29th Oct 2025. 9.00am

Regency View:

BUY Admiral (ADM)

- Income

Regency View:

BUY Admiral (ADM)

Admiral: A well-oiled profit machine

When it comes to consistency, few UK businesses can hold a candle to Admiral (ADM)…

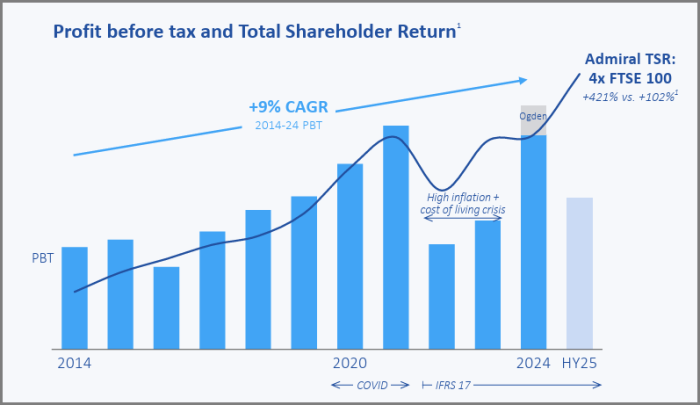

While many insurers have spent the past two years wrestling with inflationary pressures and rising claims costs, Admiral has quietly gone from strength to strength, delivering record results in the first half of 2025 and reinforcing its reputation as one of the most disciplined operators in the FTSE 100. The shares have already enjoyed a strong run, but with profitability rising, balance sheet strength intact, and a generous dividend yield, there’s every reason to believe there’s more upside ahead.

This isn’t a speculative recovery play or a high-concept growth story. Admiral is a well-oiled profit machine that thrives on simplicity, prudence and execution. From record earnings to a clean balance sheet and a management team that knows how to use capital efficiently, the business continues to compound shareholder value year after year. It is the kind of stock that lets investors sleep soundly at night and wake up to higher dividends.

Profits surge across the board

Admiral’s first half of 2025 was exceptional by any standard. Group pre-tax profit jumped 69% to £521 million, with earnings per share up 72% to 132.5p. The company added over a million new customers in twelve months, taking the total to 11.4 million. That growth, coupled with disciplined underwriting, has driven profitability across every division.

The UK Motor business remains the powerhouse, delivering a 56% increase in profit to £559 million as margins widened and claims ratios tightened. Household Insurance more than doubled its profit to £25 million, while Admiral Money saw profits leap 139% as its loan book expanded by a quarter. Even in Europe, where the group has historically struggled, losses narrowed as profitability returned in France and Italy. It is a picture of broad-based strength underpinned by steady operational control.

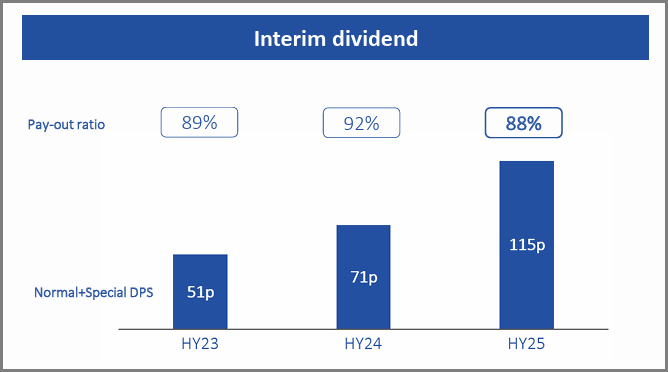

A dividend that rewards patience

Admiral’s dividend policy has long been one of its defining strengths. The interim payout for 2025 rose 62% to 115p, split between a normal and a special dividend. That represents an 88% payout ratio, supported by robust cash generation and a post-dividend solvency ratio of 194%.

At today’s price, the forward yield sits around 6.4%, comfortably ahead of the FTSE 100 average. The company has a strong record of paying both ordinary and special dividends, often returning excess capital when profits exceed internal needs. For investors seeking reliable income without sacrificing quality, Admiral’s combination of steady growth and regular cash returns is difficult to match.

Efficiency is the winning edge

Admiral’s secret weapon lies in its operational efficiency. The group’s combined ratio improved to 77.7% in the first half, while the insurance service margin climbed from 12.6% to 18.8%. That means Admiral is writing profitable business while maintaining cost discipline, a delicate balance that few competitors manage consistently.

Management has remained focused on sustainable profit rather than chasing market share. Even as UK car insurance prices have softened, Admiral’s disciplined underwriting and strong claims management have preserved margins. The result is a return on equity of 57%, comfortably ahead of peers such as Direct Line and Aviva. The pending sale of its US unit, Elephant Insurance, later this year should further streamline operations and free up capital for future dividends or reinvestment.

Valuation still offers value

Despite its reputation as a high-quality compounder, Admiral’s valuation remains reasonable. The shares trade on a forecast price-to-earnings ratio of around 13.6 times, which looks fair given expected earnings growth of roughly 5% a year and a market-leading return on equity. The price-to-book ratio of seven may appear rich at first glance, but it reflects Admiral’s asset-light model and strong profitability rather than overvaluation. Investors are paying for quality, not hype.

The stock’s enterprise value to EBITDA multiple of around ten times sits in line with its long-term average, suggesting the market has yet to fully re-rate the business after its stellar first half. When combined with the 6.4% dividend yield, Admiral offers an appealing balance of income and growth potential. For a business of this quality and consistency, there is still room for capital appreciation if earnings momentum continues into 2026.

Technicals: Pulling back to long-term average

After a strong run earlier in the year, Admiral’s share price has spent the past few months consolidating just above its rising 200-day moving average. This kind of price action is typically healthy, allowing the market to absorb gains before resuming the broader uptrend. The long-term trend remains firmly positive, and buyers have repeatedly stepped in near the 200-day line, which continues to act as dynamic support.

The current price around 3,290p sits roughly 10% below the summer highs. If the shares hold this area and begin to turn higher, it would confirm the next leg of the long-term trend. The consolidation phase looks more like a resting point than a reversal, offering investors an opportunity to build positions during a period of relative calm. With the next earnings update due in early March, a return of buying momentum could see Admiral retest its prior peak near 3,650p.

A rare blend of quality, income and momentum

Admiral may not capture headlines like fast-moving tech names, but its appeal lies in the power of consistency. It is a business that delivers steady earnings, healthy dividends, and disciplined capital management through every market cycle. With record profits, a robust balance sheet, and a valuation that still leaves room for upside, Admiral stands out as one of the few FTSE 350 names offering both dependable income and long-term growth potential.

In an uncertain market, Admiral offers investors something increasingly scarce: stability with a sense of momentum. It is not just an insurer, it is a compounding engine built on prudence and execution. For investors seeking a core UK holding with resilience and reliability, Admiral remains a class act.

Five key takeaways

- Record profits: H1 2025 pre-tax profit rose 69% to £521m with EPS up 72%, driven by strong UK Motor and Household growth.

- Dividend strength: The interim dividend jumped 62% to 115p, giving a forward yield near 6.4%.

- Operational efficiency: Combined ratio of 77.7% and ROE of 57% show tight cost control and profitability.

- Attractive valuation: Trading on a forward PE of 13.6x, Admiral offers quality growth with limited downside.

- Technical support: Shares are consolidating above the 200-day moving average, signalling a healthy long-term uptrend.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.