20th Dec 2024. 12.24pm

Regency View:

TAKE PROFITS Cohort (CHRT)

Regency View:

TAKE PROFITS Cohort (CHRT)

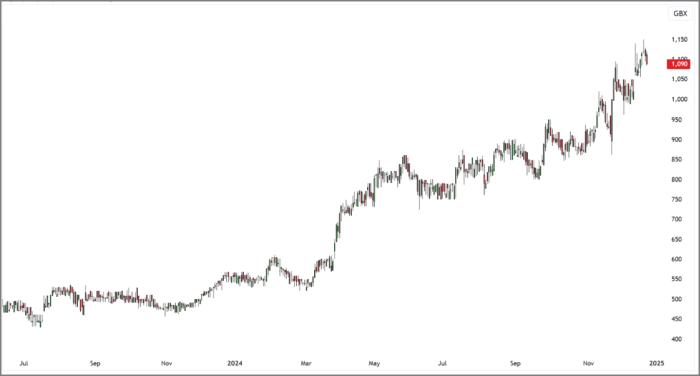

Close Cohort (CHRT) at market (1,090p)

We’re also recommending taking profits in Cohort (CHRT), having been in the stock since 2022. This year, the stock has benefitted from the increased global defence spending, with the share price soaring by 89% over the past 12 months. The company has seen strong growth, particularly in its Communications and Intelligence and Sensors and Effectors divisions, both crucial areas within the defence sector.

Cohort’s revenue growth has been impressive, with a 25% rise in sales during the latest interim period, alongside a substantial 138% jump in EPS. The stock’s momentum has been robust, but with a P/E ratio of 21.1 and a price-to-book ratio of 4.68, it’s now trading at a premium. The company’s strong cash flow and low net debt position are encouraging, and its growth prospects in the defence sector remain solid. However, given the substantial run-up in the stock, now feels like a prudent time to lock in profits.

Despite its positive outlook, we believe that the current valuation reflects much of the good news. With the stock up nearly 90% over the last year, we feel it’s time to take profits and look for other opportunities in the market with more potential upside.

Profit = +93%

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.