7th May 2025. 8.57am

Regency View:

Update

Regency View:

Update

ABF eyes bakery exit amid sugar struggles

Associated British Foods (ABF) has confirmed it is in talks with Endless LLP, owner of Hovis, regarding a potential deal for its struggling Allied Bakeries business. While no terms have been agreed and there is no certainty a deal will be completed, this marks a significant step towards a possible exit from a division that has weighed on ABF’s Grocery performance for some time. Any transaction would likely attract regulatory scrutiny, given Hovis’s existing presence in the UK bakery market.

This update follows the group’s interim results which showed a 10% decline in adjusted operating profit to £835m and a steep drop in free cash flow to just £27m, down from £468m the previous year. Revenue was broadly flat, but Sugar delivered an adjusted operating loss of £16m, dragging down overall performance. Primark was the standout, growing sales by 1% to £4.5bn and lifting operating profit by 8% thanks to margin improvement and growth in the US and Europe.

Management was blunt about the challenges in its Sugar and Bakery units. Sugar faces ongoing pressure from weak European pricing and operational issues at its Vivergo bioethanol plant, which may be mothballed or closed. Meanwhile, Allied Bakeries continues to face structural headwinds in the UK market, with ABF confirming that a strategic review is well underway. The potential sale to Endless could streamline the business and reduce exposure to unprofitable segments.

Despite these challenges, ABF reiterated its full-year outlook, with stable expectations for most divisions. Primark’s store rollout and digital initiatives are progressing well, and Grocery and Ingredients continue to perform steadily. The group’s strong balance sheet, with £201m in net cash (pre-lease liabilities), gives it the flexibility to continue investing while navigating tougher conditions in specific markets.

BP delivers steady Q1 despite lower cash flow and takeover speculation

BP (BP.) posted a resilient set of first-quarter results, with underlying replacement cost (RC) profit rising to $1.4 billion, up from $1.2 billion in Q4 2024. That’s despite softer results in its gas marketing division and lower upstream production, partially offset by stronger refining margins and reduced turnaround impacts. CEO Murray Auchincloss highlighted progress on cost-cutting and project delivery, with three new upstream projects online and six fresh exploration discoveries already this year.

Operationally, BP continues to run a tight ship. Upstream plant reliability hit 95.4%, while refining availability was even stronger at 96.2%. This supported stable oil production profits and a turnaround in the customers & products division, where underlying profits recovered to $0.7 billion from a $0.3 billion loss in the previous quarter. Still, net debt crept up to $27.0 billion, largely due to a seasonal $3.4 billion working capital build and timing of various payments.

The company has reiterated its commitment to shareholder returns, maintaining its quarterly dividend at 8 cents per share and announcing a $750 million buyback. BP now expects 2025 capex to total around $14.5 billion, as it continues to focus spending discipline and progress its divestment plan—including strategic reviews of Castrol and downstream exits in Austria, the Netherlands and Gelsenkirchen. Management remains confident in hitting its $14-18 billion net debt target by end-2027.

Meanwhile, speculation has intensified around a potential takeover bid from Shell, with Bloomberg reporting the rival oil major is evaluating options with advisers. While no decision has been made, further weakness in BP’s share price could accelerate such discussions. Investors will be watching closely, especially as the sector consolidates and the energy transition drives strategic shifts across the board.

Glencore cautious but confident as copper rebound looms

Glencore’s (GLEN) Q1 2025 production update served up a mixed bag, with a hefty 30% drop in copper volumes grabbing the headlines. But management is sticking to its full-year guidance, betting on a second-half rebound as operational challenges at Collahuasi and Antapaccay ease and throughput at KCC improves. Copper output is expected to be backloaded, with 58% forecast for H2. Despite the sluggish start, CEO Gary Nagle struck a calm tone, citing similar seasonality in 2024 that ultimately didn’t derail annual targets.

Coal was the standout, boosted by the July 2024 acquisition of Elk Valley Resources. Steelmaking coal production hit 8.3Mt in Q1, up sharply year-over-year. Energy coal, meanwhile, slipped 7% due to planned mine closures, prompting a modest trim to the full-year guidance. Zinc production grew 4%, thanks to stronger showings in Peru and Australia, while cobalt surged 44% as Mutanda benefitted from higher grades. Nickel production held steady, if adjusted for the closure of Koniambo.

Marketing, the heart of Glencore’s earnings engine, is expected to deliver an Adjusted EBIT near the midpoint of its $2.2–3.2bn long-term range, despite volatile conditions. The company flagged ongoing geopolitical friction and new US tariff threats as likely to cause some disruption, but also potential opportunities. For now, core commodity trade flows remain largely intact, and Glencore’s global footprint and risk controls are helping it navigate the turbulence.

With copper sentiment perking up globally and coal markets rebalancing, Glencore is positioning itself to benefit from both operational recovery and pricing tailwinds. The group’s cautious optimism stands out in a sector often rocked by external shocks. Investors will now be watching for signs that the copper turnaround in H2 materialises—and that volatility continues to play into Marketing’s hands.

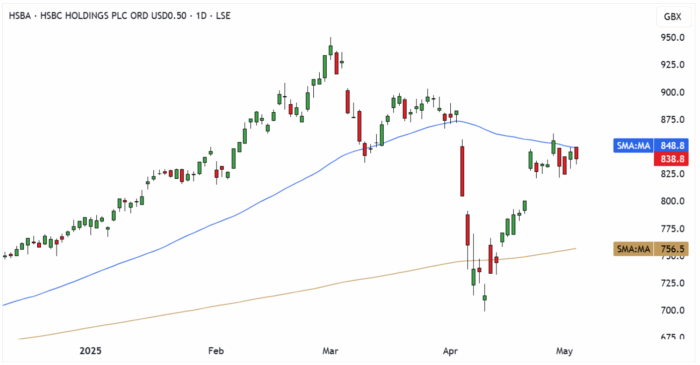

HSBC marks 160 years with record results

HSBC (HSBA) celebrated its 160th anniversary at this year’s AGM with a confident message to investors: the bank is delivering record profits, growing returns, and executing against its international strategy. Group Chairman Mark Tucker opened the event by highlighting 2024’s strong financial performance, including a record profit before tax of $32.3bn and a return on tangible equity of 14.6%. HSBC returned nearly $27bn to shareholders last year, including a special dividend from the sale of HSBC Bank Canada and four share buybacks that helped lift the share price more than 20%. The dividend outlook for 2025 remains robust, with a 50% payout ratio target and continued buybacks in the pipeline.

The bank’s international footprint remains a core strength, with profits underpinned by diversification across regions and business lines. Tucker struck a cautious but constructive tone on global trade, noting that HSBC remains well positioned to benefit from rising intra-regional trade, especially across Asia and Europe. In the face of geopolitical tensions and uncertain macroeconomic trends, the bank reaffirmed its target of a mid-teens return on tangible equity through 2027, citing its strategic alignment with key trade corridors and a trusted presence in critical markets.

Group CEO Georges Elhedery continued the upbeat message, reporting strong momentum in Q1 2025 results. Excluding notable items, profit before tax rose 11% and return on tangible equity reached 18.4%. Standout areas included FX trading, equities and debt businesses, and a fifth straight quarter of double-digit growth in Wealth. Since taking the helm in September, Elhedery has set in motion structural simplifications aimed at making HSBC more agile and customer-focused. These changes are already driving higher client satisfaction and improving operational focus, with the bank investing heavily in digital infrastructure, AI, and cyber protection.

Sustainability remains on the agenda too. HSBC has already facilitated $400bn in sustainable finance since 2020 and is reviewing its interim emissions targets as it reaches the halfway mark toward its 2030 goals. With a strong balance sheet, healthy capital buffers, and growing customer trust, the message from management was clear: HSBC is not just navigating uncertainty—it is embracing it as an opportunity to deliver higher returns and long-term value.

Indivior navigates transition with stable guidance despite top-line pressure

Indivior’s (INDV) Q1 2025 results came in broadly as expected, with net revenue of $266m representing a 6% decline year-on-year. The drop was primarily driven by a sharp reduction in SUBOXONE Film sales, which faced intensified generic competition in the U.S. market. SUBLOCADE revenue held steady at $176m, in line with full-year guidance of $725m–$765m, although near-term pressures from funding gaps in the justice system slightly weighed on growth. With overall net income falling to $47m and diluted EPS down 15% to $0.38, the headline figures reflect the shifting dynamics of Indivior’s product mix and evolving market access environment.

That said, SUBLOCADE remains the company’s strategic anchor. U.S. patient numbers held firm at 170,700, and volumes in the more stable organised health system channel continued to climb. The FDA’s approval of new label updates for SUBLOCADE in February—including a rapid initiation protocol and alternative injection sites—should improve flexibility and uptake in the second half. Management reiterated full-year revenue and earnings guidance, suggesting confidence in the back-end loaded recovery as these changes take hold.

Indivior’s cost discipline also deserves a mention. SG&A and R&D spending declined by 8% and 19% respectively on a non-GAAP basis, as the company streamlined operations and focused development efforts on its two Phase 2 candidates: INDV-2000 and INDV-6001. Gross margin softened to 83%, reflecting the unwinding of favourable inventory effects seen last year, but overall profitability was preserved with $66m in operating income. A recently completed $100m share buyback shows a continued commitment to shareholder returns, even as management reshuffles and prepares for a new leadership era.

Looking ahead, growth remains tied to SUBLOCADE’s ability to offset losses from older brands, especially as SUBOXONE’s market share erodes further. The opioid treatment market is expected to continue expanding in the U.S., and Indivior’s efforts to position SUBLOCADE as the long-acting treatment of choice could bear fruit as policy changes and destigmatisation efforts expand access. With Mark Crossley set to step down and Joe Ciaffoni stepping in, the upcoming quarters will be key in determining whether Indivior can unlock its next chapter of sustainable growth.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.