5th Mar 2025. 9.00am

Regency View:

Centrica (CNA) Second Tranche

- Value

- Income

Regency View:

Centrica (CNA) Second Tranche

Centrica: Ready for a second tranche after strong prelims

The earnings season always brings with it a fresh wave of opportunity, especially for those who know how to spot the winners. Centrica (CNA) has certainly emerged as one of the standout performers, delivering a set of preliminary results that have impressed the market and sparked a new wave of price momentum.

With its focus on energy security, Centrica is showing resilience and growth in the face of headwinds. The company has a promising pipeline of projects, a strong recovery trajectory, and its recent results are catching the eye.

Impressive Preliminary Results

Centrica’s preliminary results for 2024 show a company in solid shape, exceeding analysts’ expectations and reaffirming its transformation in recent years. The company posted an adjusted operating profit of £1.55 billion, surpassing the average market estimate of £1.54 billion. Revenue came in at £24.64 billion, a notable performance in a challenging energy market. This level of revenue growth highlights Centrica’s ability to adapt and deliver value despite fluctuating energy prices and regulatory changes.

The company’s underlying earnings per share (EPS) showed a decline of 44.3% year-on-year, primarily due to higher costs in energy procurement. However, this is in line with expectations given the volatile energy landscape. Importantly, Centrica has made significant strides in its core operations, with the announcement of a £4 billion investment programme designed to boost capacity and infrastructure, particularly in the green energy space. Half of this investment has already been committed, ensuring that Centrica is laying down a strong foundation for the future.

On the balance sheet, Centrica remains in a healthy position, with £2.7 billion net cash, as per their recent preliminary results. The company has already committed £2 billion to upgrading key assets like the Rough gas storage site, alongside its strategic involvement in the Sizewell C nuclear power plant project, a potential game-changer for its energy mix. Furthermore, Centrica’s continued focus on cost efficiency and growth in sustainable energy sources strengthens its long-term position as a leader in the UK energy market.

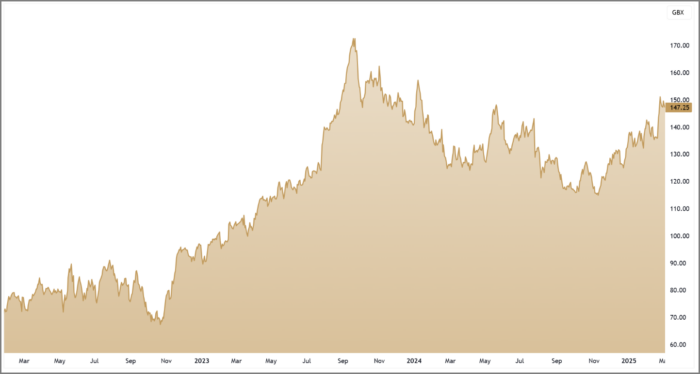

Bullish recovery in play

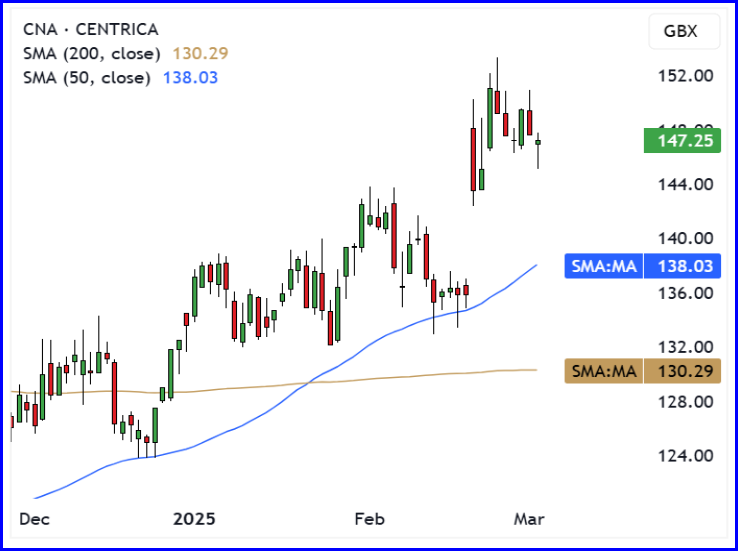

From a technical perspective, Centrica’s share price has been on a bullish recovery since the start of the year. The stock has demonstrated a consistent series of higher swing lows and lower swing highs, signalling a shift towards an uptrend.

The most notable technical development has been the crossover of the 50-day moving average (MA) above the 200-day MA, often referred to as a “golden cross.” This is typically viewed as a positive signal, indicating potential for sustained upward momentum.

After the release of its preliminary results, Centrica’s share price gapped higher, sparking a burst of bullish momentum. This reaction from the market demonstrates strong investor confidence in the company’s future prospects. The shares have now rallied by around 12% over the past three months and continue to show positive relative strength, outperforming the broader market.

Looking ahead, Centrica’s price action is well-supported above key moving averages, suggesting further upside potential. The 50-day MA has been acting as strong support, while the price is consistently trending higher. Given this technical setup, we’re optimistic about the potential for Centrica’s shares to continue climbing, with the recent bullish momentum suggesting a good entry point for a second tranche buy.

A sweet spot for value, income, and quality

Those of you who follow our FTSE Investor reports closely will know that we like to apply a quality filter to traditional income value and growth metrics. We believe Centrica presents a compelling proposition for investors focused on value, income, and quality…

The stock currently trades on a forward price-to-earnings (P/E) ratio of 10, well below the industry average, positioning it as a value pick in the utilities sector. Despite challenges faced by the energy sector, Centrica has maintained a strong market position, with its focus on green energy and energy security paying off.

For income investors, Centrica offers an attractive 3.59% dividend yield, supported by the company’s solid cash flow generation. This is a healthy payout in the context of the current market, providing investors with reliable returns while the company continues to grow and expand its operations. Furthermore, the company’s return on equity (ROE) stands at 32.1%, reflecting efficient capital utilisation and strong profitability.

Adding to this, Centrica has reinforced its commitment to shareholder returns with a further £500 million extension to its share buyback programme, bringing the total to £2 billion. This additional capital allocation, set to be completed by the end of 2025, highlights the company’s confidence in its financial position and long-term growth prospects.

In terms of quality, Centrica scores highly with a return on capital employed (ROCE) of 16.6% and an operating margin of 6.64%. These metrics highlight a business that is not only growing but doing so with high operational efficiency. Centrica’s ability to generate strong returns on capital, combined with its solid financial position, makes it an attractive option for investors looking for a balance of growth and stability.

With its mix of strong technical performance, solid financial results, and attractive valuation, Centrica is well-positioned to reward investors who look beyond the short-term volatility.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.