17th Oct 2019. 8.55am

Regency View:

BUY Churchill China (CHH)

Regency View:

BUY Churchill China (CHH)

A Five-Star Stock

‘We eat first with our eyes’ – a sentiment so inescapably true that at the world’s top Michelin star restaurants, chef’s will deliberate as much over the plate on which the steak is served as the cut of beef itself.

Churchill China is one of the world’s leading manufacturers of high-quality ceramic tableware. Based in the heart of the Potteries since 1795, Churchill is a great example of a family-owned British business that has used AIM as a platform to build a global brand.

Churchill Conquers Europe

Management have done an excellent job of re-positioning the business as a supplier of higher margin ‘performance ceramics’ to the hospitality industry – delivering revenues of £62m for the last twelve months (TTM).

Through a 508 strong global distributor network, Churchill products are used in hospitality establishments in over 70 countries worldwide. Exports increased by 13% during the first half of the year and now represent over 65% of the company’s ceramics revenues.

With strong sales momentum and increasing market penetration across Europe, Churchill are also seeing encouraging levels of sales growth in North America and the Rest of the World which are at an earlier stage of development.

Benefits of Dudson Deal Yet to Be Realised

In April, Churchill purchased brand and intellectual property from fine china company Dudson.

As part of the deal Churchill bought some of Dudson’s printing, manufacturing and glazing machinery, including a kiln, which could more than double Churchill’s finished firing capacity over the next three years.

Along with its capacity benefits, the Dudson brand is highly regarded within hospitality sector and the deal is likely to open up new distribution opportunities across a number of key export markets.

Churchill also purchased a majority holding in Furlong Mills in February. Furlong is a ceramic materials manufacturer based in Stoke on Trent and provides processed clay body and glaze to Churchill and other major manufacturers. This strategic acquisition has enabled Churchill to secure an important part of its supply chain – allowing it to focus on building distribution networks.

Coiled and Ready to Rocket

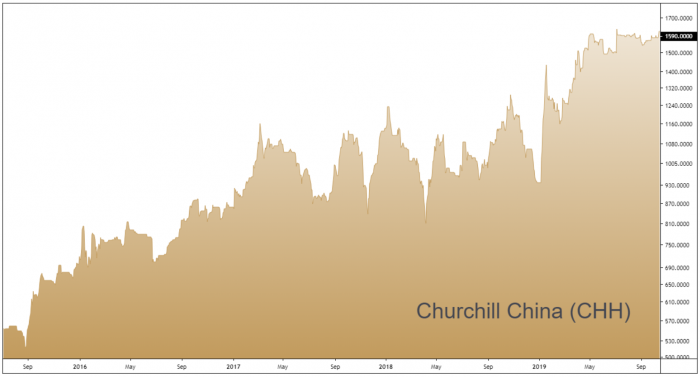

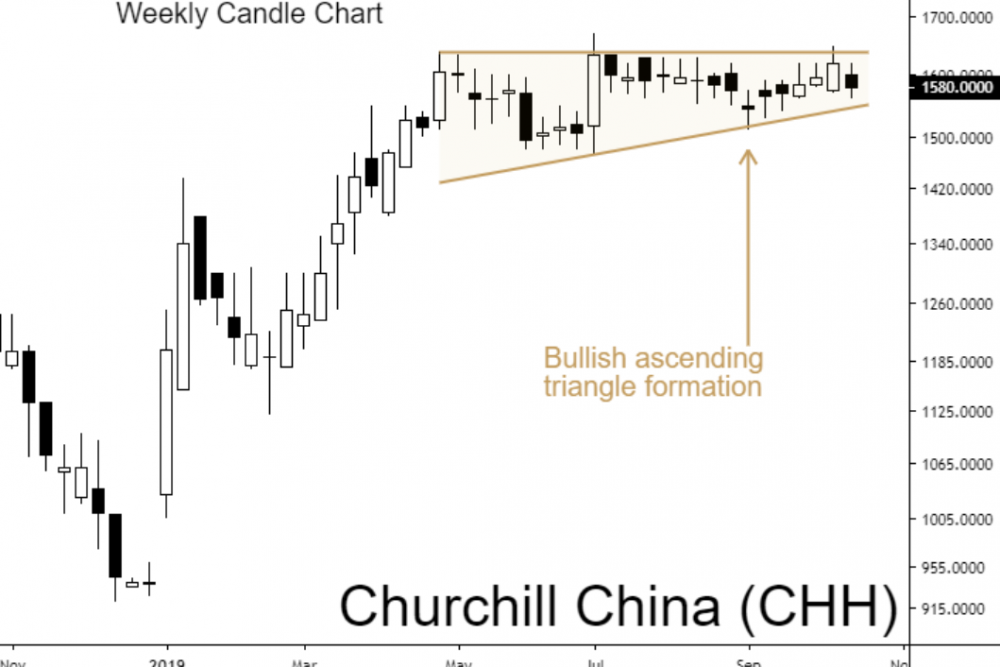

Churchill’s share price has been consolidating since May. These periods of consolidation are very healthy as they help to ensure that we’re not buying into an over-extended market.

This consolidation is especially eye-catching as prices are being ‘funneled’ and compressed within a bullish ascending triangle pattern.

Compression patterns of this nature tip the probabilities in favour of an explosive move in the direction of the dominant trend and Churchill’s uptrend is very well established.

Brexit Preparations on Schedule

In true Churchillian style the company’s Brexit preparations have been thorough and were completed in June.

The potential impact of a hard Brexit on its European distribution has been mitigated by investing in a new warehouse based in Rotterdam.

Given the rising percentage of Churchill’s overseas revenue, a cheaper pound could make them more competitive, however this impact would be partially offset by a rise in the cost of its raw materials.

August Numbers Saw 18% Payout Increase

Churchill’s end of summer interim results made for a pleasing read.

The headline numbers matched up to the market’s expectations. Operating profit before exceptional items increased 30% to £4.2m with Furlong Mills contributing £0.2m (5%) of this increase. On a like-for-like basis operating profit increased by 25%, with margins increasing to 13.6% versus 11.9% in H1 2018.

The company maintained their record of improving cash returns to shareholders, announcing an 18% increase in their interim dividend to 10.3p per share. And with dividend cover of 2.36 and net cash of £13.5m, we expect this trend to continue.

Overall, with the benefits of the Dudson acquisition yet to be realised and the shares having undergone months of intense consolidation, we believe Churchill are well positioned to kick on higher.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.