19th Nov 2020. 8.57am

Regency View:

BUY Arcontech (ARC)

Regency View:

BUY Arcontech (ARC)

Click here for printer friendly version

An AIM star in the making

In the opaque world of small-cap investing, the terms ‘Quality’ and ‘Value’ are banded around with such frequency that they tend to lose all meaning.

By definition, these two terms are often diametrically opposed and ‘paying up for quality’ is something we’re more than happy to do, especially given the pace at which small stocks can grow.

However, once in a while our scans will throw up a stock that ticks pretty much every quality metric going whilst also being modestly valued…

Meet Arcontech (ARC), they’re a software developer with a blue-chip customer base, 93% recurring revenues and operationally geared to deliver consistent earnings growth.

Based in the City, Arcontech specialise in creating bespoke solutions for the collection, processing, distribution and presentation of time-sensitive financial markets data.

An independent middleman

Crucially, Arcontech do not deliver market data and hence are not having to compete with global giants like Bloomberg and Thomson Reuters (now known as Refinitiv). Instead, Arcontech’s software is fully compatible with a range of market data vendors and a range of different operating systems such as Windows, Linux, and Solaris.

Hence, Arcontech’s software sits as an independent middleman – allowing its clients, primarily investment banks, to manage a wide range of market data in real-time from a multitude of sources.

This ability to create bespoke, reliable and complaint software packages for its blue-chip client base means that Arcontech’s contracts tend to be very sticky, generating recurring licence fee income that equates to 93% of the company’s annual revenue.

With this level of revenue visibility, you’d expect to see the firm trade on an enterprise value to earnings ratio (EV to EBITDA) of around 25, but Arcontech trade on an EV to EBITDA of 18.61 – making them modestly valued.

Geared for growth

Whilst Arcontech’s sales cycle tends to be quite protracted, their contracts have a natural tendency to become more complex and therefore more lucrative as new layers of bespoke data integration are added.

This means that gross margins have been growing as revenues rise. Since 2016 revenues have increased by 38% to £2.96m and operating margins have nearly doubled – causing operating profit to more than triple to £1.05m.

Arcontech is also debt free and highly cash generative creating the sort of balance sheet we look for during these challenging times. Its cash pile has increased five-fold since 2016 to £5.1m and that including the introduction of a dividend in 2017.

The revenue and profit numbers may be small, but with a market cap of less than £30m and a market share of just 0.15%, there’s significant scope for Arcontech to grow, and grow profitably.

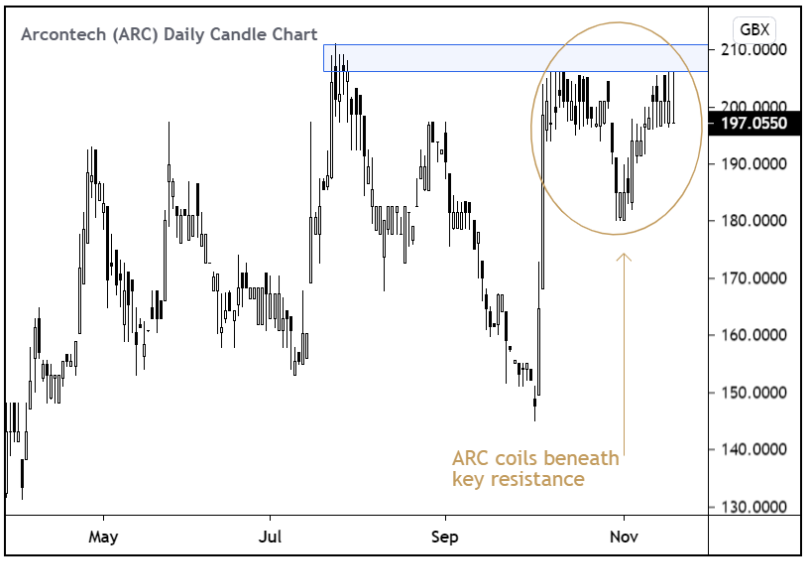

Coiled beneath resistance after key contract win

Arcontech’s share price surged higher in October after they announced an “important” contract win with another tier one bank.

The move took prices back to their summer highs, and since then the shares have been in consolidation mode…

Recent price action has seen the shares tread water within a series of tight trading ranges just below the key resistance zone created by the July and October highs.

This form of price compression beneath resistance tends to be followed by an explosive breakout move in-line with the dominant trend.

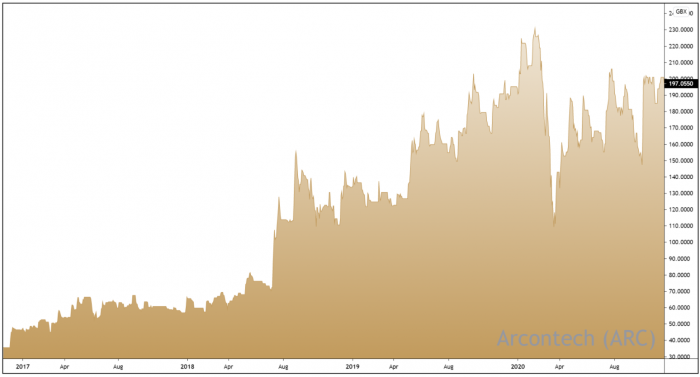

A glance at the long-term 3-year chart (below) shows that Arcontech’s dominant trend structure is undoubtedly bullish, and we are looking to position ourselves within the consolidation phase in order to optimise our entry timing.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.