27th Aug 2020. 9.04am

Regency View:

BUY Begbies Traynor (BEG)

Regency View:

BUY Begbies Traynor (BEG)

The perfect portfolio hedge

The government’s unprecedented support packages for UK businesses have, on the whole, been very well received.

From the £100bn furlough scheme to ‘Eat Out to Help Out’, take-up has been high, UK business insolvency rates have actually fallen, and Chancellor Rishi is sitting pretty at the top of the opinion polls.

But what happens when the free money stops flowing?

This sobering question is a real party killer, but with the furlough scheme coming to an end in October, even the most optimistic economist cannot fail but foresee a spike in insolvencies when tax-payer support is reduced.

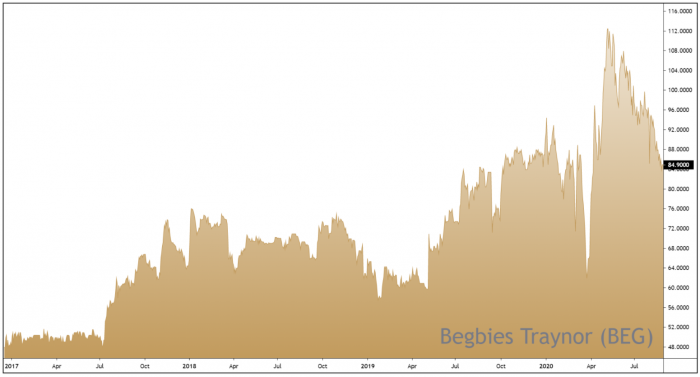

A market leader

The grim backdrop of a struggling UK economy is an unavoidable positive for insolvency practitioner Begbies Traynor (BEG) – making it a natural hedge against the economic strain weighing on most UK businesses.

Founded by Manchester brick-layer turned accountant Ric Traynor during the early 90’s recession, the firm has seen plenty of boom and bust cycles. Ric’s firm, then called Traynor & Co merged with London-based Begbies and floated on AIM in 2004.

The merged business is the UK’s biggest and best at what they do. Just as the vultures on the savanna play an integral role in the food-chain, so too do BEG, ensuring that creditors recover what they can and defunct business accounts are forensically evaluated.

Operating across a network of 740 UK staff and partners, BEG has a focus on mid-market and smaller companies. They also run a property advisory business, which contributes 30% to revenues, and handles asset valuations, consultancy work and transactional services.

BEG has as a strong track record of cash-generative, profitable growth and operates a progressive dividend policy. The business is consistently delivering on the market’s expectations and the outlook for the second half of the year is very strong.

Winter is coming

BEG’s full-year numbers, released in July, were solid and in-line with expectations.

Revenues jumped 17% to just over £70m and adjusted hit £9.2m, up 31% on the prior year. This is all very reassuring but it’s the outlook which is of most interest…

Since 1 August, employers have had to pay National Insurance and pension contributions for their staff. In September, employers will have to pay 10% of furloughed employees’ salaries – rising to 20% in October.

Whilst the tapering of government support will no doubt continue to be a gradual, the taps are slowly starting to be turned off.

In a recent survey of UK insolvency and restructuring professionals, an overwhelming majority (93.7%) believed there would be a spike in business insolvencies during the coming winter, and more than half (56.1%) said numbers would be “significantly higher” than in 2019.

BEG echo these views and Ric Traynor, now BEG’s exec chairman, commented:

“We anticipate that as the support measures are removed in the coming months there will be a significant increase in corporate distress, which is likely to lead to increased insolvencies.”

Earnings forecast catches the eye

From a valuation standpoint BEG ticks plenty of boxes…

A mid-tier forward earnings multiple of 12.7 starts to look very attractive when compared to a forecast earnings per share growth rate of 87.4%.

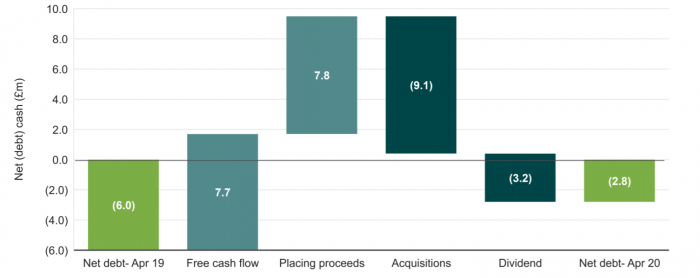

The firms balance sheet is also strengthening. The proceeds of a share placing last year were used to reduce net debt (excluding lease liabilities) to £2.8m. And a steadily rising dividend payout, currently yielding 3.7%, adds a layer of income to what’s likely to be a high growth period for earnings.

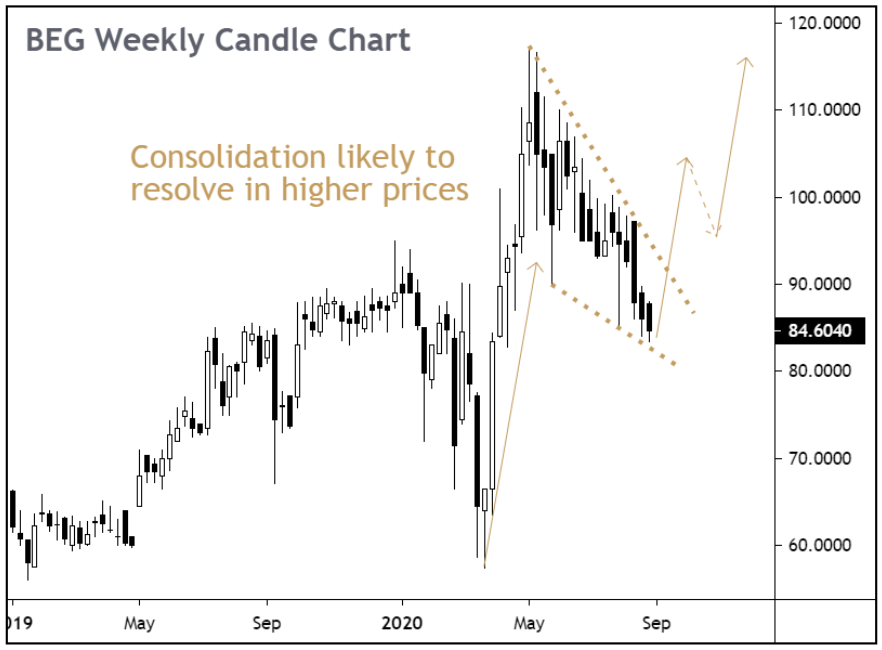

3-month consolidation creates attractive entry

Consolidation patterns come in all shapes and sizes and every pattern has its own name, but they all signal the same thing – mean reverting price compression.

When BEG’s price chart is viewed on the weekly timeframe (where every candle is a week), it becomes clear that recent share price weakness is merely a period of consolidation within a long-term uptrend.

The name attached to the consolidation pattern we’re seeing on BEG’s chart is a ‘descending wedge’, but as mentioned above, it is the cyclical nature of volatility that’s important, not the name of the pattern.

As prices have retraced almost 30% from their May highs during the last three months, volatility has compressed, and prices now look poised to deliver a directional move in-line with the underlying trend.

By positioning ourselves within the wedge pattern, we are entering BEG’s long-term uptrend at attractive levels of risk / reward.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.