1st Apr 2021. 8.59am

Regency View:

BUY Alumasc (ALU)

Regency View:

BUY Alumasc (ALU)

Alumasc’s momentum built on strong foundations

According to the World Green Building Council, “the building and construction sectors are responsible for 39% of all carbon emissions”.

To break that number down a bit, operational in-use emissions account for 28%, and carbon embodied in materials and the construction processes accounts for the remaining 11%.

From energy efficiency to water management, ‘designing for a net zero’ has become a necessity and the global green building materials market is expected to be worth more than $350 billion by 2022.

Today’s stock, Alumasc (ALU) is a sustainable building products supplier with thriving export sales and an increasingly profitable UK business.

Over 80% of group sales relate to one or more of the following long-term growth drivers: energy management, water management, bespoke architectural solutions and ease of construction.

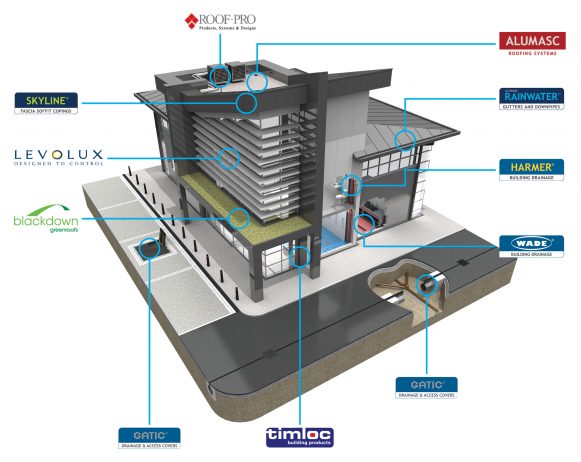

Alumasc’s sub-brands operate across three distinct business segments:

Water Management accounts for 42% of group revenues and delivers the highest operating profits of the three segments. Sub-brands include Wade, a leading manufacturer of drainage products, Gatic drainage covers and Skyline who manufacturer aluminium fascia and rainwater systems.

Building Envelope accounts for 46% of group revenues but has the lowest margins of the three segments. Sub-brands include Levolux, the UK’s leading solar shading company, RoofPro and Balckdown Greenroofs.

Housebuilding Products accounts for just 12% of group revenues but has the highest profit margins of the three segments. Alumsac’s sole brand in this space is Timloc, a well-established UK-based manufacturer of construction accessories.

Alumasc’s focus on sustainability makes it very well positioned to benefit from the increasing importance given to the green agenda by governments and businesses. Barratt Developments, the UK’s largest housebuilder has recently committed to achieving net zero by 2040 and more will surely follow.

The below graphic shows Alumasc’s diverse collection of sub-brands in action:

Levolux taps into lucrative US market

Alumasc’s purchase of solar shading specialist Levolux in 2007, was integral in re-positioning the group’s building products activities more firmly in the growing, sustainable building products arena.

However, a legacy of poor management meant that Levolux had struggled to become profitable until recently…

In 2019, over £1.5m in costs were taken out of Levolux and a renewed focus on the North American market. This has been highly successful and Levolux had turned a profit in every month of Alumasc’s H1 reporting period a ‘significant increase of sales into North America’ – causing group export sales to jump by 23% in H1 to £6.2m.

Attractive valuation

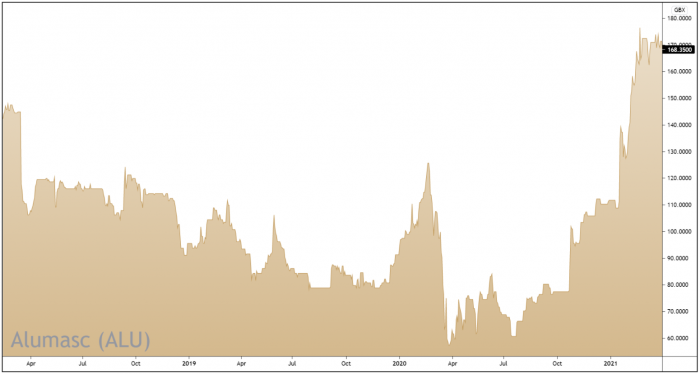

Despite Alumasc rallying more than 50% since the turn of the year, the shares are still changing hands on a single digit forward PE ratio of 7.7.

This low earnings multiple looks attractive relative to Alumasc’s peer group (6th out of 18 companies in the construction & engineering sector). It also looks attractive relative to Alumasc’s forecast earnings growth of 25.1% – giving the stock a Price/earnings to growth ratio of just 0.4 (where anything below 1 is considered good value).

Alumasc should not be considered a growth stock though, revenues are cyclical and whilst bolt-on acquisitions are part of managements long-term strategy, a good chunk of profits are paid out in dividend income. In fact, Alumasc’s forward dividend yield of 5.5% is one of the best in its peer group. The payout is covered more than 2.25 x earnings, so one could say it is safe as houses!

The balance sheet does have some debt (£5.76m), but this is counterbalanced with £20m in cash reserves and a recent rise in profitability…

February’s Interim Results read well with a ‘substantially strong performance’ from all divisions. Group revenues were up by 11% to £45.6m (2019: £41.1m), with a 23% increase in export sales and more than 100% increase in underlying pre-tax profit during the period.

The big jump in profitability was a result of improved margins and the benefit of a cost reduction programme which Alumasc implemented in 2019.

Bull flags and breakouts

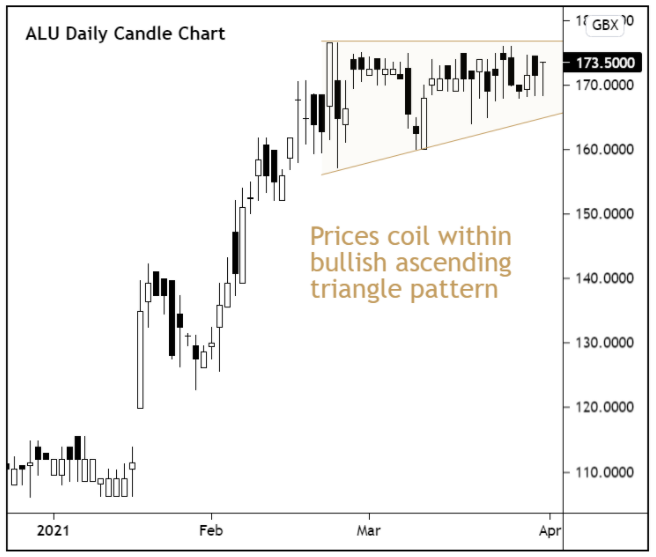

Alumasc’s share price has carved out an almost text-book uptrend in recent months…

The uptrend has been built on strong foundations, with a series of bullish trading updates and broker upgrades fuelling fresh buying appetite.

Recent price action has seen the shares consolidate sideways – forming a small series of higher lows into a horizontal area of resistance and forming a technical pattern known as an ascending triangle.

As prices continue to be ‘funnelled’ into the apex of the triangle, the probability of a breakout is increasing.

With this in mind, we’re going to position ourselves within the consolidation pattern, and use this technical catalyst to time our entry.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.