8th Jan 2025. 9.00am

Regency View:

BUY Kier Group (KIE)

- Value

- Income

Regency View:

BUY Kier Group (KIE)

Kier: A key player in the UK infrastructure boom

We’re kicking off the new year by looking at a stock that’s poised to benefit from Sir Keir Starmer’s tax-and-spend tactics…

Kier Group (KIE), a stalwart in the UK infrastructure and construction sector, is perfectly positioned to take advantage of the Labour government’s commitment to ramping up infrastructure spending.

With a bursting order book, a solid financial recovery, and a valuation that hasn’t quite caught up with its improved fundamentals, Kier looks set to capitalise on the UK’s infrastructure boom in 2025 and beyond.

A pillar of UK infrastructure

Kier’s been a fixture in the UK’s construction and infrastructure scene since 1928. With over 10,000 employees, the company is involved in more than 400 projects across a wide range of sectors. It operates across four key divisions:

- Transportation: Designing, building, and maintaining infrastructure for highways, rail, aviation, and ports.

- Natural Resources & Nuclear: Providing repair and maintenance services for the energy, water, and telecoms sectors.

- Construction: Delivering private- and public-sector projects in education, healthcare, defence, and more.

- Property: Developing mixed-use sites, including residential and urban regeneration projects.

This diverse portfolio places Kier in a prime spot to weather economic cycles and thrive in sectors seeing increasing demand due to government investment.

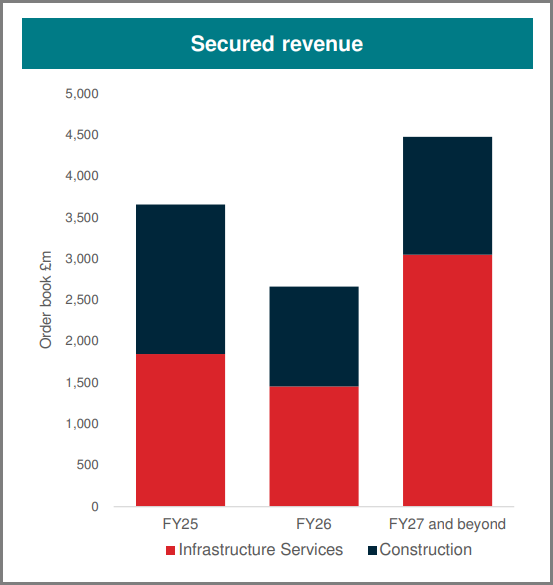

Solid order book and secure revenue

The government’s renewed focus on infrastructure spending presents a major growth opportunity for Kier. With projects spanning transport, healthcare, education, energy, and housing, Kier is well-positioned to capture a significant portion of the surge in public sector investment. The company has long-standing relationships across these sectors, and with 90% of its contracts coming from the public sector, its future revenue is looking secure.

Kier’s most recent trading update (14 November 2024) confirmed a strong performance track record for FY25. With an order book totalling £10.9 billion, the company has already secured 95% of its expected revenue for FY25, offering investors strong visibility. Notable recent contract wins include:

- Wessex Water: A place on a £3.7 billion framework, reinforcing Kier’s position in the utilities sector.

- Royal Naval Air Station Culdrose: A £100 million project to refurbish key facilities.

- Riverside Group: A £300 million fire safety and retrofit programme.

These wins are a highlight Kier’s solid footing in sectors where government spending is set to increase.

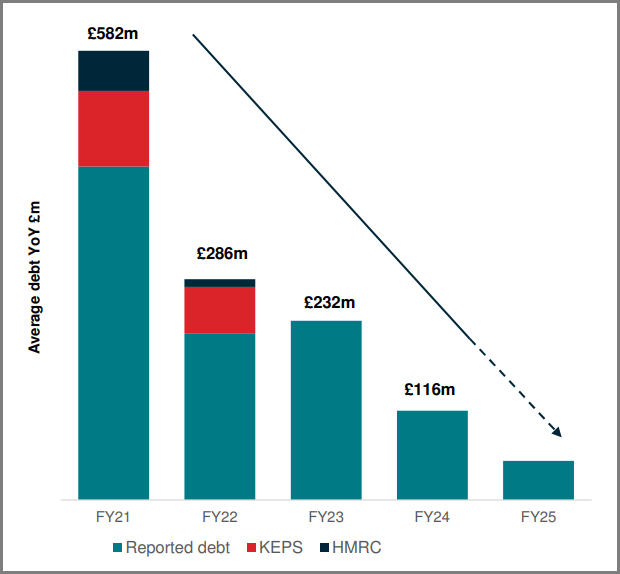

Financial turnaround

Kier’s turnaround since 2020 is very impressive. After battling through significant challenges, including unprofitable contracts, the company has streamlined operations and focused on managing contract risk more effectively. This shift has led to improved cash generation, with free cash flow for the year to June 2024 reaching £186 million. The company also ended the period with net cash of £167 million (excluding leases), giving it the flexibility to reinvest in the business and return value to shareholders.

The reduction in net debt is notable, having halved over the past 12 months. This gives Kier the financial flexibility to reinvest in its business, particularly in the Property division, where it targets a return on capital employed of 15%.

Kier is targeting steady growth over the medium term, with goals including 3.5%-plus operating profit margins, 90% cash conversion, and a dividend three times covered by earnings. With a strong order book and exposure to high-priority sectors, these targets appear well within reach, suggesting solid growth ahead.

Growth at a reasonable price

Despite solid fundamentals, Kier’s shares remain undervalued. Trading at just 6.9x forecast earnings for FY26, the stock presents considerable upside potential as the company continues to execute on its growth strategy. Additionally, the forecast dividend yield of 4.7% further enhances its appeal as an income-generating investment.

Currently, Kier’s stock is trading well below its peers in the infrastructure sector. As the company continues to execute its strategy and deliver on its targets, the market will likely re-rate the shares, creating upside potential for investors.

Technical analysis: A healthy consolidation phase

Kier’s share price has been locked in a broad uptrend since 2023, with the 50-day moving average sitting above the 200-day moving average.

Over the last six months, the stock has entered a period of sideways consolidation, bringing it back to the upward-sloping 200-day moving average. This phase of mean reversion is healthy, indicating that the stock is no longer overbought and has created an attractive entry point for long-term investors.

Overall, we believe Kier’s strong position in the UK infrastructure market, improved financial health, and attractive valuation, the company is poised to benefit from the UK government’s infrastructure push in the coming years. As Kier continues to execute its strategy and deliver on its targets, its current undervaluation should close, providing significant upside potential for investors.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.