20th Dec 2024. 10.51am

Weekly Briefing – Friday 20th December

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | +3.9% (YTD) |

| FTSE 250 | +3.9% (YTD) |

| FTSE All-Share | +3.9% (YTD) |

| AIM 100 | -6.7% (YTD) |

| AIM All-Share | -6.9% (YTD) |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 20th December

Market Overview

Dear Investor,

Welcome to this special annual review edition of the Weekly Briefing. As the year winds down, it’s the perfect time to reflect on a market that has navigated its fair share of challenges in 2024.

This year, global stocks once again proved their resilience, standing firm against the backdrop of profound political, economic, and social shifts. Elections dominated headlines, with Donald Trump reclaiming the U.S. presidency, Labour reshaping the UK’s political landscape, and Mexico electing its first female president.

At the same time, geopolitical tensions loomed large. The Russia-Ukraine war entered its third year, with Ukraine’s counter-offensives and U.S.-backed strikes reigniting discussions on NATO’s role and global security. In the Middle East, the Israel-Gaza-Lebanon conflict escalated, drawing attention to humanitarian crises and the limits of international intervention.

Despite these challenges, the FTSE 100 is on track for a steady 4% gain year-to-date, buoyed by its defensive qualities. However, the strong U.S. dollar created headwinds for its commodity-heavy constituents. Across the Atlantic, the S&P 500 surged over 20%, powered by the transformative rise of AI, which has reshaped industries from semiconductors to automation. In Asia, Chinese stimulus injected fresh optimism into equities, helping the Shanghai Composite climb more than 13%. By comparison, Europe took a more cautious approach, with the EUROSTOXX 50 delivering an 8.3% gain amid ongoing energy concerns and uneven recoveries.

This year wasn’t all about markets, of course. The Paris Olympics delivered a spectacle that reminded us there’s more to life than inflation and interest rates, while natural disasters such as Hurricane Helene brought the realities of climate change into sharper focus.

As we step into 2025, the interplay between technology, policy, and geopolitics will continue to shape markets. The resilience of major indices this year serves as a reminder of the opportunities that lie ahead for those prepared to adapt and evolve with the landscape.

Wishing you a fantastic festive period and a prosperous year ahead,

Tom

Market Movers

On the rise: Rolls Royce (LSE:RR.) +95% Year-to-Date

Rolls-Royce’s resurgence this year is nothing short of remarkable, driven by a combination of operational improvements, strategic focus, and a resurgent aviation industry. The latest trading update confirmed that the company is on track to meet its full-year targets, even as supply chain challenges persist.

Central to this success is the rise in engine flying hours (EFH), which now stand at 102% of 2019 levels, with further growth expected by year-end. Rolls-Royce’s reliance on servicing its installed base of long-haul aircraft engines has proven to be a resilient revenue stream, buoyed by robust demand for long-haul travel.

Under the leadership of Tufan Erginbilgiç, Rolls-Royce has embraced a leaner, more efficient operating model. Layoffs, contract renegotiations, and data-driven process improvements have transformed the business. These changes have significantly boosted margins, ensuring the increased revenue from EFH translates directly into profits. This operational discipline, coupled with a sharp focus on reducing debt, has allowed Rolls-Royce to reinstate its dividend, with a prospective yield of around 1.1%—a notable milestone in its recovery.

The defence division continues to provide stable, long-term revenue, bolstered by a multi-billion-pound order book and high barriers to entry in the aerospace sector. Meanwhile, the company’s advancements in nuclear technology and its strategic focus on small modular reactors align well with government priorities, positioning Rolls-Royce for future growth. However, challenges remain, including regulatory delays on fixes for newer-generation engines underperforming in sandier climates. Resolving these issues will be crucial to maintaining momentum.

REGENCY VIEW:

With its 2027 mid-term targets firmly in sight, Rolls-Royce has given investors plenty of reasons to stay optimistic. That said, with the stock trading well above its historical valuation on a forward P/E basis, the potential for volatility remains. For now, the company’s enviable position in defence and aerospace, alongside its operational turnaround, ensures its place as one of the standout performers of the year.

Ocado’s share price has been one of the UK’s worst performers this year due to a combination of operational challenges and unconvincing financial results.

Despite achieving revenue growth of 13% in the first half of 2024, the company remains unprofitable, with a net loss of £217 million during this period. Its high levels of investment in logistics and automation technology have yet to deliver the expected returns, leaving investors questioning its ability to turn a profit. The persistent losses have created a narrative of cash burn and financial strain, which continues to weigh heavily on the share price.

The company’s struggles are further compounded by a competitive grocery market and rising operational costs. While Ocado has built a reputation for innovation, its cost base remains disproportionately high relative to its revenue. This imbalance has left it vulnerable to inflationary pressures and ongoing challenges in scaling its operations. Additionally, delays in key international partnerships and slower-than-expected adoption of its automated solutions have added to market concerns.

Investor confidence has also been shaken by the broader macroeconomic environment. Consumers facing cost-of-living pressures are increasingly drawn to low-cost retailers, which has put Ocado at a disadvantage as a premium operator. At the same time, higher interest rates have amplified scrutiny of companies with weak cash flow and heavy capital requirements. With Ocado falling squarely into this category, it has struggled to attract meaningful buying interest in its shares.

REGENCY VIEW:

Ocado is a fascinating story—a company that has long promised to redefine retail logistics but hasn’t quite lived up to the hype. While its technology is undeniably cutting-edge, the business feels caught in a costly balancing act between innovation and profitability. For now, it’s a stock that demands patience and a strong stomach; the potential is there, but the path to realizing it remains uncertain.

UK Sector Snapshot Annual Review

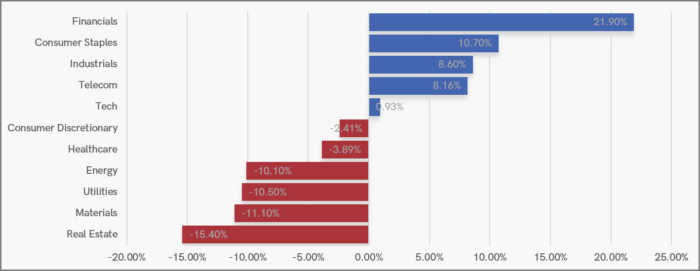

2024 has been a year of stark contrasts across sectors. Financials emerged as the standout performer, delivering double-digit gains, supported by rising interest rates and robust earnings growth. Consumer Staples and Industrials also posted strong returns, benefiting from defensive positioning and steady demand.

On the flip side, Real Estate struggled, reflecting challenges from rising borrowing costs and weaker demand. Energy and Materials grappled with falling commodity prices and a strong dollar, while Utilities faced pressure from regulatory changes and inflationary costs.

These divergences underscore the importance of sector rotation in navigating the FTSE 100. For traders, keeping an eye on lagging sectors like Real Estate and Energy might uncover opportunities in 2025, especially if macro conditions shift in their favour.

UK Price Action Annual Review

The big picture: FTSE 100’s weekly technical story

Looking at the weekly candle chart, the FTSE 100’s broader post-pandemic uptrend remains intact, barring any last-minute surprises before year-end. The index breached trend highs earlier in the year, only to spend the last six months consolidating. What’s notable is how broken resistance levels have transformed into firm support, a broadly bullish sign.

Zooming in: The daily drama of 2024

If the weekly chart gives us the framework, the daily chart paints the details. From January to May, the FTSE 100 surged almost exponentially, driven by optimism over earnings growth and a stable macro environment. However, this momentum hit a ceiling at the 8,400 level, which proved to be a stubborn resistance point. Meanwhile, the 8,000 level established itself as a key support zone, with multiple successful retests throughout the year.

The second half of 2024 has been defined by mean reversion, with the index recently breaking back below its 200-day moving average. This signals a return to equilibrium after the exuberance of the first half. The FTSE now sits in a relatively narrow range, and traders will be eyeing breakouts above 8,400 or breakdowns below 8,000 to determine the next major move.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.