14th Feb 2019. 9.00am

Regency View:

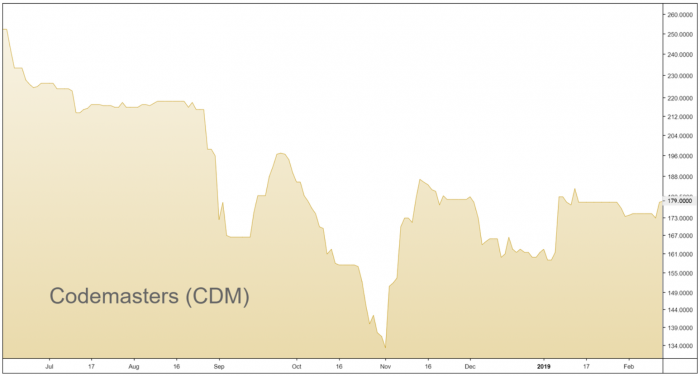

BUY Codemasters (CDM)

Regency View:

BUY Codemasters (CDM)

The tiny UK tech stock set to surge

The global gaming industry is booming. Like it or not, gaming is now the world’s biggest entertainment industry with revenues topping $116bn a year, that’s bigger than movies and music combined.

While music labels and film studios have been irreparably damaged by the move to digital, the gaming industry has never had it so good. Game developers are now able to go direct to the consumers and retain close to 100% of the retail selling price of the game. Digital distribution is allowing the once low margin, bottom feeding game developers to become global, high margin software power players.

Meet Codemasters

Codemasters is one of Britain’s most recognised game developers. Headquartered in Warwickshire, it specialises in high quality racing games and holds an exclusive licence for the Formula 1 franchise. They own a further three racing game franchises namely; ‘DiRT’, ‘GRID’ and ‘ONRUSH’ of which DiRT in particular boasts a huge global fanbase.

Their extensive back-catalogue is benefiting greatly from new digital distribution channels. Global platforms such as Steam, Xbox Live and PlayStation Store allow Codemasters to offer new content to existing games, helping to extend product lifecycles, boost profit margins and deepen customer relationships.

With some of the highest quality gaming experiences in their arsenal and a series of game-changing tie-ups in place, we believe Codemasters are perfectly positioned to ride the global gaming boom.

The keys to the world’s biggest gaming market

China is the centrepiece of gaming’s global growth story. 619 million players spent $38 billion in 2018. Gaining access to this mega-market is only possible through revenue sharing partnerships with local Chinese firms. In November, Codemasters struck a deal with NetEase, China’s second biggest online games publisher.

As the exclusive publisher for three of Codemasters’ PC titles, NetEase will not only obtain the necessary Chinese regulatory approvals, they will invest in marketing and localising the games to accelerate their growth. This is essential given Beijing’s tendency for regulatory roadblocks.

Super-fast 5G will suit Codemasters high quality gaming experience

The strategic importance of the NetEase deal should not be underestimated. NetEase are world renowned for their mobile games, an area in which Codemasters lack expertise. In January Codemasters announced that it would be making a mobile racing game with NetEase, a move that prompted a 14% jump in their share price.

Combining Codemasters specialised racing IP with the mobile gaming experience of NetEase is very exciting, especially given Beijing’s ambitious commitment to rolling out a lightning fast 5G network that can achieve speeds of up to 100 times faster than 4G.

Codemasters and the eSports phenomenon

If global gaming is booming, then eSports is the tip of the rocket. Growth in electronic sports, where gamers play against each other for prize money in front of millions of online viewers, has gone exponential. The eSports market was worth $130m in 2012, it is now worth over eight times that number, with a global audience of 450 million. By 2022 the eSports market is estimated to be worth $1.8bn and Codemasters ultra realistic racing games are tailor made for the eSports revolution.

In 2017 they launched a hugely popular F1 eSports series which even saw former F1 world champion Fernando Alonso enter a team. Frank Sagnier, Codemasters’ enthusiastic CEO firmly believes that eSport racing will make become so popular that it will make it into the Olympics! A new partnership with Motorsport Network will see Codemasters’ games being built into a global programme to create, promote and manage esport events.

Earnings forecast looking healthy

Putting the gaming industry headlines to one side, Codemasters is underpinned by solid fundamentals which set it apart from many other ‘hot sector’ AIM stocks.

They have a healthy net cash position of £16.7m (Sep 2018) which they will likely use to acquire expertise within the mobile gaming space. Gross margins have increased to 88.5% thanks to digital distribution which now represent over 50% of their revenues. Broker Liberum hold a forecasted average earnings growth rate of 25% over the next three years. And with a PE ratio of 18.7 (in-line with its peers) we think now would be a good time to snap up some shares.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.