15th Oct 2025. 9.02am

Regency View:

BUY Trainline (TRN) Second Tranche

- Growth

Regency View:

BUY Trainline (TRN) Second Tranche

Trainline: Back on track for the next leg higher

After recommending Trainline (TRN) in February 2024, the shares have spent most of the past year travelling in the wrong direction, down around 15% on our first tranche. But if markets teach us anything, it’s that good businesses often take the scenic route to deliver long-term returns.

With robust fundamentals, a stronger balance sheet and an ambitious share buyback programme now in motion, we believe this pullback represents an attractive opportunity to add a second tranche at more favourable prices.

Highly scalable market leader

Trainline is the UK’s leading online rail and coach booking platform, connecting millions of passengers with operators across Britain and Europe. Its model is beautifully simple. Travellers use the app to plan journeys, compare fares, and buy tickets, while Trainline earns commission on every sale. It’s a business with high scalability and low capital intensity, meaning growth doesn’t require hefty spending on physical assets.

Beyond the UK, Trainline has been expanding into continental Europe where rail liberalisation is opening up a wave of opportunity. As new operators enter the market, passengers increasingly need a single, trusted platform to compare and book tickets across different providers. Trainline fills that role, leveraging its data, technology, and brand recognition to gain a first-mover advantage. The more carriers that compete, the more consumers benefit and the more valuable Trainline’s aggregator model becomes.

Growth on the right tracks

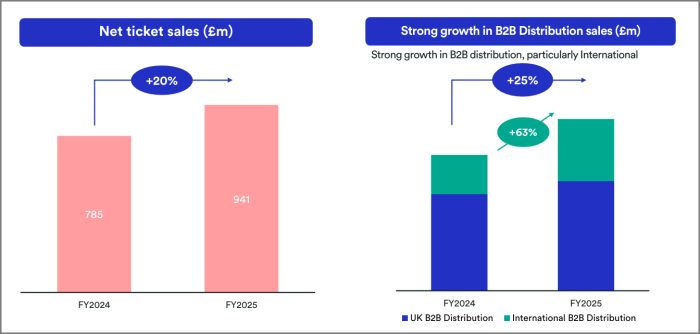

September’s trading update was one of Trainline’s most encouraging in years. Group net ticket sales climbed 8% year-on-year to £3.25 billion, pushing revenues up 2% to £235 million and tracking towards the upper end of guidance. Underneath the headline numbers, the story was of a business firing on multiple cylinders. UK Consumer ticket sales grew 8%, reflecting a continued recovery in commuter and leisure travel as the industry puts strike disruption behind it. International sales rose 2%, buoyed by growth in France, where new competition between operators such as Trenitalia and SNCF is boosting demand on high-speed routes.

Meanwhile, Trainline Solutions, its B2B arm serving corporate clients and travel agencies, saw an 18% surge in net ticket sales. It’s now a £1 billion business in its own right, driven by rising business travel and expanding partnerships through its Global API platform. Importantly, management raised full-year guidance for adjusted EBITDA growth to the top end of its range, underscoring the benefit of operating leverage and a successful cost-optimisation programme completed earlier in the year.

Alongside those strong trading figures came another shareholder-friendly move: an enhanced £150 million share buyback programme. That’s on top of £196 million already spent repurchasing stock since 2023, representing roughly 13% of the share capital. In total, if the new buyback is completed, Trainline will have retired £350 million worth of shares over three years. It’s a powerful signal of management’s confidence in the company’s cash generation and long-term growth prospects.

Financial health and valuation

Trainline’s financial profile looks solid. The company’s operating margin has expanded to 19.4%, return on capital employed sits at a healthy 24.1%, and the balance sheet remains well managed with net gearing below 30%. It generated £30m in operating cash flow per share and maintains strong earnings quality. Revenue has compounded at an annual rate of 11% since 2020, while EPS has grown from a loss of nearly 19p in 2021 to a forecast 14p this year, with analysts expecting further progress to 20.7p in FY2026 and 22.8p in FY2027.

At around 12 times forward earnings, Trainline trades at a discount to its own growth profile, with a PEG ratio of just 0.7. That’s rare for a tech-enabled platform with double-digit earnings growth and expanding margins. Analysts’ consensus price target of 431p implies upside of roughly 60% from current levels, which looks achievable given the improved earnings trajectory and the mechanical boost from the buyback reducing share count. While there’s no dividend on offer yet, management’s commitment to capital returns through buybacks provides an indirect yield that could prove just as valuable over time.

Testing long-term support

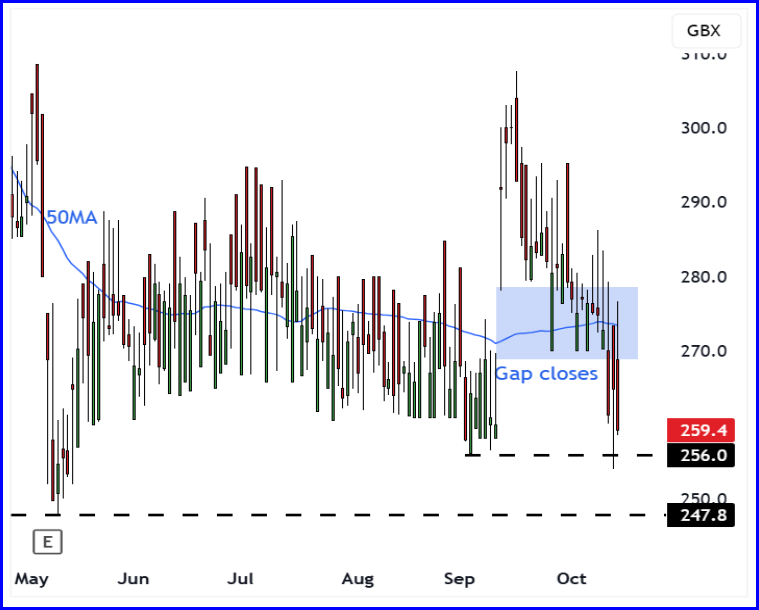

While Trainline’s fundamentals have continued to improve, its share price has lagged. The stock has underperformed the wider market this year, falling around 19% over six months and currently sitting more than 40% below its 52-week high. But that weakness may be setting the stage for the next leg higher. September’s trading update triggered a sharp gap higher on the chart which is a clear show of the markets initial backing. As often happens, that gap has since closed, with the shares retracing back to key long-term support near 250p, an area that previously attracted strong buying interest.

Price has stabilised around this support zone, and with the 50-day moving average beginning to flatten, momentum could soon turn back in the bulls’ favour. A recovery from here would confirm that the gap has successfully transitioned into a support base. For long-term investors, this is exactly the type of pullback that offers a second chance to accumulate quality at a discount.

Sometimes the best journeys start after a few delays and we believe Trainline’s next destination could be a much higher platform.

Five key takeaways

- Robust trading momentum: Net ticket sales up 8% year-on-year with strength across both UK and International markets.

- Profitability improving: EBITDA guidance raised to the top end of expectations as operating leverage kicks in.

- Shareholder-friendly actions: £350 million total buyback across three years signals management confidence.

- Attractive valuation: Shares trade on just 12x forward earnings with strong EPS growth ahead.

- Technical support in place: Gap closure complete and price stabilising near long-term support, offering a favourable entry for the second tranche.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.