12th Sep 2019. 8.54am

Regency View:

Update

Regency View:

Update

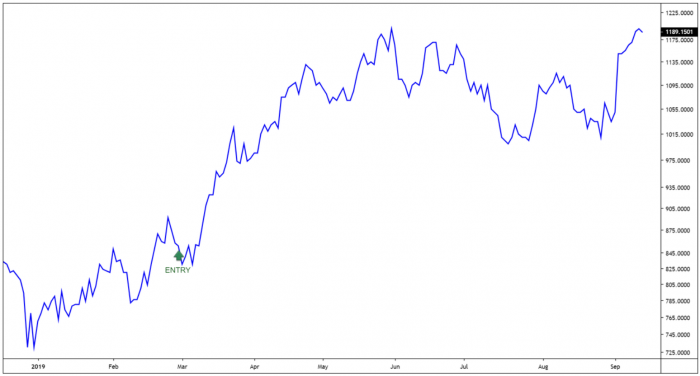

Gamma Gaps Higher as Pre-Tax Profit Jumps 40%

Gamma Communications (GAMA), the digital telecoms provider, gapped higher last week following the release of their interim trading update.

In the six months to June 30th, Gamma recorded pre-tax profit growth of 40% to £21.7m from £15.5m a year before, beating expectations.

Growth in higher-margin areas related to cloud telephony such as SIP Trunking and Cloud PBX saw gross profit margins swell by 49%.

Revenue increased 15% to £158.2m – Gamma’s Indirect unit, which is implemented through partners, rather than by Gamma directly delivered record revenue growth of 7.6%, its UK Direct unit saw 16% growth whilst year on year organic revenue growth hit a “pleasing” 9%.

Gamma also upped its interim dividend pay-out by 13% to 3.5p compared to the 3.1p paid the year before.

CEO Andrew Taylor commented:

“We have delivered a strong business performance and an excellent set of financial results during the first six months of 2019, with both our UK Indirect and UK Direct businesses continuing to grow well,”

Taylor continued: “The development and execution of our Gamma 2023 strategy is progressing well, and looking forward we will continue to focus our efforts on strengthening our competitive position and ensuring that we further enable both our customers and our channel partners to be successful in the marketplace”.

Johnson Service Group Posts Robust Interim Results

Cleaning company Johnson Service Group (JSG) released a solid set of interim results last week with management stating that full-year numbers would come in “slightly ahead of current view”.

The headline numbers read well with revenues up 9.8% to £167m, adjusted operating profit jumping more than 13% to just under £20m and diluted earnings per share (EPS) up 6.5% to 3.3p.

CEO Peter Egan commented:

“We are particularly pleased with the strength and quality of our organic performance which has been achieved by investing capital in our operations giving increased production capacity to meet growing customer demand.”

Egan continued: “There is good momentum in the Group and we have started the second half strongly. In view of the encouraging performance over the summer months we anticipate that the results for the year will be slightly ahead of current expectations.”

Market reaction to this update has been encouraging. In the day’s that followed the update the shares have broken to new highs for the year. We remain confident that JSG will continue to manage market expectations and deliver consistent levels of growth.

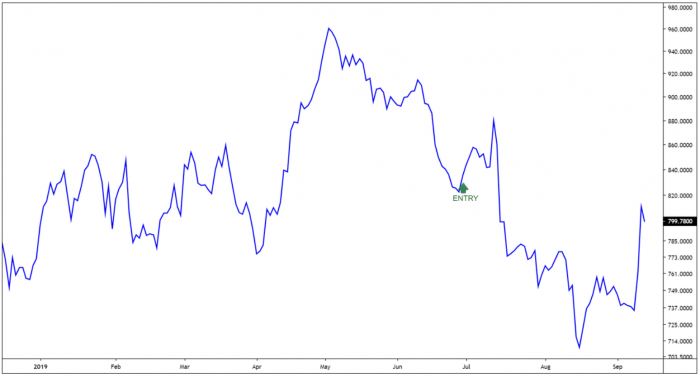

Dart Group Rallies from Key Support as Fears of a Hard Brexit Subside

Package holiday maker Dart Group (DTG) has undergone a much-needed rally in recent sessions.

Reduced risk of a hard Brexit combined with a cautious yet optimistic pre-AGM statement, Dart Group shares have jumped 20% in under a week.

Whilst management stated that they “remain very cautious in our outlook” this was countered by comments that “package holiday customer numbers as a proportion of total departing customers has increased for summer 2019” and “expectations for group profit before foreign exchange revaluations and taxation for year 2020 are to be met”

Given the shares recent price action we remain happy to hold Dart Group within our AIM Investor portfolio.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.