted operating profit to £20.9m, driven by organic growth and recent acquisitions of VIX Verify and IDology.

On the day of the trading statement, GBG’s share price burst higher, breaking through a descending trendline and realigning short-term price momentum with GBG’s bigger picture uptrend. This rally has been followed by several sessions of tight consolidation, indicating that the shares are being accumulated before another run higher and creating a compelling catalyst for today’s entry.

Given GBG’s impressive track record of exceeding market expectations, we believe this is another high-quality addition to our AIM investor portfolio.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.