12th Dec 2019. 9.06am

Regency View:

BUY Best of the Best (BOTB)

Regency View:

BUY Best of the Best (BOTB)

The small-cap stock with a winning ticket

Best of the Best is an AIM stock with a difference. It generates impressive profits by running competitions in which people can buy tickets to potentially win the car of their dreams. With a market cap of just £30m BOTB is a still tiddler, even by AIM standards. But this well-run little company has significant growth potential, with a great looking balance sheet and history of beating forecasts.

This year has been transformational for BOTB. It’s moved away from selling competition tickets in physical locations, to instead focus on lower-cost/ higher margin online-only sales. As the full benefits of this new strategy are realised over the next few years, we think profits should rise significantly and now could be a good time to snap up some shares.

Innovative business model

BOTB was founded in 1999 when car enthusiast William Hindmarch (who is still CEO today) came up with a rather unusual business idea. He started craning supercars into airport terminals, displaying them in prominent locations and then running competitions to win them.

When it comes to visual merchandising, things don’t get much more eye catching than a supercar. Particularly when you’re stuck waiting around in an airport lounge. Perhaps unsurprisingly, for bored travellers the prospect of adding a little excitement to their day with BOTB proved to be very popular.

From its first operation in Heathrow’s Terminal 4, the company grew quickly. By 2010 BOTB had sites at all major UK airports and had also expanded into several large shopping centres.

Moving into top gear online

BOTB started offering online sales for its competitions in 2003, but for a long time this only formed a very small part of the business, with most of the focus on physical venues. However, there are only so many suitable airports and shopping centres that can accommodate supercar competition stands.

Once BOTB had set up shop in as many locations as possible, it needed to come up with a new strategy to drive further growth. So, in 2015 it announced plans to start ramping up its online presence. It added new types of games, with different prizes such as luxury watches, holidays and various electrical gadgets. This greatly widened the potential target demographic for new customers and advertising online made it easier to reach them.

Running the competitions through a digital platform also allowed the introduction of various loyalty schemes and targeted promotional offers, which helped to significantly improve repeat custom.

With much better opportunities for growth, gradually the number of new players acquired online overtook those taking part at the physical face-to-face sites. Given the lower cost-per-acquisition though digital channels and improved retention rates, BOTB began to wind down it’s airport and shopping centre operations.

In September this year the company announced the closure of its last physical site at Birmingham airport, competing its transition to a purely online business. To help drive as much traffic to its website as possible, BOTB plans to invest heavily across a number of different digital marketing channels. At the core of this strategy will be social media advertising and the use of various ‘influencers’, which has already proven to be highly effective for gaining new business.

A very well-run company

From day one, CEO William Hindmarch has done a stellar job of taking the company he created from strength to strength. With a significant stake holding himself, Hindmarch is heavily incentivised to deliver value to shareholders and he’s doing a very good job indeed.

With a current Return on Equity (ROE) of 271.6%, BOTB ranks amongst the highest listed companies not just on AIM, but in the UK.

Hindmarch leads from the front with a very hands-on approach. He still delivers the car keys to many competition winners himself, as part of publicised marketing events which are very effective for increasing brand awareness.

Strong growth looks set to continue

In July BOTB published its annual report containing results for the full year ending April 30th. The figures revealed impressive growth across a number of key metrics.

Cash flow generated from operations during the period surged 134% to £4.24m, up from £1.81m in 2018. This was helped by a 14% increase in revenue to £14.81m, compared with £12.95m during the same period last year. Pre-tax profit came in ahead of analyst’s expectations at £2.11m, beating the predicted figure of £2.0m.

At the end of the year, BOTB was sitting on a very health cash balance of £3.0m, which is reassuring for a company of this size. It also gives the firm plenty of financial fire power to fund its online expansion plans.

It looks like the current fiscal year has got off to a great start too. An update last month informed investors that the first six months of trading had been encouraging, with profits tracking ahead of market expectations.

Compelling case for investment

The move to online-only leaves BOTB much better placed to grow profitably and efficiently. We think this new strategy will help the business to accelerate its already impressive growth rate and the higher-margin sales should give profits a big boost too.

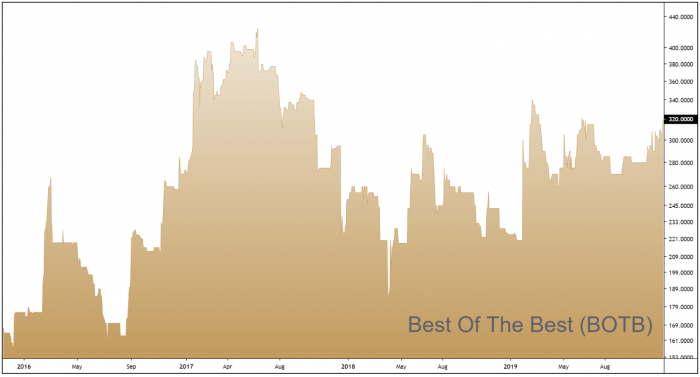

As these benefits hit the balance sheet, eventually the shares should be able to revisit and breakthrough previous all-time highs at around the 400p mark without too much difficulty. They look attractive from a technical perspective too, sitting just above a key level of support at 300p with plenty of upwards momentum.

Given the significant potential for further upside, underpinned by strong finances, this could be a good opportunity to buy.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.