23rd Feb 2023. 8.59am

Regency View:

BUY Best of the Best (BOTB)

Regency View:

BUY Best of the Best (BOTB)

BOTB back on track after wild ride pandemic

Remember the boredom of lockdown?

Treating your sourdough starter like it was a new pet, house parties over Zoom, those dreaded Joe Wicks workouts.

Against these activities, entering an online competition to win your dream car and a life-changing sum of cash seemed like one of the only pleasures Matt Hancock couldn’t meddle with.

It was no surprise that Best of the Best (BOTB), an operator of weekly online raffle competitions saw a huge rise in customer numbers during the pandemic.

From 2020 to 2021, BOTB’s headline revenue surged 250% to £45.7m and net profits more than tripled from £3.5 to £11.5m.

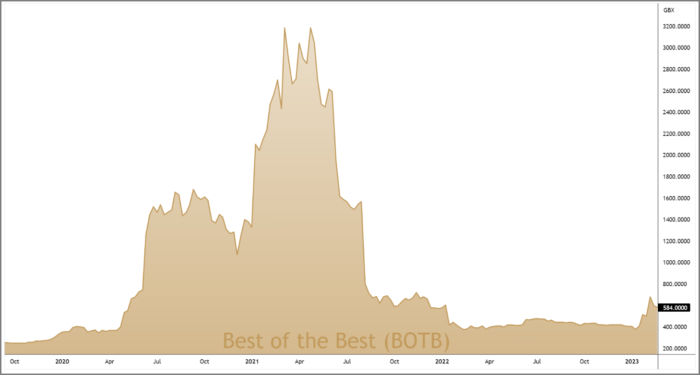

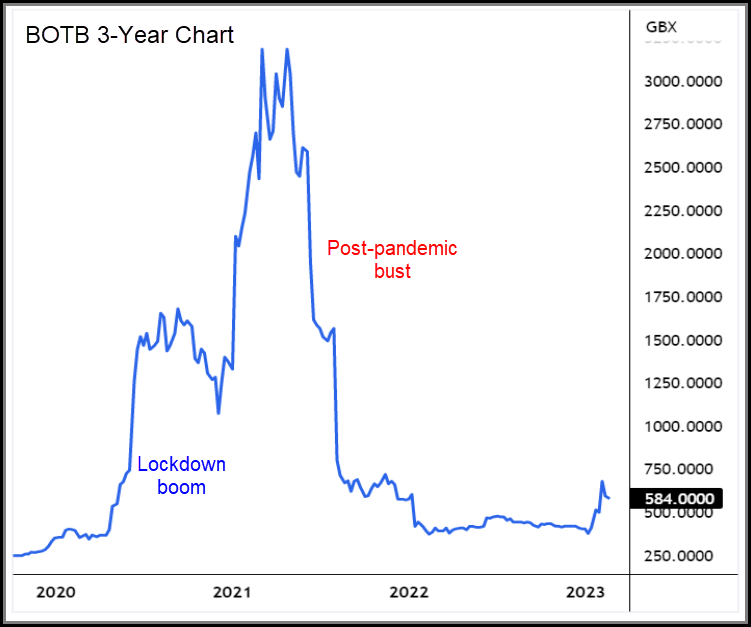

BOTB was a lockdown winner with a share price to match. From February 2020 to the final lockdown in April 2021, BOTB’s shares had gone on an exponential rally which took the shares from £5 to £30 in less that 14 months.

Regency members benefited from some of this mega-rally after we first tipped the stock in December 2019 and took a healthy profit in the summer of 2020.

When lockdown restrictions lifted, the extraordinary demand for BOTB’s competitions dissipated. And just as the stock market giveth, it is quick to taketh away when you start missing estimates, as BOTB shareholders found out.

A series of profit warnings due to falling demand and rising marketing costs, alongside some insider profit taking, saw BOTB’s share price plummet 80% in the second half of 2021.

However, after a year of share price stabilisation, we’re starting to see signs that the post-pandemic dust has finally started to settle. And we believe BOTB, which generates plenty of cash and has a strong balance sheet, is well positioned and well priced to grow again.

Positive post-pandemic changes

During its pandemic boom, BOTB built a marketing database of 1.9m and invested in a new customer relationship management (CRM) system.

So, whilst natural customer attrition rates combined with a post-pandemic drop in demand meant BOTB was faced with reduced levels of revenue, the business hasn’t had to make drastic changes in order to get back on track.

It has streamlined its product line-up from three principal weekly competitions to two enhanced ones, with an additional ‘Friday Fun’ competition under trial.

And BOTB’s principal competitions are now the flagship Weekly Dream Car entered via Spot the Ball and a Midweek Lifestyle Competition entered via a skill-based question.

BOTB is experimenting with pricing and promotional scheduling to engage existing and reactivate lapsing players. It has also seen a steady transition toward customers using its app, which now accounts for 25% of weekly players and revenue.

January’s half year results indicated that these changes have been positive and that the business remains in a far better position than it was before the pandemic.

Half year revenue was £13.65m, down from £19.12m in the same period last year, but significantly greater than the £7.6m delivered pre-pandemic.

The same pattern was seen in BOTB’s profit before tax which came in at £2.71m (H1 2022), a drop from £3.04m (H1 2021), but more than double the £1.38m generated pre pandemic (H1 2020).

BOTB also said that marketing costs had improved, with founder and CEO William Hindmarch stating:

“CPMs on Meta channels have started to return towards pre-Covid levels, allowing for more efficient player acquisition, particularly for the Midweek Lifestyle Competition where the wide-ranging prize offering is attracting a broader pool of players”.

He also said the business is well placed for a return to growth:

“The very large cohort of customers acquired during the pandemic period has exhibited the normal attrition profile, and with this comparative headwind behind us, player numbers are well placed for a to return to growth”.

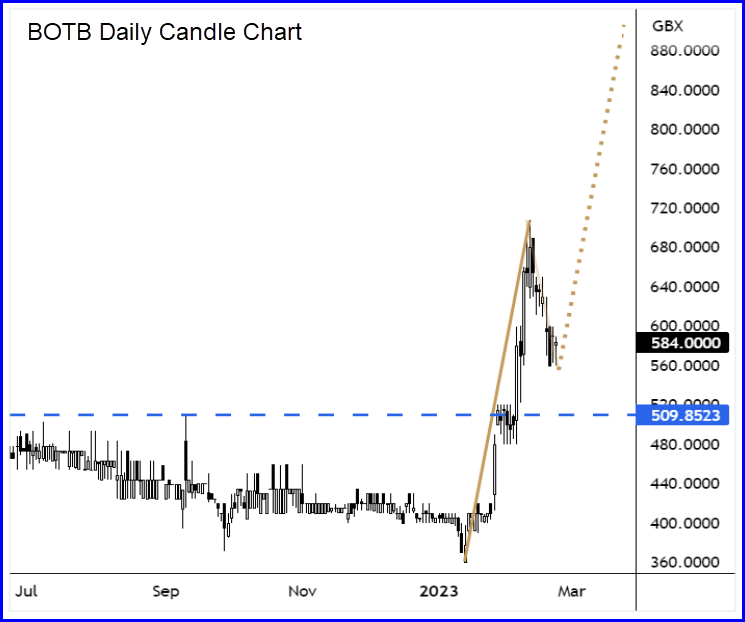

The half year results were well received by the market and caused the shares to surge higher.

This burst of bullish momentum broke through short-term resistance and it indicates that a long-term bottom is now in place.

The magnitude of the recent rally puts a medium-term technical price target at £9 – some 60% above current prices.

Targeting global growth with Globe Invest

A natural pathway for BOTB’s growth is international expansion, delivering its product set to a wider audience.

But for a small business, taking a gamble on international expansion can be too risky and often partnering with the right business can be the smartest move.

In September last year, international affiliate marketing group Globe Invest Limited (GIL) acquired a 29.9% stake in BOTB to become its largest shareholder.

This is an exciting step for BOTB as GIL have a proven track record of growing global B2C and B2B businesses.

BOTB and GIL intend to enter into a Licensing and Distribution Agreement and a Marketing and Collaboration Agreement.

“This is a great opportunity and further updates on the progress with GIL will be made in due course” said William Hindmarch last month.

Cash generative engine

BOTB is a relatively illiquid micro-cap which means it’s not for the faint hearted and this should be factored into your position sizing.

That said, for a volatile micro-cap the stock has high quality financials…

BOTB have an impressive five-year average Return on Equity (ROE) of 148% (CAGR) and a 5-year average gross profit margin greater than 20%.

This indicates that BOTB has a sustained competitive advantage and that it can effectively deploy shareholder capital to generate growth at attractive rates.

The stock trades on a forward PE multiple of 10.5, which looks reasonable relative to its peer group, and double-digit forecast earnings per share (EPS) growth.

Operating cashflow is very robust at £40.8m on a trailing twelve-month basis (TTM) and BOTB’s asset-light online model means that virtually all of this cash flows through into free cashflow, creating a healthy debt-free balance sheet.

In summary, BOTB have been on a wild ride during the pandemic but the dust has finally settled. And whilst the market’s expectations may have run ahead of itself, the business is in a much better position than it was before the pandemic and looks ready to achieve top-line growth again.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.