27th Jun 2019. 9.00am

Regency View:

BUY Dart Group (DTG)

Regency View:

BUY Dart Group (DTG)

Dart Group looks ready to fly higher

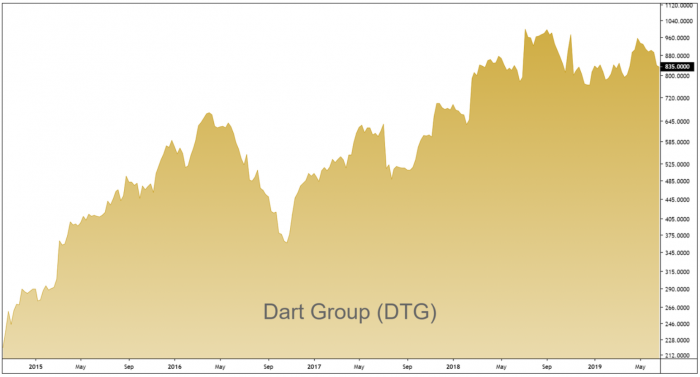

Whilst results across the UK travel sector have generally been quite mixed in recent years, there’s one AIM listed company that stands head and shoulders above its peers. Airline operator and package holiday provider Dart Group PLC (Dart) has been consistently hitting the bullseye, with solid figures and impressive growth, which shows no signs of slowing down. The shares have already performed well, giving a tailwind of strong upwards momentum and there are a number of positive catalysts which we think should drive them even higher.

Solid business model

With a market cap of around £1.4bn, Dart is one of the largest companies listed on AIM and already very well-established. It began life back way back in 1971 as an aviation logistics firm, transporting flowers from the Channel Islands over to the UK mainland. Fast forward almost 50 years later and Dart has evolved to become the UK’s second largest tour operator (with its Jet2holidays business) and now runs the UK’s third largest airline (Jet2.com).

For obvious reasons, these businesses complement each other perfectly and are hugely popular with customers. Both have won an impressive number of consumer-voted industry awards. For example, in this year’s all-important TripAdvisor Travellers’ Choice awards, Jet2.com won ‘Best UK Airline’, ‘Best European Airline’ and even ranked as one of the top 10 airlines in the world (the only European company to do so).

Staying true to its roots, Dart also still runs a logistics arm, called Fowler Welch. However, this is now quite separate from the other two businesses and specialises in land-based distribution across a nationwide supply chain, boasting nine strategically located warehouses and over 500 lorries. Fowler Welch is one of the UK’s leading supermarket logistics providers, working with several big-name clients, including Tesco and Asda. Whilst sales from this business only account for around 7% of Dart’s overall group revenue, it provides some useful diversification away from the core travel-focused businesses.

Very well-managed

As part of his investment strategy, Warren Buffet has famously always placed huge amount of importance on assessing the quality of a company’s management, before deciding whether to buy a stock. We think he’d be equally as impressed as us with the management team at Dart, headed up Executive Chairman Philip Meeson.

Meeson is a former RAF pilot who bought the company privately during its early days in 1983 (before floating it in 1989) and has been at the helm ever since. During his tenure, he has led Dart from strength to strength, with an ambitious drive for growth and a hands-on leadership style, as part of which he still makes weekly surprise ‘spot checks’ on Jet2.com check-in desks across the country. Given his time leading the company, Meeson knows the business inside-out and retains a 37% stake in Dart, meaning he’s reassuringly well-incentivised to make the right strategic choices for shareholders.

Strong growth set to continue

In recent years, Dart has focused on steadily increasing its flight capacity, helping to expand both the Jet2.com and Jet2holidays businesses significantly. In 2017 it opened two new operational bases at Birmingham and Stanstead airports, just before Monarch Airlines went into administration. The timing of this left Dart perfectly placed to benefit from the collapse of its close rival, strengthening its growth trajectory. This has continued to gather momentum, with group revenue increasing by 38% to £2.4bn last year and pre-tax profit jumping an impressive 49% to £134.6m.

With further investment planned to continue increasing capacity, as part of Dart’s long-term growth strategy, sales are forecast to reach £3.5bn by the end of next year. Surging demand for package holidays should help to underpin this prediction, as more and more people are opting to book all-inclusive deals, rather than build their own holiday. This year, around 50% of holiday makers have booked package holidays, attracted to the financial protection they afford. For consumers, this is more important than ever, with so much Brexit uncertainty (which doesn’t seem to be going away any time soon) and the associated concerns over potential exchange rate fluctuations.

Potential buying opportunity

There’s been a steady flow of positive news from Dart over the last twelve months. In November, Dart reported that pre-tax profits for the first half of the current financial year were up 58% and last week a trading update from the group revealed that full-year profits are expected to be ahead of expectations. The healthy balance sheet, boasting £460m net cash, reflects Dart’s strong history of cash generation too.

The solid investment case for Dart hasn’t gone unnoticed by the market and the shares have been locked into a solid uptrend for the last five years. However, after a recent period of sideways consolidation, we think they’re ready to take off on a fresh leg higher, making now a good time to jump onboard.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.