29th Aug 2019. 9.03am

Regency View:

Update

Regency View:

Update

IG Design Posts Strong Trading Update

IG Design (IGR) released an encouraging trading update this week with revenue and profit showing strong year on year growth.

The global giftware specialist’s order book and production volumes are both ahead of this time last year and in line with management expectations.

The benefits of last year’s game changing Impact Innovations acquisition are still being seen with the restructuring of their manufacturing operations into Memphis now fully supporting the production and conversion activities of the combined US business. This will be further enhanced by the introduction of a new ultra-high speed printing press in November 2019.

IGR also stated that it had recently reached an agreement with one of the US’s largest retailers for the supply of all year round themed and seasonal ‘Impulse’ gifting products, to over 1500 stores nationwide. This new agreement is expected to generate significant incremental revenues in the following financial year and beyond.

Paul Fineman, Chief Executive said:

“Our strong performance to date illustrates our ability to drive organic growth whilst also integrating a large acquisition and delivering the associated operational and financial benefits. The momentum throughout the business continues apace alongside good forward visibility of our order book going into the remainder of the year.

“The investments made in the Group are continuing to deliver and this, alongside the benefits of the Group’s scale and ability to cross sell, stand the Group in good stead to continue to deliver growth in the coming period and beyond.”

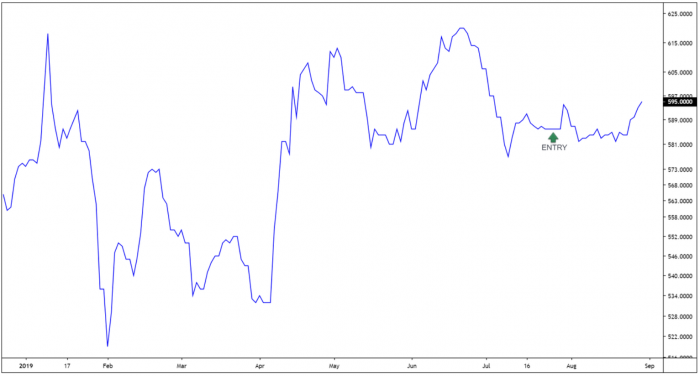

The market has welcomed this trading update and the shares jumped to six-week highs on the back of the news and we would expect to see prices rest 627p before long.

Whilst it’s still very early days, we are more than happy to hold IGR within our AIM Investor portfolio.

D4T4 Solutions Appoints New CFO

Big data business, D4T4 Solutions (D4T4) announced Charles Irvine as their new Chief Financial Officer, effective 1st October.

Charles is currently CFO of Ergonomics Solutions Group, a £30m turnover, fast-growing technology mounting solutions business with activities in Europe & North America, prior to which he served as UK Head of Finance at Bausch & Lomb (2014 to 2017) and with Alliance Healthcare (2012 to 2014).

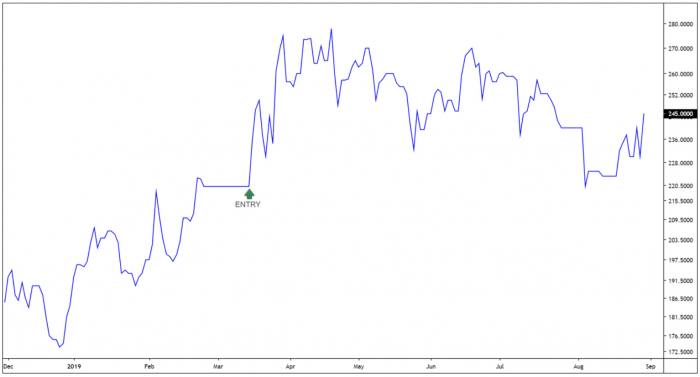

The market reacted well to the appointment with the shares bouncing more than 4% on the day of the announcement.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.