Regency View:

BUY Crestchic (LOAD)

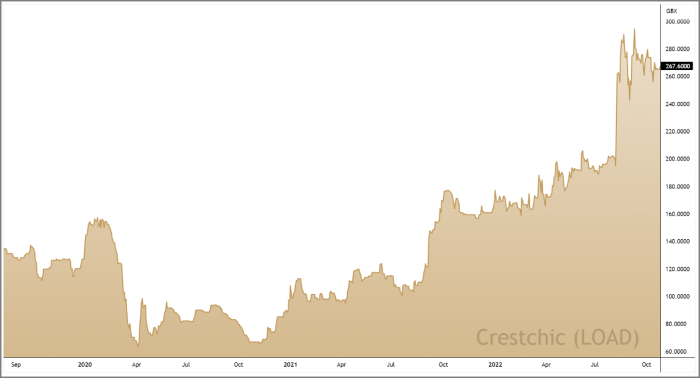

Crestchic powering higher

If weak market conditions have a benefit, it’s that strong stocks are easy to spot!

One such stock is Crestchic (LOAD) which has outperformed the wider market by a whopping 71% over the last year.

Crestchic manufacture, sell and rent load banks and transformers for the commissioning, testing and maintenance of independent, off-grid power sources.

The business is riding a wave of upgrades and has real momentum on and off the price chart.

And despite the share’s strong performance, we believe Crestchic’s valuation remains attractive.

A buoyant load bank business

Load banks ensure the quality and reliability of power sources.

They verify the accuracy of the generators’ output capacities by creating a variety of different loads that replicate real-world use.

If you own, sell or operate generators, especially for backup power, you need to test them regularly. Without testing, you cannot be assured the generator will provide the required power when the lights go out!

Due to their critical usage, demand for load banks is non-cyclical and has been largely undiminished by the weakening global economic backdrop.

In fact, demand for Crestchic’s load banks is growing rapidly in two particular sectors:

1. Energy transition

The accelerating transition from coal and oil-based energy sources towards cleaner and renewable energy is resulting in a rapid increase of smaller energy generators whose sites require commissioning.

These in turn create an increased need for testing both the primary generators and also backup generators, which are becoming even more important as Crestchic’s customers seek to ensure the resilience of supply in the face of less stable primary distribution. This is driving demand for Crestchic’s products, both for outright sale and for rental.

2. Data centres

‘Big data’ and cloud computing has seen a significant rise in the number of data centres which require back-up power generation.

Global investment in ‘big data’ is likely to remain strong and stable for years to come with data centre construction expected to enjoy a compound annual growth rate of 6% over the next decade.

The continuing worldwide growth in data centres is providing Crestchic with significant opportunities for both the sale and rental of its load banks, especially in the US which has a data centre market worth more than $94bn (according to Statista).

To capitalise on this rapidly growing market, Crestchic have signed a lease on a new rental depot in Texas and appointed a US business development manager.

Riding a wave of upgrades

Last month, Crestchic published interim results which raised full year forecasts for the fourth time this year.

This wave of upgrades has generated a bow wave of bullish momentum…

Half year revenue is growing at a pace of 35% with a “buoyant performance across all sectors around the world” according to Crestchic Exec Chair, Peter Harris.

“The strength of our pipeline makes us confident that Crestchic will continue to grow strongly into 2023” he added.

And servicing this strong order pipeline will be much easier due to a recent 60% increase in factory capacity.

Operating profit from continuing operations more than doubled to £4.2m from £1.8m in the first half of 2021, driven by a “vibrant global data centre market and the imperatives of energy security and sustainability”. And this increase in profitability backed by strong cash generation should allow for investment in its rental fleet.

Bullish consolidation signals trend continuation

Crestchic’s steady stream of bullish trading updates and broker upgrades has created a well-established uptrend on the price chart.

The shares have been staircasing higher for several months and recent price action has seen the shares undergo a healthy period of mean reversion.

This mean reversion or ‘consolidation phase’ has taken the form of a narrowing channel, also referred to as a wedge or bull flag pattern.

Consolidation patterns of this nature signal that buyers are accumulating shares, tipping the probabilities in favour of upside continuation and creating a bullish short-term catalyst.

And despite a strong uptrend on the price chart, the shares remain very reasonably priced.

Investors are only being asked to pay 10.8 x forward earnings, which looks attractive relative to forecast earnings per share (EPS) growth of 23.8%.

Crestchic also have a Return on Equity of 19% which is one of the best in its peer group and indicates that the company can grow efficiently.

Operating cashflow is strong at £14.3m on a trailing twelve month (TTM) basis, far outstripping a modest balance sheet which has debt of £4.29m and low levels of gearing.

With the shares showing consistently high levels of strength relative to the wider market, we are more than happy to add this momentum stock to our list of open AIM Investor positions.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.