28th May 2025. 9.02am

Regency View:

BUY Barclays (BARC)

- Growth

- Value

Regency View:

BUY Barclays (BARC)

Barclays: Where value meets momentum

Financials have quietly taken the lead across the FTSE this year, and Barclays (BARC) is starting to join the front runners…

Having taken profits in Barclays last year after a healthy move, the shares have now broken out of a long-standing resistance level around 312p. That move adds a technical spark to what was already shaping up to be a compelling turnaround. With a solid Q1 performance and a confident tone on returns, Barclays now has both the momentum and the fundamentals to justify a fresh look.

The real opportunity here lies in the blend. Barclays is no longer just a restructuring story or a value trap, this is a bank that’s generating cash, growing earnings, and returning capital, all while trading on a deep discount to its underlying assets.

Broad-based growth underpinning the recovery

Barclays’ strength lies in the balance of its business model. UK retail banking continues to benefit from a favourable rate environment, with improved deposit margins supporting earnings quality. That steady engine is complemented by activity in the wealth division, where assets under management are rising and helping to generate more stable fee income. This side of the bank adds a layer of durability that helps smooth over any short-term macro noise.

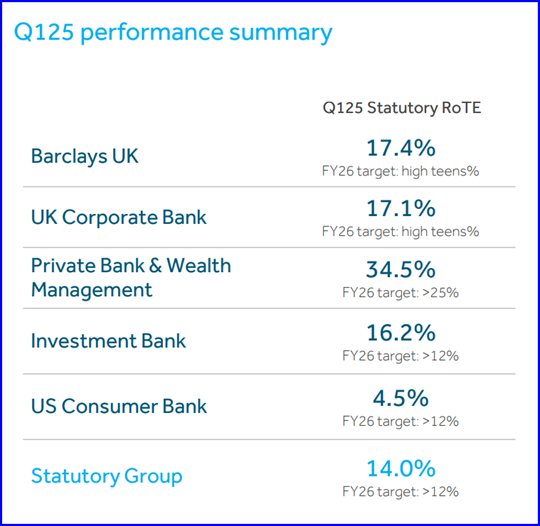

The investment bank, meanwhile, is no longer the drag it once was. Markets revenues were up in Q1 as volatility returned, and the institutional client franchise remains a key differentiator. There’s also upside potential if M&A activity or equity markets recover into the second half of the year. Rather than swinging between feast and famine, the unit is starting to show consistency which is exactly what long-term investors want to see.

This breadth of revenue makes Barclays more resilient than peers leaning too hard on one segment. It also means there are multiple levers for growth. That flexibility is valuable in an environment where the macro picture remains mixed, and policy paths are far from certain.

Lean, liquid and well disciplined

Barclays has made serious progress on efficiency, stripping out costs while continuing to invest where it counts. Operating costs were down 4% year-on-year in Q1, with management reaffirming its plan to reduce the group cost base to £13.8bn for FY24. That target is achievable given continued reductions in headcount and tech upgrades behind the scenes. The result is a leaner, more focused bank that can scale without piling on costs.

Capital strength is also in a good place. The CET1 ratio stood at 13.5% at the end of March, providing a solid buffer above regulatory minimums and giving management freedom to return excess capital without risking stability. The 2024 plan includes a £10bn capital return over three years, starting with a £1bn buyback in Q1. That’s a strong signal of confidence from the board.

Credit quality remains under control, with impairment charges stable and no signs of stress across key portfolios. Barclays’ risk profile has shifted considerably from where it was just a few years ago. The focus now is on sustainable returns, not chasing market share at all costs and the business is better for it.

Returning cash while laying foundations for growth

Few UK banks offer a more balanced approach to capital allocation right now. On one hand, Barclays is returning meaningful cash to shareholders – £10bn over three years is no small feat. On the other, it’s continuing to invest in growth. The acquisition of Tesco Bank shows strategic intent in retail, while wealth management initiatives help strengthen relationships with high-value clients. It’s not growth at any cost it’s targeted expansion that complements the existing footprint.

Buybacks are also being deployed at a time when the shares remain well below book value. That amplifies the effect for shareholders and reflects management’s view that the market is undervaluing the business. The Q1 buyback alone accounted for roughly 3.2% of the total market cap at the time of announcement, which is meaningful in the current climate.

This blend of short-term reward and long-term positioning is rare. Barclays isn’t banking on one silver bullet it’s building multiple paths to higher returns, all while rewarding shareholders along the way. That makes it a much more attractive story than some of the more volatile names in the sector.

Valuation and technicals: The setup looks strong

Technically, the breakout above 312p is significant. It marks the first time in over a year that buyers have taken control above this key resistance level. It also marks a complete V-shaped recovery from Trump’s ‘tariff tremor’ sell-off. With recent price action showing broken resistance has become new support, Barclay’s long-term uptrend is very much in full swing.

The valuation metrics support the bullish case. Barclays trades on a forward PE of 7.2 and a PEG of just 0.6, implying strong earnings growth at a very reasonable price. Forecast EPS growth of 14.5% shows the underlying engine is firing, and the dividend yield of 2.95% adds another layer of appeal for income-focused investors. For a bank of this scale and diversity, those numbers stand out.

On asset-based metrics, the shares still look cheap. Barclays trades at 0.61x book value and just 0.69x tangible book, well below peers and the broader market. Price to free cash flow sits at 6.5, and price to sales is just 1.5, suggesting there’s room for a re-rating as sentiment shifts.

For those looking for exposure to the financial sectors current dominance with both value and momentum, Barclays makes a strong case for fresh entry.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.