27th May 2021. 8.58am

Regency View:

BUY Character Group (CCT)

Regency View:

BUY Character Group (CCT)

A toy story

COVID-19 has impacted many things, but the children’s toy market it has not…

For those of us who’ve had to keep little ones occupied during Zoom calls, the value of a toy that entertains your child for more than ten minutes is almost priceless!

The global toy market has enjoyed five years of uninterrupted growth and is currently worth more than $90bn, with North America leading the regional market share.

Today’s stock, Character Group (CCT) is a leading children’s toy manufacturer and distributor, with an enviable product range and revenues that almost doubled during their last Half-Year period.

World class product portfolio

Selecting a toy that won’t be a ‘one-play-wonder’ is harder than it seems, and one of the easiest ways to avoid this is selecting products attached to major children’s TV shows or films…

Character have used this strategy to great effect in recent years, building a product portfolio which has key licences to manufacture toys for a range of the most popular show brands.

Prime among them is the wildly popular Peppa Pig, which is broadcast in over 180 countries. Character has an exclusive licence agreement for use of the Peppa Pig brand, from which they manufacture a range of interactive toys that are distributed globally.

Character has additional licences with world class brands including Pokémon, Goo Jit Zu, Disney Princess and Fireman Sam.

“We currently have one of the strongest portfolios that we have ever taken to both our domestic and international markets” read Character’s Half-Year numbers.

Social Media and sustainable toys represent key growth drivers

Character’s brand collection has real breadth and depth and the Group believe this diversity will be driven by the growing popularity of YouTube, social media and dedicated digital channels…

“The trends and characters originating from these sources (YouTube and social media) are now very much part of the focus for our attention” said Character in their Half Year report.

A clear example of this phenomenon is My Magic Pet Morphle (an energetic little red creature who can transform into anything). Over 300 episodes of his adventures have been released to date on non-traditional, digital media and there has been a growing international audience for the series.

Based on Character’s expertise and successes in toy brand management, Moonbug Entertainment, the creator of My Magic Pet Morphle, selected Character as its Master Toy Partner to collaborate with it to design and roll out a full and sustainable toy products programme for this new brand.

Sustainability also represents a key growth trend for Character…

The plastic-dominated toy industry is a million miles from being carbon neutral and there is a growing pressure from consumers and distributors to improve the sustainability of children’s toys.

According to research house Thomasnet, more than 70% of US shoppers claim they would alter their spending habits to support sustainable brands, and this is being reflected in the toy market. In 2019, John Lewis reported a 21% jump in the sale of wooden toys, and this trend is set to increase over the next decade.

To address this trend Character are developing a sustainable, Eco-friendly range of products over numerous brands with their World of Licensed Wood range of figures, vehicles and playsets (which includes products produced under the Peppa Pig, Disney Princess, Batman and Fireman Sam brands) as well as their Eco-Plush multi-licenced ranges (products manufactured from recycled materials).

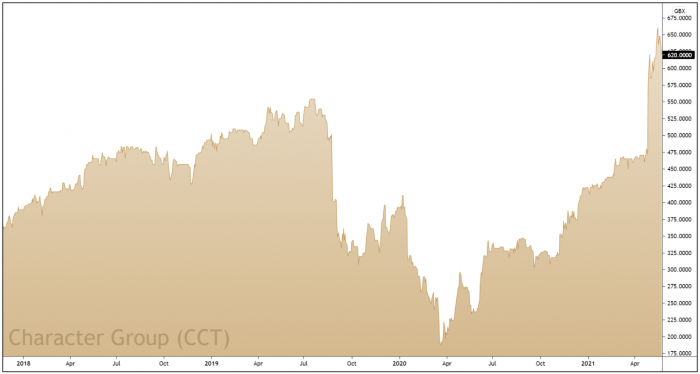

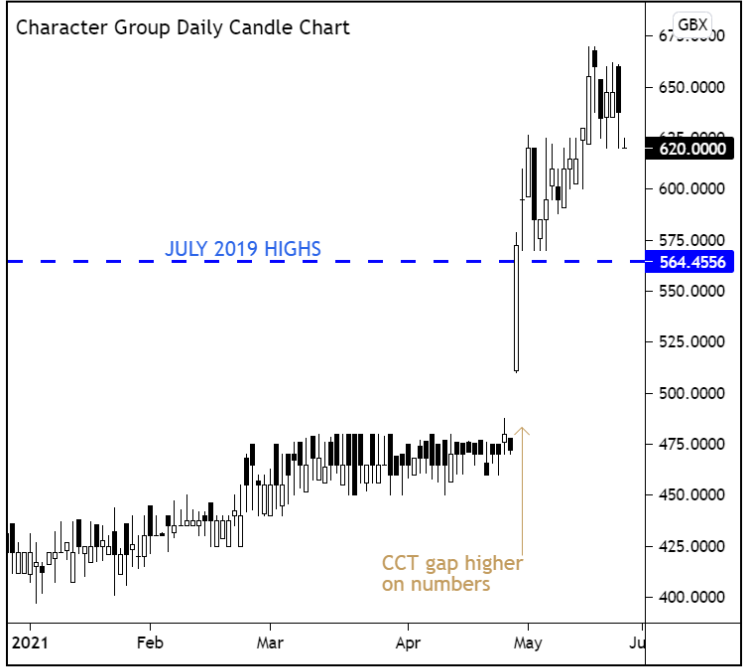

Trading update sparks major technical breakout

Character released a blockbuster set of Half-Year numbers at the end of April, causing the shares to break and hold above a major area of resistance…

Revenue for the six-months to 28 February jumped 44% on the same period last year at £74.5m (HY 2020 £51.7m; FY 2020: £108.9m).

While underlying profit before tax for more than doubled to £6.1m (HY 2020: £2.45m; FY 2020: £5.0m) and underlying earnings were £7.9m (HY 2020 £4.3m; FY 2020: £8.2m).

This growth is forecast to “continue through to and beyond Christmas 2021” and Character are on target to deliver the “best sales performance in any calendar year in the Group’s history”.

However, it’s not all rainbows and sunshine for Character as margins are being squeezed across the industry due to ongoing delays at ports, shipping shortages and opportunistic pricing on freight rates – all principally fall-out resulting from the COVID-19 pandemic.

On the price chart, the shares gapped higher on the update and proceeded to break above the key July 2019 highs at 564p.

Price action following the breakout has seen the shares consolidate within a steady range that has an upwards-sloping bias.

For a strong update to be followed by a key technical breakout is a very bullish sign, as it indicates that the market is playing catch-up. And from our experience, these bullish price gaps rarely come in isolation and we wouldn’t be surprised if another bullish gap prints on the release of their Full-Year numbers on 31st August.

Valuation looks reasonable despite rally

Although Character’s share price is up north of 50% year-to-date, the stocks valuation metrics are yet to look stretched…

The shares trade on a relatively modest forward Price Earnings multiple of 14.2, and this looks attractive relative to its peers, and relative to its forecast earnings growth rate of 28.7%.

Character also has a rock-solid balance sheet, they have no long-term debt, £35m cash in the bank and access to a £50m finance facility.

Character’s sustainable cashflow has seen them deliver stable dividend policy which has put them on a not too shabby forward dividend yield of 2.46%. The current interim payout is 6p per share, covered 3.8 times by underlying earnings.

Overall, we believe Character offers high quality exposure to the stable and growing children’s toy market.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.