26th Mar 2020. 9.01am

Regency View:

BUY Frontier Developments (FDEV) – Second Tranche

Regency View:

BUY Frontier Developments (FDEV) – Second Tranche

Gaming Outlook Remains Favourable

The seismic selloff in equities that we’ve witnessed during the last month has driven several stocks within our portfolio to levels well below our entry price.

Whilst for some stocks the sell-off is justified, for others, the fundamental picture remains relatively unchanged and the underlying fundamentals of the company are robust enough to withstand the short-term volatility. We believe Frontier Developments (FDEV) is a prime example of this…

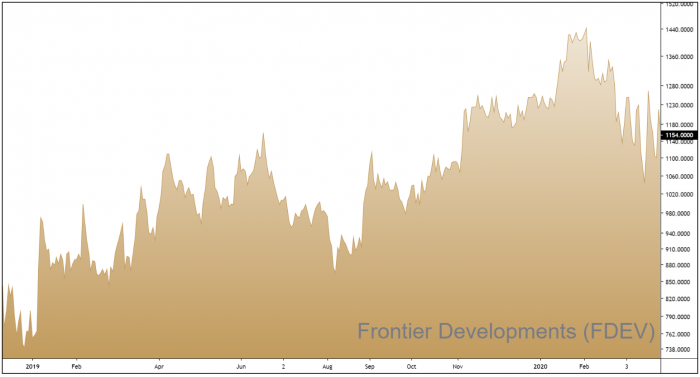

We showcased Frontier back in January, they are the UK’s largest independent game studio and have more than 8m self-published games to their name. With signs that gaming demand has actually increased following the COVID 19 outbreak, and Frontier’s shares now changing hands 25% below our original entry price, we are going to use the market sell-off to snap up a second tranche.

Self-Isolation Boosts Gaming Demand

It would be wrong to argue that the gaming industry has been unaffected by the COVID 19 outbreak. This year’s Game Developers Conference has been cancelled, Nintendo have had to delay production of their Switch console for the entire Japanese market and the release of the new Oculus Quest virtual reality gaming headset has been delayed. However, we are starting to see clear evidence from Asia that state-enforced lockdown and self-isolation has significantly increased demand for gaming…

Chinese mega-conglomerate Tencent, who own a 9% stake in Frontier, released a statement earlier this month which revealed that ‘millions of people in China self-isolating at home had spent an increasing portion of their time on its online games, video, music and online reading services.’

According to the FT, Smartphone users in China downloaded a record number of games and other apps in February as tens of millions of people were confined to their homes. Weekly gaming downloads in China surpassed 60 million, three times that of any other sector – it is widely anticipated that we will see a similar pattern in the US and Europe.

Game-Changing F1 Deal

Earlier this month, Frontier announced that it had won exclusive rights to develop and publish FIA Formula One games worldwide for PC and console platforms, together with the rights for streaming services.

The first game is expected to be released for the 2022 F1 season and the licence provides Frontier with the rights for four F1 seasons (2022 to 2025 inclusive). As a result of the increased earnings visibility that the F1 deal creates, Frontier’s CEO, David Braben confirmed that “confidence in the outlook for FY22 and beyond has been further strengthened”.

The timing of this statement should not be underestimated. This was a clear display of confidence at a time when markets were in panic mode and it underpins our view that Frontier is well positioned to not just survive but thrive during the next two years.

Cash is King

For businesses looking to survive this unprecedented crisis, cash is king and Frontier’s rock-solid balance sheet provides investors with significant comfort.

The firm has zero debt, £29m cash in the bank and forecast earnings per share growth of 31%.

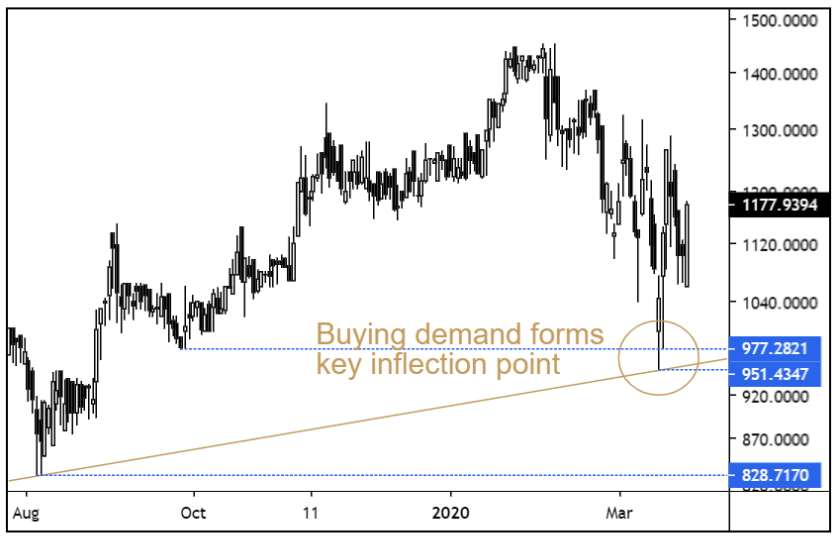

Frontier’s recent price action shows that it’s sell-off has been reluctant, choppy and significantly less severe than many others. This is a very encouraging sign as it indicates that underlying buying demand remains robust.

In fact, last week the shares surged more than 30% in three sessions following the statement from Tencent and prices have formed a major inflection point that is likely to provide support going forward. We believe the shares are well positioned to recover the ground lost in recent weeks and we’re happy to buy a second tranche at current prices.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.