28th Feb 2019. 9.00am

Regency View:

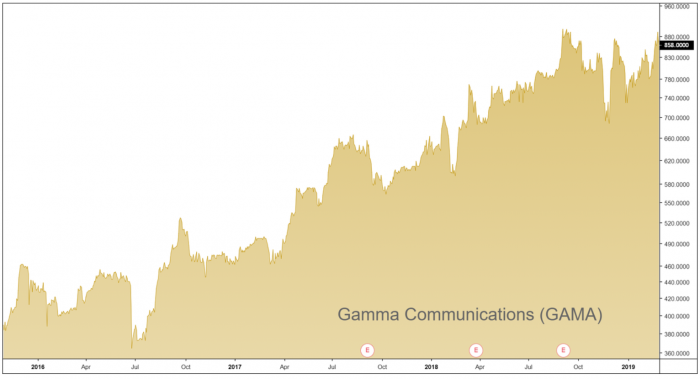

BUY Gamma Communications (GAMA)

Regency View:

BUY Gamma Communications (GAMA)

Fast growing Gamma has Europe in its sights

A key element of legendary investor Warren Buffett’s approach to stock selection is to find companies with high levels of recurring revenues. He does this because firms with plenty of repeat business don’t have to try so hard just to stand still. In addition, recurring revenues tend to be earned in a less competitive fashion than new business, so they often have good profit margins attached to them.

Whilst Buffett is famed for his value-based investment approach we believe the ‘Oracle of Omaha’ would approve of today’s selection. Digital telecoms provider, Gamma Communications boast recurring revenues of 90% and is a text-book example of how repeat business can be leveraged to achieve high levels of growth.

Technology that’s transforming the traditional office

Gamma is the UK’s largest ‘SIP trunking’ provider, holding 29% of the market. SIP trunking has nothing to do with pensions or elephants, SIP stands for Session Initiated Protocol and is basically the methodology behind telephone calls over the internet also known as Voice Over Internet Protocol or VoIP to add yet another acronym!

A SIP trunk is like an analog phone line, but in the virtual world. Using a SIP trunk, a provider like Gamma can connect one, two or thirty different channels directly to a business’s private telephone exchange. Along with being super scalable SIP trunks are also far more cost-effective than paying standard line rental.

The traditional telephony-based office is being transformed by this new technology and Gamma has been taking full advantage, posting 22% compound annual revenue growth since its AIM IPO in 2014. Gamma also offer a host of other services including broadband, mobile services, security and unified communications solutions.

A 1,000 strong army of channel partners

More than two-thirds of Gamma’s revenues are generated by an army of over 1,000 channel partners. This gives Gamma access to a substantial indirect salesforce enabling it to continue expanding in the UK business market. Indirect sales in Gamma’s growth products – such as data, mobile and SIP trunking – have delivered consistently strong revenue growth and we believe they will continue to do so.

The remainder of Gamma’s revenues are generated through direct sales into specific market sectors. Direct sales have recently delivered significant new multi-year contract wins, including supermarket chain Aldi, finance group BGL and the London Stock Exchange. Gamma’s five-year Aldi contract will entail providing one of the market’s largest wide-area-networks (WANs), covering Aldi’s estate across the UK and Ireland.

£35m European war chest

As the UK VoIP market matures, many other European countries remain in their infancy when it comes to adopting VoIP technology. Gamma views European expansion as the logical next step in their ambitious growth plans.

Gamma have identified the Netherlands as their gateway into Europe, snapping up Dean One for EUR 13.2m in October 2018. The Dutch cloud telephony market is the fourth largest in Europe and Dean One looks like a good fit. It has a very similar product portfolio to Gamma and will add EUR 19m in revenue and around EUR 2.5m in earnings.

Even after the purchase of Dean One, Gamma has plenty left in the coffers (£35.5m to be precise) and we expect them to plough ahead with their European growth-by-acquisition plans this year.

Don’t be put off by the PE

A glance at Gamma’s price chart shows a powerful long-term uptrend and January’s trading update was well received by the market. The update indicated that earnings would be at the top end of market expectations and this bodes well for Gamma’s full-year numbers which will be released in March.

A PE of 27 is a little punchy but this is a stock with highly visible future earnings and forecasted EPS growth of 20% in 2019. Should management continue to deliver on their ‘Gamma 2023’ growth plans we believe shareholders will remain well compensated.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.