9th Apr 2020. 9.00am

Regency View:

BUY Ergomed (ERGO)

Regency View:

BUY Ergomed (ERGO)

A Firm on the Frontline in the Battle to Reduce Covid-19 Mortality

The speed at which a Covid-19 vaccine becomes available is likely to break all records – aided by the rapid genetic sequencing and open publication of the virus by Chinese scientists.

However, given the scale of manufacture and distribution that is required, even the most optimistic projections indicate that a vaccine would be ready by the start of 2021 at the earliest.

A potentially faster route to reducing Covid-19 mortality rates is through the repurposing of existing drugs. Ergomed (ERGO), a little-known AIM-listed biotech, is uniquely positioned to play a valuable role in this ‘rapid repurposing’ movement.

The Ergomed group consists of three separate but complementary arms:

1. Clinical Research

Ergomed offers a suite of services specifically designed to match the needs of drug development programs. With experience in over 600 Phase I – IV trials, Ergomed has planned, managed, monitored and reported clinical trials with a range of technologies that include small molecule drugs, monoclonal antibodies and other targeted agents as well as cancer vaccines, immunotherapy, radioactive agents and photodynamic therapies.

2. Orphan Drug Development

An orphan drug is a drug developed to treat medical conditions that are so rare it would not be profitable to produce without government assistance.

Ergomed’s rare disease subsidiary, Orphan Experts (PSR) is one of the few companies exclusively focused in orphan disease drug development and recognised as a leading expert in assisting biotech and pharma companies in the rare disease niche. Through their Site Management model and Study Physician Team Support, Ergomed find hard to locate patients around the globe and work with the investigative sites to create the best designs to maximise clinical programs and registries.

3. Pharmacovigilance

Aside from giving you a maximum score in scrabble, Pharmacovigilance is an essential part of any drug development cycle. It is the practice of monitoring the effects of medical drugs after they have been licensed for use, in order to identify previously unreported adverse reactions.

Ergomed’s PrimeVigilance subsidiary supports pharma and biotech companies in managing the global safety of their products from early clinical trial development through to full post-marketing activities.

Covid-19 Clinical Trials

Ergomed is on the frontline in fight against Covid-19.

In early March, they were approached by long-term partners EUSA Pharma to assist in conducting an urgent clinical trial of targeted immunotherapy drug Siltuximab.

Siltuximab works by blocking a group of monoclonal antibodies called IL-6 and has been used to great effect in the treatment of HIV – there have been several medical journals published which suggest the drug could be of use in the treatment of Covid-19.

EUSA were approached by Papa Giovanni XXIII Hospital in Bergamo, Italy which has become overwhelmed by patients with COVID-19 who have developed serious respiratory complications.

Ergomed’s unique expertise in clinical trial physician support and site maintenance meant Ergomed were EUSA’s first point of call. Talking in an interview last week, Erogmed’s Head of Clinical Development, Dr Gordana Tonkovic said, “within 48 hours of the request we had the first intensive care patient treated”.

Ergomed’s nimble response is critical when dealing with such a rapidly evolving problem. On Monday, Ergomed announced that it would be helping to run a second trial out of the same Italian hospital. This second trial will target the GM-CSF cytokine (small proteins important in cell signalling) using the rheumatoid arthritis drug Namilumab developed by Oxford-based Izana Bioscience.

The GM-CSF cytokine has been found in higher levels of Covid-19 intensive care patients and early treatment to suppress it might help to improve mortality rates.

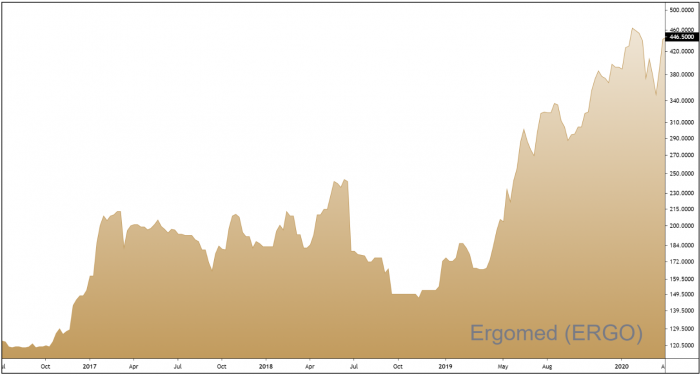

Transformational 2019

Whilst Ergomed are using their skills to help reduce Covid-19 mortality, the company were building plenty of momentum before the pandemic…

On 25 March, Ergomed announced their full-year results for 2019, showing that the year had been “transformational”. Revenue increased by 26% to £68.3m and adjusted earnings surged from £2.3m in 2018 to £12.5m.

With a workforce which is used to working 80% remotely, and a new £30m credit facility in place, Ergomed are very well positioned to thrive in the current climate. And whilst the firm’s acquisitive growth plans have been put on hold, an order book of future contracted revenue of £124.1m will ensure that earnings continue to grow.

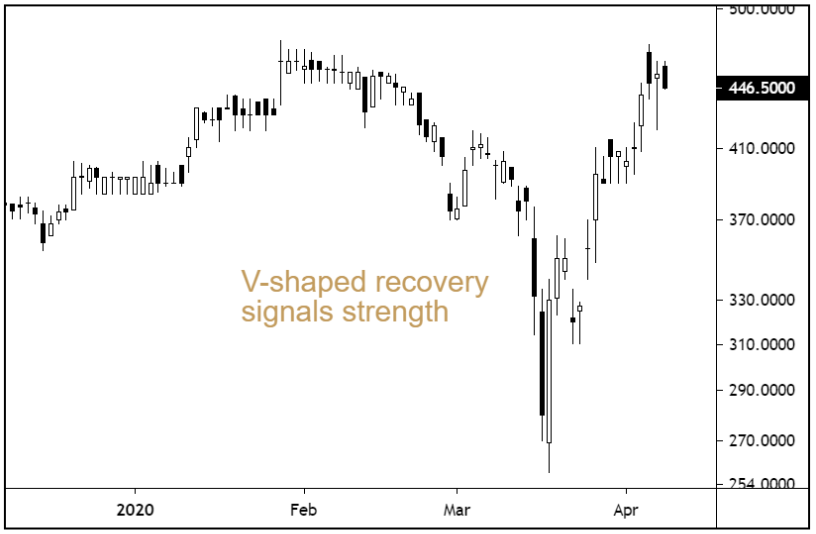

V-shaped recovery signals strength

Many stocks have bounced from their lows in recent weeks, but with visibility over future demand for many sectors so thin on the ground, we feel the focus must remain on quality rather than bargain hunting…

The shares have undergone a V-shaped recovery in recent weeks and prices are now trading back near all-time highs. Whilst this is far from a bargain basement stock, a competitive forward earnings multiple (PE) of 23, and a forward earnings per share growth rate of 23%, make Ergomed, in our opinion, reasonably priced.

As mentioned in the previous section, the firm is in robust financial shape and has not only clear earnings visibility but increased demand due to the Covid-19 outbreak. There is naturally a premium for these Covid-19-proof stocks and in this instance, we’re more than happy to pay it.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.