21st May 2020. 9.00am

Regency View:

BUY Anglo Asian Mining (AAZ)

Regency View:

BUY Anglo Asian Mining (AAZ)

Gold Shining Bright

Gold represents a key theme within our AIM Investor portfolio.

Along with gaming and data security, we have been bullish on gold since early 2019. Our direct exposure comes through low cost producer Highland Gold (HGM), which is currently nicely in profit and we have secondary exposure through Goldplat (GDP), a gold mining waste recovery specialist.

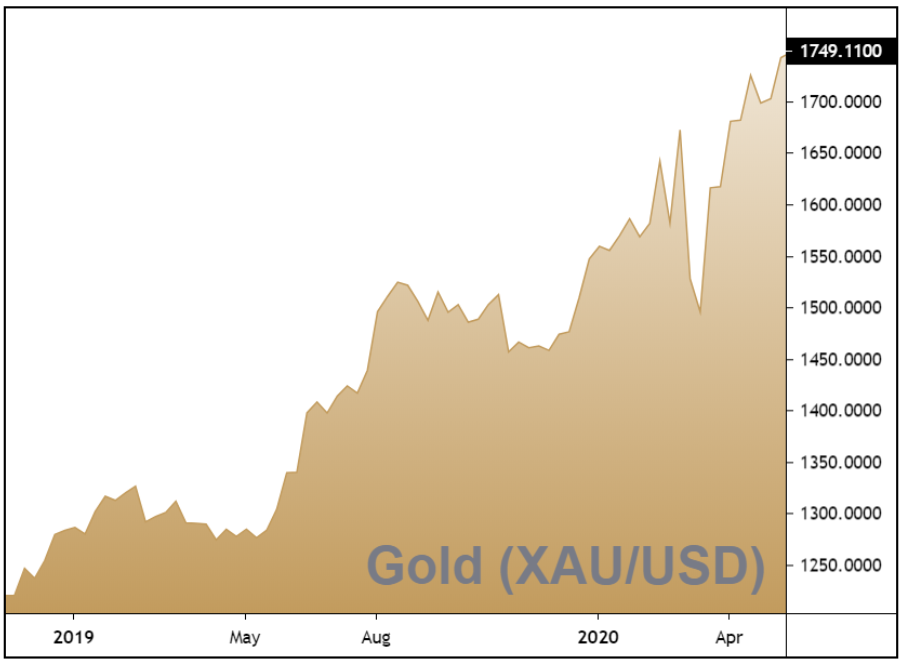

With gold hitting eight-year highs earlier this week, we feel the timing is right to increase our exposure though debt-free producer, Anglo Asian Mining (AAZ).

Gold outlook – the perfect storm

Before we jump into AAZ’s investment case, it’s worthwhile taking a moment to look at the outlook for the underlying gold price and some of the key catalysts behind its recent rally.

In March, the US Federal Reserve cut rates to zero and unleashed a massive asset purchase program dubbed ‘QE-infinity’ by many media channels. The Fed were not alone, central banks around the world have done much of the same in response to the pandemic. On top of that, the US government passed a historic $2.2 trillion fiscal stimulus bill.

The world has known easy money for more than a decade, but not to this scale. The result of stimulus is looking increasingly likely to bring rampant inflation later this year and this is bullish gold and commodities.

Another catalyst for gold is the global economy contracting and currencies around the world are being devalued, this has reinvigorated not only the safe-haven characteristics of gold but also its reserve currency characteristics. This combination of short-term deflationary factors combined along with the potential for long-term rampant inflation have created the perfect storm which has caused gold to hit eight-year highs this week.

Anglo Asian Mining

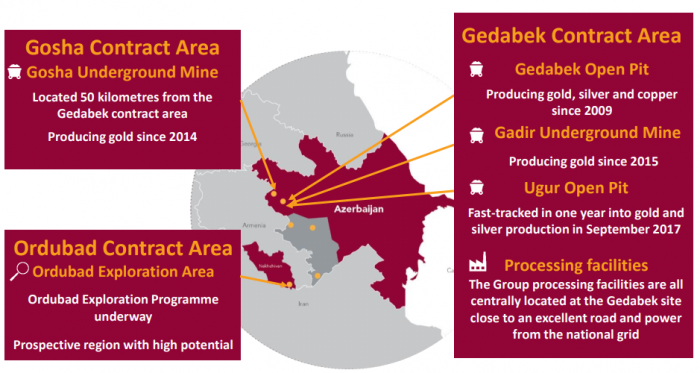

AAZ operates from four mines located in Western Azerbijan producing over 82,000 ounces of gold, 159,000 ounces of silver and around 2,200 tons of copper.

Gedabek Open Pit – AAZ’s largest mine with a JORC total resource of over one million ounces of gold and 95,000 tonnes of copper. Whilst the mine is nearing the end of its production cycle, in a statement released last week, AAZ said “Gedabek, together with recent near-mine exploration work, provide confidence of a combined mine life of Anglo Asian’s existing mines to at least 2024”.

Gadir Underground Mine – has a JORC mineral resource of over 172,000 ounces of gold and 1,300 tonnes of copper and has been producing gold since 2015.

Ugur Open Pit – a newly-discovered gold deposit three kilometres north-west of its processing facilities with JORC ore reserves of 147,000 ounces of gold.

Gosha Underground Mine and exploration site – the Gosha mine, in it’s current state, is relatively small and was not mined during the first half of 2019. However, the Gosha ‘contract area’ is at the heart of AAZ’s exploration plans and is believed to be a very promising ‘under explored’ area.

Debt free, low cost producer

Thanks in part to its copper by-products, AAZ has low all-in sustaining costs (AISC) of just $591 per ounce of gold produced.

This low cost base combined with strong production levels has given AAZ’s balance sheet a healthy glow. The firm has operating cashflow of $50.5m (FY 2019) along with a net cash position of $21.2m (FY 2019) and this provides the quality that we require when investing in these uncertain times.

Whilst the Azerbaijan government has imposed restrictions to prevent the spread of the coronavirus, AAZ have been able to maintain production and continue to sell its gold doré and copper concentrate.

Last week AAZ released a robust set of full-year 2019 results which delivered record total revenues of $92.1m and a 19% jump in pre-tax profits of $30.1m. It also upped its dividend pay-out to $0.08 per share, a trend that CEO Reza Vaziri, who owns a 29% of the shares, is fully motivated to maintain.

One negative in the numbers was a small decrease in its gold production guidance to 75,000-80,000 ounces. However, we expect the strong underlying gold price to help offset the reduced production.

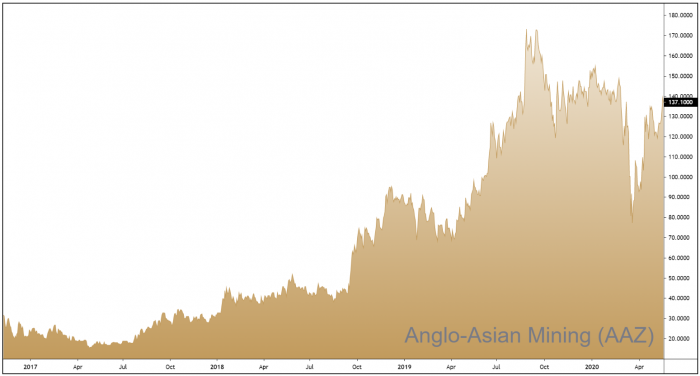

AAZ’s long-term (3-year) price chart has an uptrend the likes of which is not typically seen in small AIM-listed miners and this serves to underline their quality. We believe that given AAZ’s robust balance sheet and exploration programme, the shares are well positioned to benefit from underlying bull market in gold.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.