14th Mar 2019. 9.00am

Regency View:

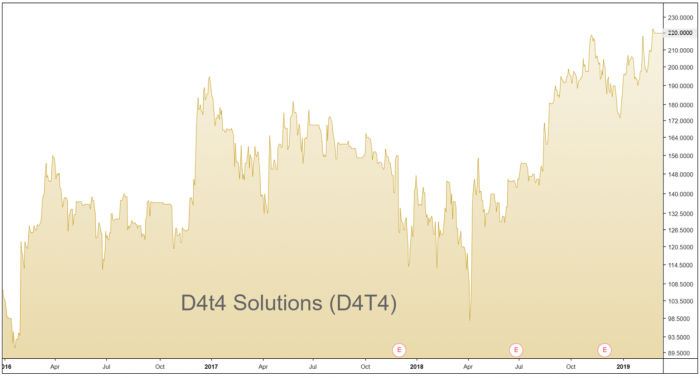

BUY D4t4 Solutions (D4T4)

Regency View:

BUY D4t4 Solutions (D4T4)

The small stock profiting from the big data boom

As Clive Humby, architect of Tesco’s Clubcard once said, “Data is the new oil”. This quote has never been more true, data is the fuel driving the furious progression in artificial intelligence (AI) and the DNA linking our ever growing ‘internet of things’.

Unlocking the value from data is seen by many business leaders as the very definition of a competitive edge. Indeed, ‘big data’ and business analytics is the world’s fastest growing software market with revenues expected to top $260bn by 2022.

Businesses want personalised customer experiences at scale and whilst it’s AI that grabs the headlines, one truism will always remain – machine learning tools are only as good as the data they use. One company that is carving out quite a niche in this high-demand world of big data analytics is D4t4 Solutions…

All about the data

D4T4’s moto is simple, they’re “All about the data”.

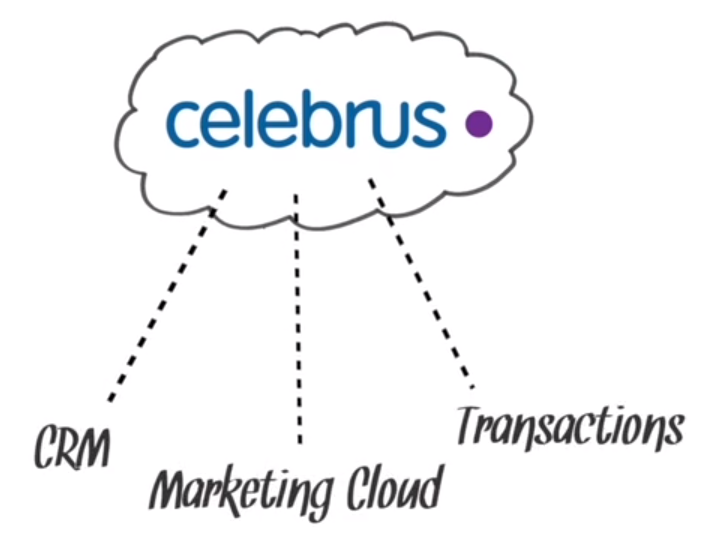

Through its patented customer data software, Celebrus, D4t4 provide a slick solution for businesses seeking to improve customer engagement. The software captures customer data across multiple digital and physical channels, building profiles in real time.

Celebrus can be plugged into industry standard applications for use in AI, advanced analytics, compliance, fraud, marketing and customer experience initiatives. For example, the Celebrus software can enable a business to optimise promotions by personalising webpage content for each visitor in real-time, transforming their engagement and improving the customer experience significantly.

D4t4 maintain their software throughout the life a of contract, creating a steady stream of high margin recurring revenue. They have a hugely diversified customer base and several high-profile partners including Adobe, Dell and Microsoft. The Celebrus software is used in banking, insurance, retail, travel, automotive and telco industries. This vast level of diversification combined with the ever-growing skills shortage in data science make D4t4 a compelling investment case.

The big opportunity in banking

Big banks are complex beasts and they’ve been relatively slow to adopt AI-style data solutions due to fears over security and untested technology. However, this is rapidly starting to change and in a recent IDC survey, 28% of banks listed big data and analytics as their primary investment priority for the coming year.

In fact, banking and finance is forecast to be big data’s fastest growing sector, accounting for 14% of the total market. The financial sector represents a huge opportunity for D4t4 who already site several top-tier banks as clients including HSBC, Bank of America, UBS and Deutsche Bank.

To have your technology adopted by banks is not easy, you must support on-premise deployment where banks’ internal servers run your software. Banks also perform rigorous “penetration testing”, where security experts attack and break any new technology being evaluated. D4t4’s strong track record in this hard to access, high growth sector is the type of strategic advantage we look for in our recommendations.

Not your average AIM stock

Look under the bonnet of D4t4 and you’ll see that this is far from your average AIM stock. D4t4 has a Return on Capital Employed (ROCE) of 38%, over three times the industry average and significantly higher than their own ROCE of 18 just three years ago.

They have a solid five-year track record of revenue growth and whilst many analysts expect this to plateau following a record breaking 2018, operating margins are likely to continue increasing. We believe D4t4 is a great stock to tuck away in your SIPP or ISA and forget about for five years.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.