25th Jul 2025. 10.45am

Weekly Briefing – Friday 25th July

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | +1.32% |

| FTSE 250 | +0.85% |

| FTSE All-Share | +1.26% |

| AIM 100 | +0.45% |

| AIM All-Share | +0.37% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 25th July

Market Overview

Dear Investor,

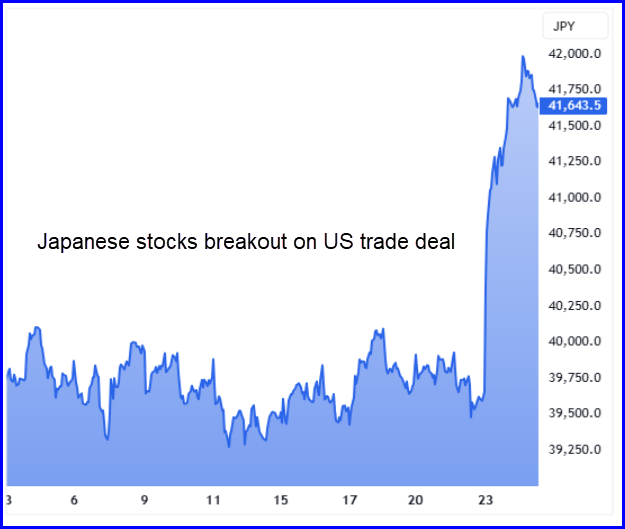

This week has been dominated by trade deal optimism, with the global markets rallying after US President Donald Trump announced a breakthrough with Japan. The deal, which sets a 15% tariff on Japanese imports instead of the previously threatened 25%, has been welcomed by investors who are now hoping this could be a sign of things to come for other major trading partners.

On the back of this, Japan’s Nikkei 225 index surged and other global indices such as the S&P 500 and FTSE 100 continued to hit new highs. The optimism surrounding these agreements is clear, and markets are clearly betting on more deals to follow, which has injected a renewed sense of confidence.

Expectations are growing that the EU and the US will reach a similar deal. Brussels is reportedly close to agreeing on a 15% reciprocal tariff on European imports, mirroring the Japan agreement. The deal, which aims to stave off Trump’s threat of hiking tariffs to 30% from August 1, has sparked a rally across the European automotive sector. Car manufacturers such as Volkswagen have seen their shares rise in anticipation of a reduction in tariffs on cars, which would fall from 27.5% to 15%. For European manufacturers, this is a welcome shift that could save them from the full brunt of a trade war.

But, as with all good news, there are caveats. While the 15% tariff deal is a relief for now, it’s important to remember that it is still a hike from the 10% tariffs the US had imposed previously, on top of the average 4.8% duties already in place. And with the EU approving a €93bn retaliatory tariff package should negotiations fall through, it’s clear that Trump isn’t the only one willing to play hardball.

For now, though, markets seem to be betting on a positive outcome. European indices and shares in export-heavy sectors have been buoyed by the prospect of the EU-US deal, and global market sentiment is leaning towards cautious optimism. But, as always, it’s worth keeping an eye on how negotiations unfold in the next few days, especially with the looming August 1 deadline. Tariffs have a knack for resurfacing just when we think we’ve got a handle on them, and while investors have reason to be hopeful, the road ahead remains tricky.

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: Greencore (LSE:GNC) +14.5% on the week

Shares in Greencore surged higher this week following the company’s strong trading update for the 13 weeks ended 27 June 2025, which revealed impressive revenue growth and operational efficiency. The UK convenience food manufacturer reported a 9.9% increase in Q3 revenue, reaching £511.1 million, bolstered by favourable summer weather and new business wins. This performance was underpinned by a 6.8% increase in total volumes and a 3.1% positive impact from inflation recovery. Notably, the food-to-go category, which includes popular items like sandwiches, sushi, and ready meals, saw robust demand, with an 11.4% revenue increase in other convenience categories.

Greencore said its focus on innovation has played a key role in its success, launching 168 new products, including a Japanese-inspired strawberry and creme sandwich and poke bowls, just in time for the summer season. This product innovation, coupled with the company’s operational excellence initiatives such as best practice deployment and manufacturing automation, allowed Greencore to maintain strong volume growth and efficiency, surpassing wider market growth. Additionally, the company reported an impressive operational service level of 99.3%, further cementing its position as a strategic partner to its customers.

Looking ahead, despite caution around the UK’s uncertain economic environment and ongoing inflationary pressures, particularly in protein and labour, Greencore raised its full-year adjusted operating profit forecast to £118-121 million, surpassing previous guidance. The group is also progressing with its proposed acquisition of Bakkavor Group, which is expected to complete in early 2026, subject to regulatory approval. This acquisition, alongside its continued investment in technology and process improvements, signals Greencore’s commitment to long-term growth and value creation.

REGENCY VIEW:

Greencore continues to show strong fundamentals, with a healthy operating margin of 5.21% and a solid return on equity of 12%. The company’s focus on efficiency and product innovation is driving its growth, and the stock remains firmly on our watchlist.

It’s been another tough week for troubled makeup manufacturer Revolution Beauty, as the stock continues to slide following Mike Ashley’s Frasers Group pulling out of a bid in June. This came after Frasers Group confirmed on 19 June 2025 that it would not proceed with an offer for Revolution Beauty, ending speculation that the retailer might take control of the company.

Despite initially participating in Revolution Beauty’s formal sale process, Frasers Group’s withdrawal has added to the uncertainty surrounding the business, further dampening investor confidence.

The move also means that Frasers Group and any parties acting in concert with it are now bound by the restrictions in Rule 2.8 of the Takeover Code, which limits them from making an offer for the company unless certain conditions are met, such as a material change in circumstances or a competing offer from another bidder.

With no immediate suitors stepping forward, Revolution Beauty finds itself in a precarious position, struggling to navigate through a challenging period marked by both operational and market headwinds.

REGENCY VIEW:

Revolution Beauty continues to struggle with its financials, posting disappointing results amid ongoing operational challenges. Despite efforts to restructure, the company faces significant hurdles in improving profitability, and without a clear strategic shift or external support, it remains a risky proposition for investors.

Sector Snapshot

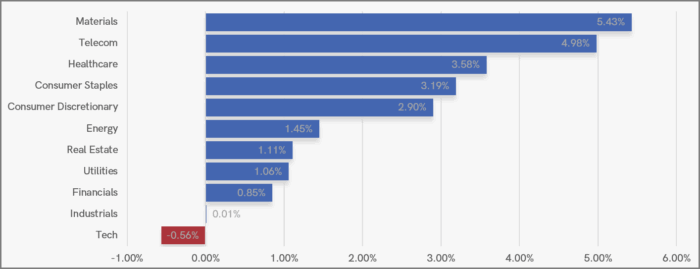

Materials and Telecom stocks led the pack this week, powering ahead with strong gains and helping to lift broader sentiment. Healthcare and Consumer Staples followed closely behind, with both sectors benefiting from renewed interest in defensive growth. Consumer Discretionary also saw solid upside, supported by improving confidence in the economic outlook.

Energy, Real Estate, and Utilities posted more modest gains, while Financials and Industrials rounded out the week with quieter performances. Tech was the only sector to finish in the red, slipping despite the broader rally, as investors rotated out of recent winners and into under-owned areas of the market.

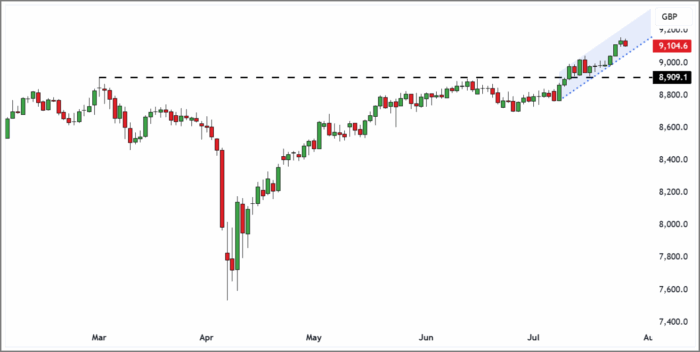

UK Price Action

The FTSE continues its summer rally, steadily climbing within a well-defined ascending channel. With the recent break of resistance, the market now boasts several significant support levels beneath it.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.