13th Aug 2020. 9.01am

Regency View:

BUY Ideagen (IDEA)

Regency View:

BUY Ideagen (IDEA)

The ‘business critical’ software stock with robust recurring revenues

The summer earnings season has revealed some interesting characteristics of those businesses which are thriving while others are merely trying to survive.

Mining and biotech’s aside, the general characteristics of stocks that have been fairing best during these uncertain times are those with high recurring revenues and low costs, delivering products that are deemed by their clients to be essential. These characteristics are highly prevalent in those operating a software-as-a-service (SaaS) model.

Our AIM Investor portfolio holds a select group of SaaS stocks and we believe Ideagen (IDEA) is another high-quality addition.

Ideagen operates in the fast-growing ‘integrated risk-management’ market.

They supply a suite of risk management software to companies in tightly regulated sectors such as aviation, banking and life sciences.

Their products include quality and safety management software Q-Pulse, along with audit automation software Pentana and compliance software PleaseReview.

Blue-chip customer base keeps ambitious growth plans on track

Ideagen’s 4,700 strong customer base includes 250 hospitals, seven of the top ten UK accounting firms and many of the world’s biggest pharma’s. This is a highly diversified business across both sector and geography, with 28% of sales coming from the US and more than three-quarters of clients based outside of the UK.

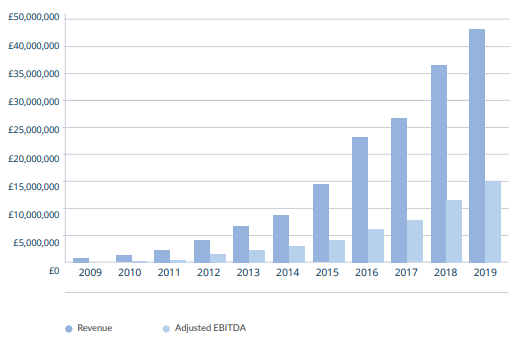

The business is growing at break-neck speed, delivering a compound annual revenue growth rate of 57% during the last decade. Ideagen’s blue-chip customer base, combined with the ‘business critical’ nature of its products, has created a great deal of insulation from the brutal impact of the pandemic.

Management have ambitious plans to double revenues to £100m by 2022, they also want to grow recurring revenues from 66% (2019) to 75% and fatten cash profit margins to 30% – numbers that CEO Ben Dorks believes can be achieved through a combination of organic and acquisitive growth.

Qualsys a high-quality acquisition

This week, alongside an impressive trading update, Ideagen announced the £15.6m cash acquisition of Qualsys, the UK’s top-rated supplier of quality management software and a key competitor.

The deal fits perfectly with the Ideagen’s strategic aim of accelerating the existing development of its Q-Pulse product by integrating the seventh version of Qualsys’ electronic quality management system.

Qualsys are very well established and the acquisition is expected to boost the bottom line immediately. House broker finnCap increased their revenue and EBITDA forecasts for Ideagen’s 2021 financial year by 4% and 3% respectively “to reflect the contributions of Qualsys”, while also retaining their 220p target price on the stock.

Trading update underlines robust business model

The acquisition news was followed by a reassuringly robust trading update – stating that demand for has continued among new customers and its existing client base.

“Our business model remains resilient; customer retention across all verticals has been consistent with normal business conditions and net cash generated from operations being as expected, with neither materially affected by COVID-19.”

Sectors such as financial services, pharmaceutical and US Federal were “performing particularly well” with several notable contract awards, while Ideagen said it is starting to see “increased business activity and a growing pipeline within manufacturing”, although aviation remained suppressed but stable due to the coronavirus pandemic.

Fresh momentum triggers buying opportunity

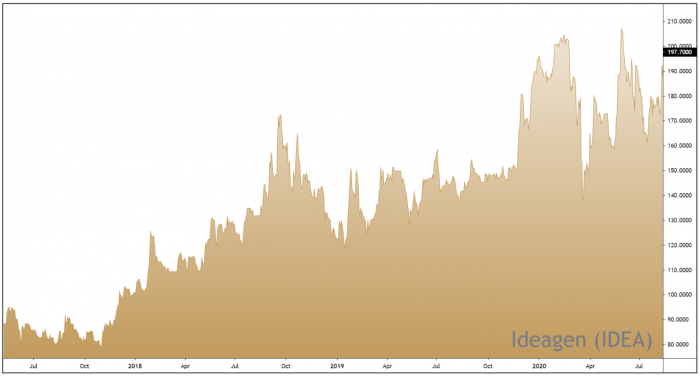

News of the acquisition, along with the robust trading update, has been very well received by the market. The shares have surged higher this week, creating a burst of short-term momentum which realigns Ideagen’s technical trend structure across multiple timeframes.

Whilst their confident growth plans have created scope for punishment should they fail to deliver, the level of fast-growing revenue visibility and management track record that Ideagen bring to the table, in our view, justify their premium valuation.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.