12th Mar 2020. 8.54am

Regency View:

BUY Goldplat (GDP)

Regency View:

BUY Goldplat (GDP)

Not Your Typical Recovery Play

The idiom ‘one man’s trash is another man’s treasure’ is particularly true in the world of gold mining.

A vast amount of waste is produced when mining for gold. In fact, it’s estimated that a £1,000 wedding ring – equivalent to one ounce of gold – creates up to 30 tons of waste!

Goldplat (GDP) is a gold recovery specialist with operations in South Africa and Ghana. Its recovery technology extracts gold from by-products of the mining process, thereby providing mines with an environmentally-friendly and cost-efficient way of removing waste material.

Targeting West African Growth

Whilst a market cap of just over £8m makes Goldplat a relative minnow, it has a substantial blue-chip supplier base that includes all the major names of the African mining industry such as Anglogold Ashanti, Goldfields, Harmony, and Lonmin – making it a world leader in gold mining waste recovery.

Goldplat also has a small gold mining and exploration portfolio which includes the Kilimapesa mine in Kenya which has a current JORC compliant resource of 649,804 oz of gold. However, management are currently looking for partners to invest in the mine and the firms primary focus is on increasing earnings visibility through expansion of its gold recovery business.

CEO Werner Klingenberg believes there is a great amount of growth potential in the West African gold mining region.

Speaking before Christmas Werner said:

“It’s taken some time to unlock that market, most of those countries are ringfenced and you need to deal with the governments in terms of getting the rights to export concentrates containing gold…

But our persistence is paying off and we recently exported our first batch of material out of Mali”.

Werner has also identified South America as a possible growth market and they are looking at opening up a subsidiary in Peru to help them to facilitate the exportation of gold mining waste material from the region.

Bullish Technical Backdrop

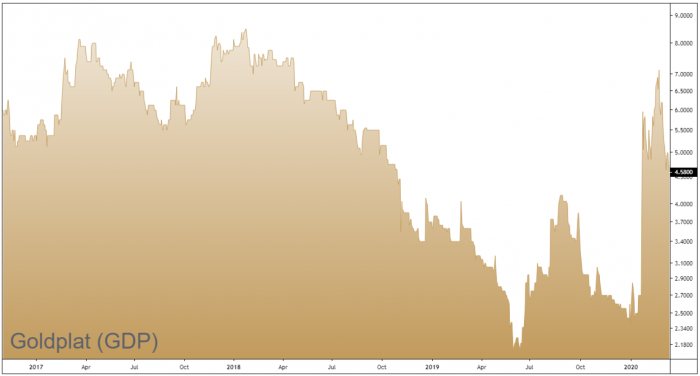

Goldplat’s share price surged higher in January following the release of an upbeat trading statement which boasted of a “very strong operational performance” during the first half of its 2020 financial year.

A “significant” improvement in Goldplat’s Ghana operation (swinging into a £148,000 operating profit for the six months ended 31 December 2019) was backed up by an equally impressive performance from Goldplat’s South African operations which delivered an operating profit of £2.6m for the period (31 December 2018: £752,028) and management expect sales to “exceed full-year expectations”.

The January rally has altered Goldplat’s technical picture significantly…

After breaking through key resistance at 4.4p (2019 highs) the shares went on to hit highs of 8p in February. This sharp burst of upwards price momentum has created a bullish technical backdrop and has cleared the path for a long-term uptrend to form.

Recent price action has seen the shares retrace back down into a strong area of support, creating an attractive point of entry. At a minimum we would expect the shares to retest their February highs (60% upside) but if we see a fractal pattern emerge which repeats the January rally we could realistically see prices towards the 12p marker.

Insulated from Coronavirus Impact

Goldplat is significantly smaller and more speculative than our recent addition of Highland Gold and Goldplat’s focus on gold recovery makes it a very different proposition to investing in an established gold miner.

That said, the company is still well positioned to benefit from a strong underlying gold price. The Coronavirus outbreak has driven prices of the precious metal to seven-year highs following a flight to safety across global markets. Loosening monetary policy from the world’s central banks in response to the anticipated contraction in global growth is likely to keep gold prices robust throughout 2020 – making Goldplat an attractive addition to our AIM Investor portfolio.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.