28th Oct 2021. 8.59am

Regency View:

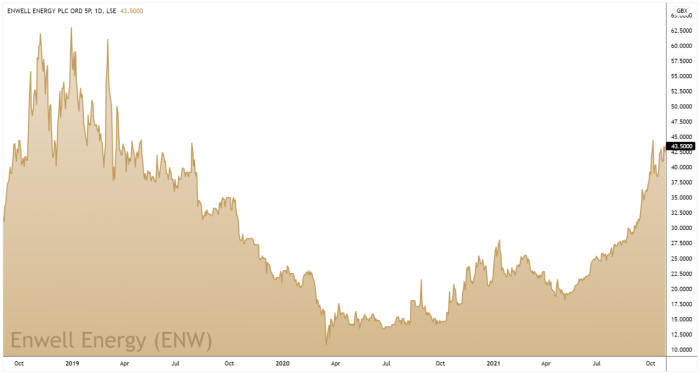

BUY Enwell Energy (ENW)

Regency View:

BUY Enwell Energy (ENW)

Enwell’s earnings set to surge as energy crisis deepens

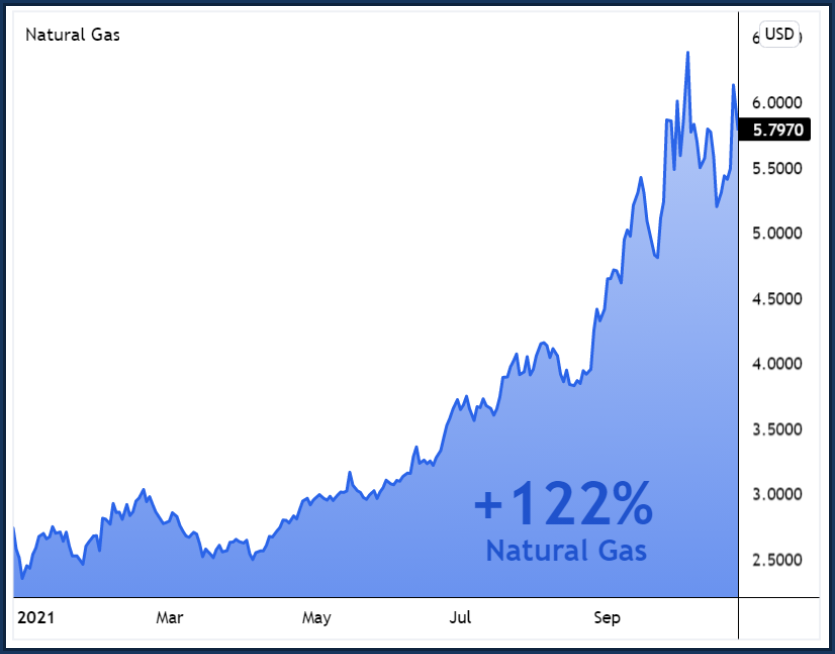

The global energy crisis shows no signs of abating…

Last week, a keenly awaited pipeline capacity auction saw no increase from Russia, causing European natural gas prices to surge higher after a brief pause earlier this month.

And a cold snap in eastern China over the weekend has prompted concerns that the La Nina weather pattern will deliver a harsh winter across Asia.

Natural gas supply remains well below the five-year average and crude oil is seeing a similar supply squeeze with OPEC+ resisting pressure to pump more.

Against this backdrop, our position in Serica Energy has performed well for us this year, and we’re looking to add another high-quality oil & gas play to our AIM Investor portfolio in the form of Enwell Energy (ENW)…

Enwell is British producer and explorer with a focus exclusively on Ukraine’s growing domestic gas market.

The company has more than doubled production and revenue since 2016, while increasing proven and probable reserves to over 50 million barrels of oil equivalent (boe).

Ukraine has a significant available gas resource, particularly in the Dnieper Donets basin where Enwell’s licences are located, with a national total of more than 35 trillions of standard cubic feet of gas (Tscf).

The Ukrainian Government has stated its intention to promote and support the domestic oil and gas production industry as it seeks to break ties with Russia.

As such the regulatory environment in Ukraine is very accommodative with subsoil taxes trending lower.

Strong production base

Enwell have four fields in appraisal, development and production – producing over 4,000 boe per day:

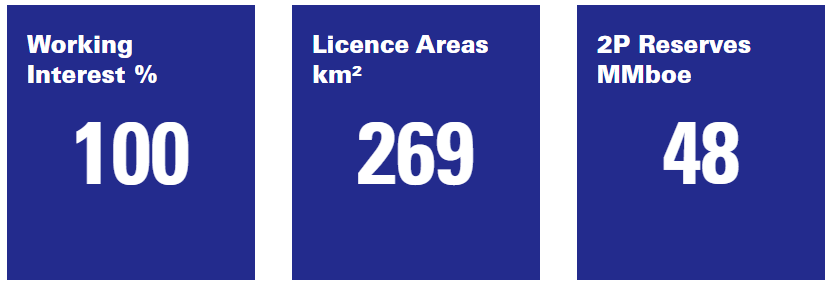

MEX-GOL & SV Fields

Enwell hold a 100% working interest in and are the operator of the Mekhedivsko-Golotvshchinske (MEX-GOL) and Svyrydivske (SV) fields.

The production licences for these fields were extended for a further 20 years in 2020, to cover the respective economic lives of these fields.

MEX-GOL & SV are Enwell’s largest operations by some margin and holds estimated 2P (proven and probable) reserves of 48 million boe, with contingent resources of 25.3 million boe.

There is also a vast prospective resource of Unconventional gas (natural gas that requires advanced production methods) within the surrounding area assessed at 2,255 million boe

VAS Field

The Vasyshchivske (VAS) field holds 2.8 million boe of 2P reserves and has the likelihood of much more recoverable gas, as well as vast quantities of Unconventional gas.

Enwell’s licence was granted in August 2012 for 20 years, and it is likely to be renewed before 2032 under Enwell’s priority right. Enwell had received an Order For Suspension relating to the production licence for the VAS field in 2019, but in a recent update, Enwell stated it was confident that this will be overturned.

The licence extends over an area of 33.2km² and is located in the south-east of Ukraine. 3D seismic acquisition and processing was completed at the field in August 2019 which revealed geological resources of Unconventional gas at the VAS field were assessed at 76 million boe (recoverable resources of 20 million boe).

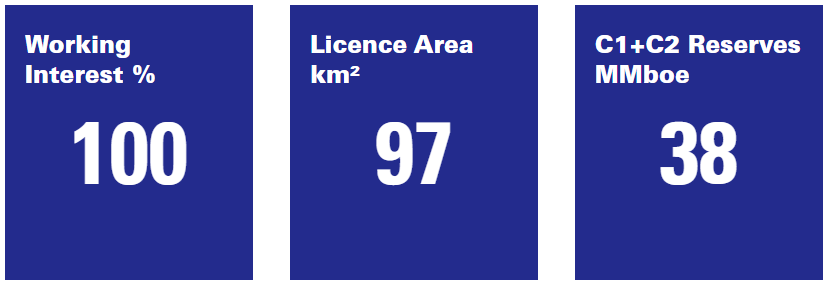

SC Field

The Svystunivsko-Chervonolutskyi (SC) field is a promising new field in Poltava region, with the potential for long running commercial production.

Enwell were granted the 20-year SC licence in 2017 with possibility of further extension.

The licence covers an area of 97km2 and has around 38 million boe C1 and C2 reserves (the highest categories of classifications of extractable hydrocarbons), comprising 4.9 billion m3 of gas and 857 tonnes of condensate. And Enwell plan to carry out a 150 km(2) of 3D seismic scan at the SC licence later this year.

Fully funded development programme

Enwell has a cash pile of $62.9m (HY21) from which it plans to fully fund its development and exploration programme for the rest if the 2021 financial year.

At the MEX-GOL and SV fields, drilling of the SV-29 well has recently been completed and Enwell are awaiting test results.

The SV-31 well was spudded (initial drilling) in September 2021 and drilling operations are scheduled to be completed by the end of the first quarter of 2022, and, subject to successful testing, production hook-up is scheduled during the second quarter of 2022.

In addition, work has commenced on upgrades to the gas processing plant at the MEX-GOL and SV fields. The works are designed to improve overall plant efficiencies, improve the quality of liquids produced and boost recoveries of LPG (Liquefied Petroleum Gas), while reducing environmental emissions.

At the SC exploration licence, drilling of the first well on this licence (SC-4) commenced in August 2021. And drilling operations are scheduled to be completed in mid-2022.

Earnings per share forecast to grow 182%

The Ukrainian market comes with its geopolitical and currency risks, but Enwell look cheap enough to compensate investors for this…

Earnings per share (EPS) growth is forecast at 182% and this makes Enwell’s forward price earnings (PE) ratio of 11.3 look attractive.

And whilst the shares have enjoyed a strong run this year, we see scope for further upside…

The shares are trading more 30% below their 2018 highs, while natural gas prices are more than 30% above 2018 levels.

Enwell’s FY 20 Operating Margin was 21%, but the average selling price during the year was only $136/Mm3. For the first half of FY 21, the average selling price was $249/Mm3, and is expected to be much higher in the second half given prices have more than doubled.

And unlike may of its peers, Enwell have refrained from diluting its share price with continuous capital raises.

Should the gas supply squeeze continue, we believe Enwell look well positioned to reward investors.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.