25th Apr 2025. 11.03am

Weekly Briefing – Friday 25th April

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | +1.64% |

| FTSE 250 | +1.55% |

| FTSE All-Share | +1.65% |

| AIM 100 | +0.43% |

| AIM All-Share | +0.37% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 25th April

Market Overview

Dear Investor,

This week, rather than focus on a single news event or market headline, I thought I’d change tack slightly and explore a different kind of opportunity: how to find strong stocks during weak market conditions. Sell-offs can look chaotic, but they’re also revealing. Not all stocks react the same way. Some get caught in the storm because they’re deeply tied to macro trends or sector rotations. Others show real resilience, and those are the ones worth watching.

One of the best ways to spot them is by zooming out. When markets wobble, the daily charts can feel noisy and overwhelming, but a longer-term view often tells a much clearer story. If a stock has been trending higher for years and is now pulling back to a key support zone, that’s very different from one that’s breaking down entirely. You’re looking for signs that the long-term structure remains intact and that buyers are still stepping in when it matters.

Next comes what I like to call bouncebackability — a term borrowed from football, but perfectly suited to investing. Strong stocks don’t just hold up better during market weakness, they tend to recover faster once pressure starts to ease. BAE Systems is a good example. We recently highlighted it in FTSE Investor, and it snapped back quickly as sentiment began to stabilise. When a stock reclaims key levels ahead of the pack, it usually means institutional support hasn’t gone anywhere.

But price action alone isn’t enough. In choppy markets, quality rises to the top. Investors often move away from speculative names and focus on companies with dependable earnings, strong free cash flow, and healthy balance sheets. Keep an eye on metrics like return on capital employed (ROCE), margin resilience, and manageable debt. When both the chart and the fundamentals are pointing in the right direction, it’s a far more convincing setup.

Lastly, keep a close watch on catalysts and relative strength. A stock might be treading water now, but a trading update or product launch can reignite interest quickly. Likewise, names that are outperforming their sector or the broader market often go on to become future leaders.

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: Croda (LSE:CRDA) +11.2% on the week

Chemical giant Croda gapped higher this week following a strong trading update which showed they could pass on tariff costs without derailing momentum.

The group reported an 8% rise in Q1 sales to £442 million, driven by volume growth across all divisions, including standout contributions from Crop Protection and Fragrances & Flavours. Notably, sales increased in every region, with EMEA delivering double-digit gains, and management confirmed that adjusted profit before tax was in line with expectations.

The improvement in volumes has helped asset utilisation across Croda’s 11 shared manufacturing sites, with efficiency gains feeding into its multi-year cost-saving programme. A key highlight was management’s confident tone around its five-point plan, with progress seen in both sales and margin recovery. Beauty Actives was the only area to dip year-on-year, but even that showed improvement compared to Q4, suggesting the worst may be behind them.

Tariffs have become a live issue again due to global tensions, but Croda’s decentralised manufacturing and procurement model appears well-placed to weather the storm. Management flagged a modest tariff surcharge, which has so far been well received by customers—another sign that pricing power remains intact. With momentum clearly building and full-year guidance reaffirmed, the update gives bulls something to build on.

REGENCY VIEW:

Croda is showing solid potential with a forecasted EPS growth of 13.1% and a healthy dividend yield of 3.77%, indicating strong financial fundamentals. While its operating margin of 13.97% reflects decent profitability, the stock’s relatively high valuation metrics suggest that it could take time for the company to translate these metrics into consistent growth.

Shares in Hochschild Mining took a tumble this week following a Q1 production miss, as adverse weather and operational hiccups weighed on output from its Mara Rosa operation in Brazil…

While Inmaculada performed solidly and there were encouraging signs from Argentina’s San Jose mine, group-wide gold equivalent production came in below expectations. Management flagged that the first quarter is typically their weakest — but even with that context, the market was unimpressed with the lack of progress at Mara Rosa, where seasonal rains and delays in waste removal rolled over from last year.

The company noted additional complications from its mining contractor, compounded by a tight labour market driven by strong metal prices. These issues have led to production constraints that are expected to persist into Q2, although a stepped-up waste removal programme is now underway.

Despite the weak start, full-year guidance remains unchanged — suggesting confidence in a stronger performance in the second half of the year, especially once site access and fleet expansion measures begin to take effect.

Beyond the short-term production drag, Hochschild continues to streamline its portfolio, with the sale of Arcata and Azuca now complete and development work underway at Monte Do Carmo. Cash levels dipped during the quarter, reflecting one-off community and tax-related payments, but the company still maintains a manageable net debt position. While the first quarter has clearly disappointed, the reaffirmation of full-year targets and a stable financial position may offer some reassurance to longer-term investors, assuming operational improvements begin to materialise in the coming months.

REGENCY VIEW:

Hochschild’s valuation looks modest relative to its growth potential, with a forecast P/E of just 7.4 despite earnings expected to surge more than 60% this year. While Q1 was a stumble, the underlying business remains profitable with strong returns on capital and a reassuringly low EV/EBITDA — suggesting this may be more of a short-term slip than a structural issue.

Sector Snapshot

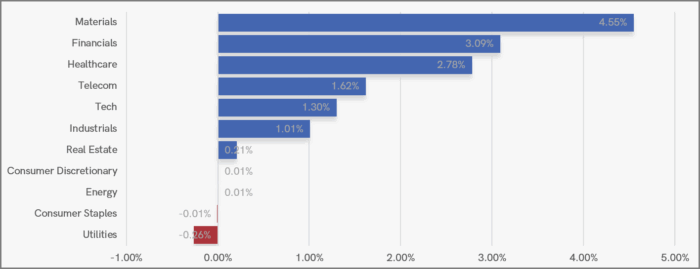

We’ve seen a reasonable recovery in risk appetite this week, with investors rotating back into cyclical areas of the market. Financials, Healthcare, and Materials led the way, suggesting growing confidence in sectors tied to economic activity and earnings resilience. Meanwhile, the more defensive areas like Utilities and Consumer Staples were left behind, reflecting a broader shift away from safety. Energy also struggled to participate in the rebound, weighed down by ongoing concerns around potential oversupply from OPEC+ and a lack of fresh catalysts to drive prices higher.

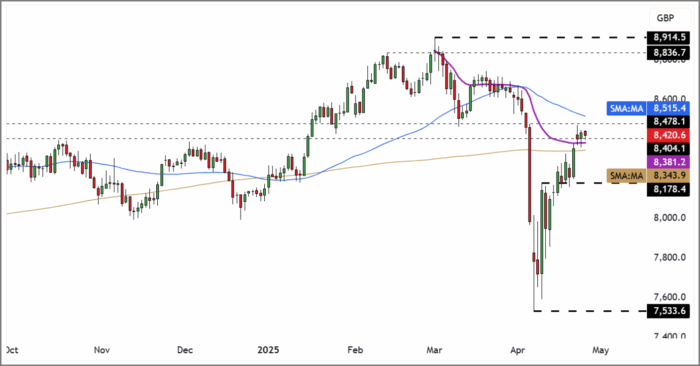

UK Price Action

In a market that feels highly uncertain, we’re starting to see some green shoots of recovery for the bulls. The FTSE has managed to reclaim its 200-day moving average, and the volume-weighted average price anchored to the early-March highs. For now, the market needs to hold its ground, the longer it can do so, the higher the chance of a sustained recovery.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.