30th Jan 2020. 8.54am

Regency View:

BUY Frontier Developments (FDEV)

Regency View:

BUY Frontier Developments (FDEV)

Playing the Global Gaming Boom

The global gaming boom is undeniable. There are now over 2.5bn gamers across the world, creating an entertainment market worth $152bn, bigger than the markets for music and movies combined.

In February last year we added racing game developer Codemasters (CDM) to our AIM Investor portfolio, now we’re looking to increase our exposure to this high-growth global market with the addition of Cambridge-based Frontier Developments (FDEV).

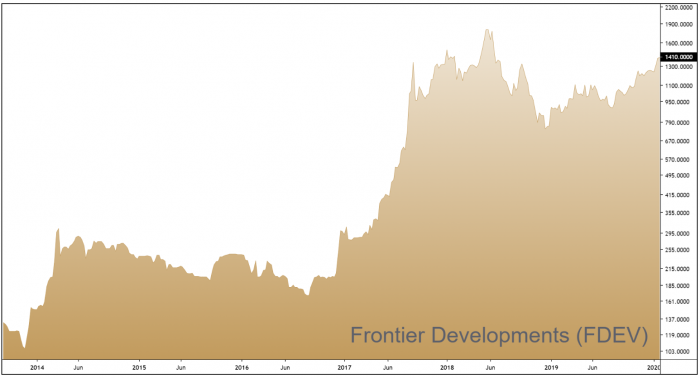

Founded by current CEO David Braben 25 years ago, Frontier has grown into the UK’s largest independent game studio with over 460 staff and sales of more than 8m self-published games. Its success attracted Chinese mega-conglomerate Tencent, which paid £17.7 million for a 9% stake in the firm two years ago.

Frontier focus purely on PC and console games which is the fasting growing segment of the games market, outstripping mobile by more than 10% last year. They have four successful game franchises which continue to perform well; 2014’s spacefaring simulator Elite Dangerous, film tie-in Jurassic World: Evolution, the 2016 fan-favourite rollercoaster park builder Planet Coaster and the newly released zoo simulator Planet Zoo.

Planet Zoo Tops the Charts

The launch of Planet Zoo in November has been highly successful. The new release sold more PC units on the first day of release than any of the group’s previous launches – topping the Steam gaming platform’s global rankings.

Planet Zoo sales have continued to be strong, particularly over the Christmas period and the title is forecast to generate revenues of £25m in the current financial year ended May 2020, that’s almost a third of Frontier’s total sales for 2019.

Frontier pride themselves on having games with strong ‘post release paid content’ (add-ons that users can purchase to enhance their gaming experience) and Planet Zoo is no different. Frontier released their first Planet Zoo add-on, Arctic Pack on 12th January, and whilst we’re yet to see the sales numbers these add-ons are sure to create an extended shelf-life.

Expanding New Release Pipeline

Much like movie studios, the revenue streams for game developers can be very lumpy as they cycle from new release to new release. Frontier is looking to expand its release pipeline by opening its doors to external developers. Alongside the two-year development cycle for a new “major global IP licence” which it secured in March, Frontier has launched Frontier Publishing.

This is an initiative designed to form partnerships with external developers, allowing smaller more nimble developers to benefit from Frontiers experience and resources and for Frontier to boost its publishing capabilities, potentially smoothing out its revenue streams. It announced its first partnership in June and a second was unveiled in early November.

Recent Trading Update Reaffirms Full-Year Guidance

Two weeks ago, Frontier released a trading statement, priming the market ahead of the release of their half-year results on Wednesday 5th Feb.

Frontier reported £32m in revenue for the six months to 30th November 2019 (H1FY20). That’s 28% ahead of the previous half-year (H2FY19), but 51% down on the £64.7m from the same period last year (H1FY19). The H1FY20 number included just 26 days of sales from Planet Zoo and Frontier reiterated its full-year revenue expectation of £65-£73m.

With zero debt and £35m cash in the bank, Frontier’s solid financials are very attractive given how revenues tend to fluctuate in this sector. CEO David Braben is yet to pay out a dividend so it is highly likely that he will use Frontier’s cash pile to fund acquisitions which can expand its portfolio and capabilities.

Frontier’s ability to roll out product updates digitally for very low cost has given them one of the highest operating margins in the sector at 21.6%. And whilst Frontier’s headline forecast PE of 39.8 looks high, if we smooth out the severe fluctuations in earnings growth by taking a five-year average, Frontier actually trade on a very reasonable price to earnings growth (PEG) of 0.76.

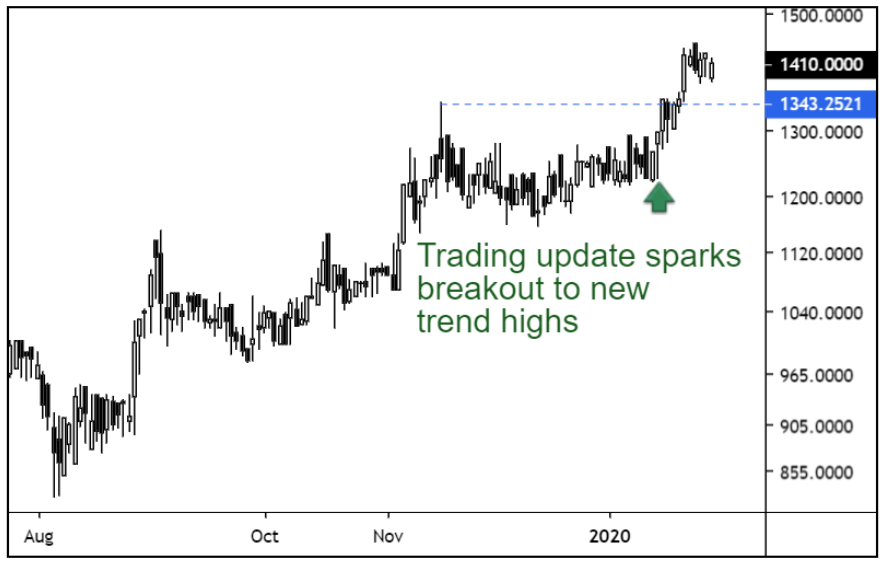

Short-Term Momentum Realigns with Bigger Picture Trend

Price action following Frontier’s January update has confirmed that the market is looking past the headline drop in revenues and focusing on Frontiers flourishing product pipeline. In fact, the day of Frontier’s trading statement (Jan 15th) represents the origin of Frontier’s recent rally (see chart below).

The shares have broken through the November swing highs and a retest of the May 2018 highs now looks to be on the cards, that’s 25% higher than current prices.

With short-term momentum aligned with Frontiers bigger picture trend structure, the timing looks right to snap up some shares.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.