5th Sep 2019. 8.59am

Regency View:

BUY Quartix (QTX)

Regency View:

BUY Quartix (QTX)

The road to growth is clear for Quartix…

When it comes to analysing trading statements, it’s crucially important to look beyond the headline numbers and one of the most efficient ways to do this is simply by gauging the market’s reaction.

Even on AIM, which is not as widely covered by the major investment banks, the collective intelligence of the market can often provide a far better insight into the health of a business than reports from a biased house broker or comments from a management team that may be past masters at turd polishing!

One company in which the market’s reaction to their summer trading update has sparked our attention is vehicle telematics company Quartix.

Little black boxes

Quartix produce vehicle tracking devices, often called ‘black boxes’, which provide real-time data analysis, helping commercial fleet businesses increase their productivity.

Founded in 2001, Newton-based Quartix have carved out an attractive niche, targeting small and medium-sized enterprises (SMEs) through flexible 12-month contracts. The little black boxes that Quartix produce allow fleet customers to track the live position of vehicles on google maps, get timesheets for drivers, receive detailed driving style reports, produce driver league tables and get alerted on unauthorised moves.

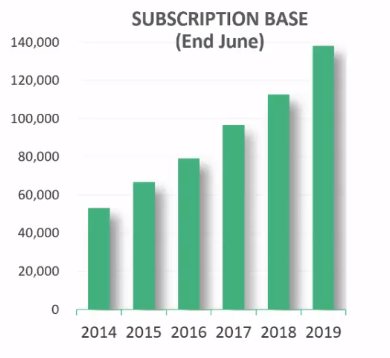

Using a largely subscription-based model, Quartix have managed to build recurring revenues of £9.4m.

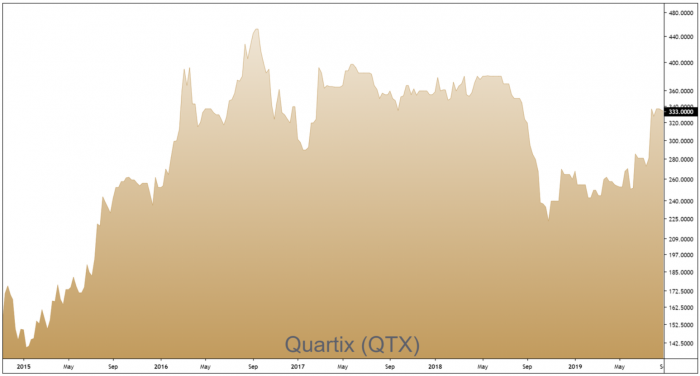

Since their AIM IPO in November 2014, Quaritx has delivered an impressive 21% compound annual growth rate (CAGR) in their subscription base which now sits at 138,000 vehicles covering more than 14,000 fleet customers globally.

Summer trading statements get the markets attention

Over the course of the summer, Quartix released two trading statements, an update on June 19th followed by half-year results on July 24th.

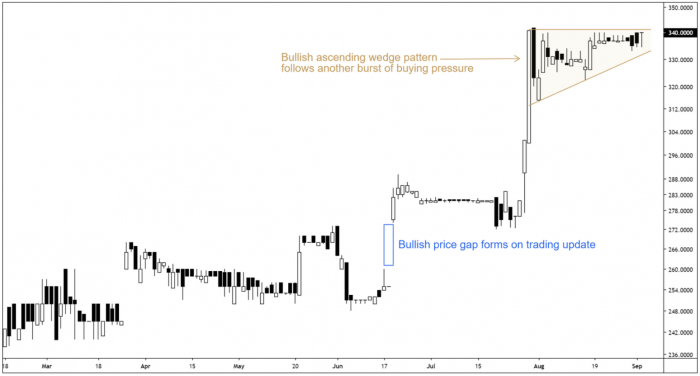

The June update briefed the market that July’s full-year numbers would be strong for its fleet business and that full-year revenue expectations would likely exceed market expectations of £25m – causing the shares to gap significantly higher.

On July 24th, with the market having been well briefed in June, the shares unsurprisingly tread water on the day of the full-year results. However, in the days that followed the July results the shares surged by more than 25%, indicating the strength of market approval behind the recent numbers which had revealed that new unit installations in the first half of the year had jumped by 48% to 22,504 units.

It’s also worth noting that recent price action has seen the shares consolidate within a bullish ascending triangle formation, creating a strong catalyst for entry.

Income and growth

Beyond its existing markets (UK, France and the US), which are performing well with growth in all regions, Quartix are seeing good early results from its marketing initiatives in Spain and Poland – winning around 40 new clients in each country. The firm also believe that the Hispanic community represent a major market opportunity and will be targeting this sub-sector in the second half of the year.

Alongside a focused plan to grow their global fleet business, Quartix operate a generous dividend policy. CEO and founder Andy Walters, who holds a 37% stake in the firm, is committed to paying out half of cash flow from operating activity plus any cash in excess of £2m – allowing investors to benefit from income as well as growth. Overall we believe Quartix will be a strong addition to our AIM Investor portfolio.