19th Dec 2024. 8.58am

Regency View:

BUY SDI Group (SDI)

Regency View:

BUY SDI Group (SDI)

SDI Group: Poised for growth after key acquisition

In a market where volatility and uncertainty often steal the spotlight, SDI Group (SDI) has quietly been making moves that position it for long-term growth.

After more than 18 months of underperformance, the company’s share price appears to be turning a corner. With key acquisitions and an improving outlook, SDI is capturing our attention, let’s take a look at the catalysts driving its recent recovery and why now could be the right time to buy.

A business model built on innovation and diversification

Before diving into the company’s recent developments, it’s essential to understand SDI’s business model and how it drives long-term growth.

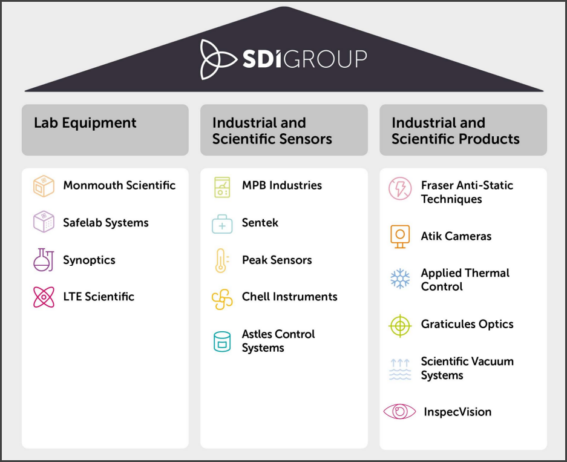

SDI Group is a leading provider of high-quality products and solutions across the industrial, scientific, and medical sectors. The company operates through a diversified portfolio of businesses that cater to the growing demand for precision instruments, scientific equipment, and automation solutions. SDI’s products help drive efficiency and sustainability across sectors, ranging from environmental monitoring to advanced manufacturing systems.

At its core, SDI’s business model helps its customers improve productivity, reduce waste, and meet regulatory requirements. Whether it’s through environmental monitoring systems or advanced production equipment, SDI’s products enable efficiency and sustainability.

Alongside organic growth, SDI has pursued strategic acquisitions to expand its footprint in high-growth markets like smart manufacturing and biomedical technology. Through these efforts, SDI has developed a strong track record of delivering value-enhancing acquisitions, further strengthening its diverse portfolio.

Acquisition and technical catalysts: Double bottom in play

In October, SDI made headlines with the acquisition of InspecVision, a deal that could propel the company forward. The acquisition aligns with SDI’s strategy of expanding its portfolio and tapping into new markets. It provides access to a leading provider of measurement systems for the automation industry, a growing sector driven by the demand for precision and efficiency.

From a technical perspective, SDI’s share price has shown encouraging signs of a reversal pattern after a prolonged period of underperformance. In early October, the shares retested the lows from May, around the 50p mark. As news of the InspecVision acquisition broke towards the end of October, the shares surged higher, creating a burst of bullish momentum – confirming a double bottom reversal pattern.

We can use this technical pattern as a short-term catalyst for timing our entry, and we can also use it to gauge a theoretical initial target near the psychologically significant £1 marker.

Interim results signal resilience

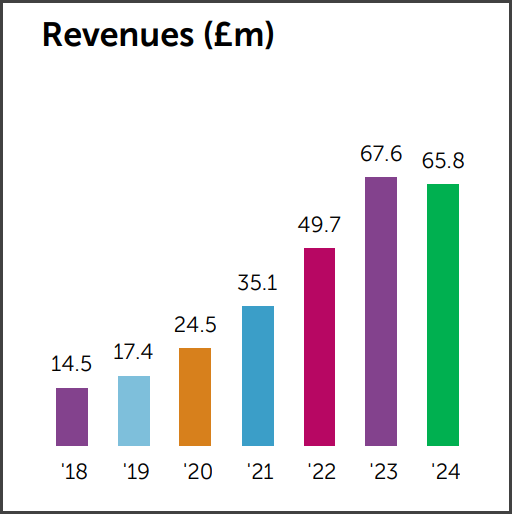

SDI’s recent interim results for the first half of the 2024 financial year provide a clear picture of the company’s resilience in the face of market challenges. Despite a 4% decline in group revenues to £30.9m (H1 FY24: £32.2m), SDI are seeing signs of recovery, especially in its Industrial & Scientific Products division, which posted 0.3% growth in sales.

A key highlight was the 10.7% increase in sales within the Industrial & Scientific Sensors segment, driven by strong demand in certain product lines. At the same time, the Laboratory Equipment division faced headwinds, with revenues falling by 16.5%, largely due to challenging trading conditions and customer delays. However, the company remains optimistic, with a solid order book and expectations for a stronger second half of the year.

One of the standout metrics in the interim results was the gross margin improvement, which rose to 65.4%. This increase reflects SDI’s ability to pass on cost increases while maintaining margin discipline, even amidst a challenging environment. Cash flow generation also improved, with £4.7m in cash generated from operations, up from £3.3m in the same period last year.

Strong growth potential at a discounted price

SDI’s valuation is one of the most compelling aspects for potential investors. The company’s forward P/E ratio of 8.9 is currently well below the sector average, making the stock an attractive option for those seeking growth at a reasonable price. This discount is particularly appealing when considering SDI’s strong earnings growth potential, with analysts forecasting EPS growth in excess of 20% next year.

As of the latest interim results, SDI’s adjusted profit before tax stood at £3.2m, down from £3.7m in H1 FY24. However, looking ahead, the company’s focus on cost efficiencies and margin expansion should support profitability growth in the second half of the year and beyond.

With a low forward P/E ratio, strong growth prospects, and a clear strategic vision, SDI presents a solid opportunity for small-cap investors looking for exposure to a diversified portfolio of niche, high-margin businesses with proven resilience and growth potential.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.